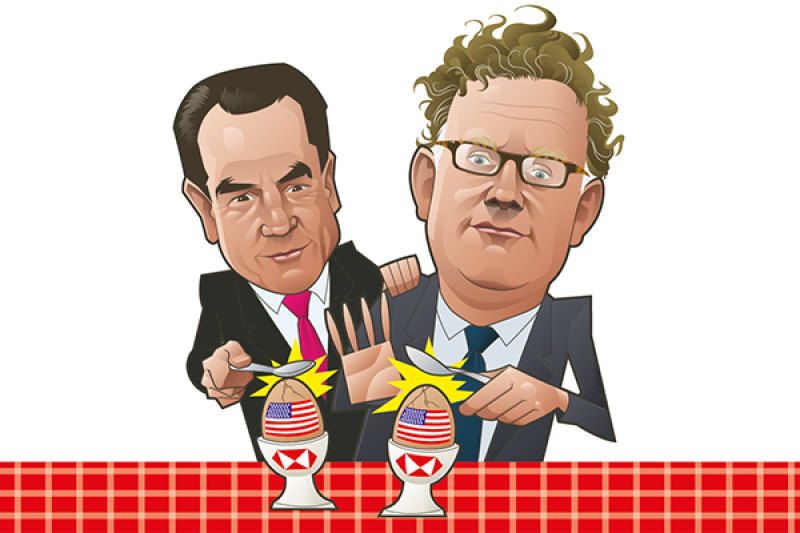

Take a weekend stroll across one of New York’s many bridges and you might just bump into Russell Julius. HSBC’s co-head of global banking for North America has been in the city for about six months, having left the bank’s Hong Kong operation in late 2014 to serve a brief stint in London before heading to the US. Since then, he has been hard at work, but in his downtime he has been exploring the bridges that link Manhattan to the mainland.

Read more

This fascination with crossing the Hudson and the East River at every opportunity might be down to the bank’s newish investment banking approach to the US, a market where it has struggled for years to understand what sort of franchise it should build.

Its unfortunate adventures in the past were epitomized by the tenure of John Studzinski, who was hired from Morgan Stanley in 2003 to co-head the group’s global investment bank and mandated to build a franchise in the classic mould, based on M&A advisory.