|

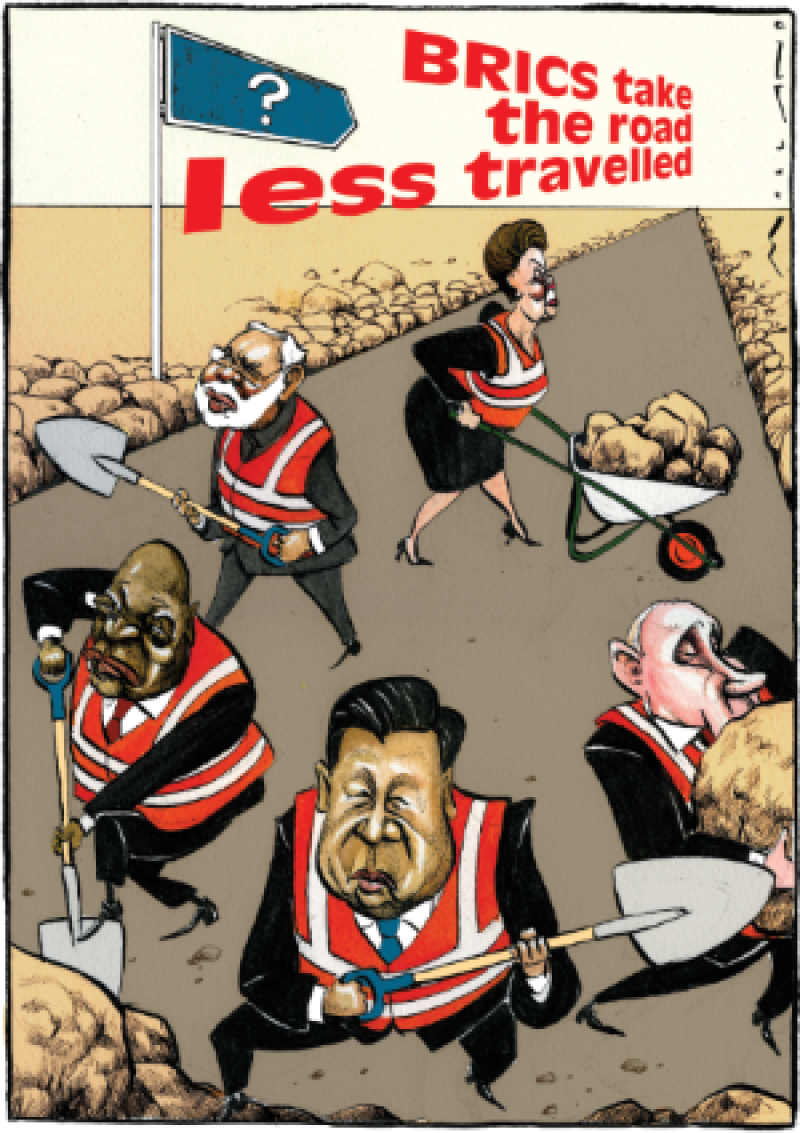

Illustration: Morten Morland |

Everything you thought you knew about China’s economy this year is wrong. While global markets are convulsing amid fears Beijing is failing to arrest its deflationary spiral, for emerging market bulls, 2015 marks a historic shift in the global financial order. After decades of relative timidity, China is now playing a leading role on the international stage by assuming its rightful position as underwriter of the global economic system, by rewiring trade, capital and FX flows.

In 2013 Chinese premier Xi Jinping duly signalled the onset of a new era securing the “great rejuvenation of the Chinese people” in global affairs. Its means: opening new trade networks and transit routes for exports, enriching underdeveloped border areas, hastening renminbi internationalization, and establishing a new monetary order.

China’s troubles this year are cyclical blips in the structural transformation of its economic might, so the theory goes, and its bid to generate new sources of demand for its excess capacity is gathering steam.

Beijing’s ambitions are no doubt staggering and, if successful, could redraw the landscape of the global economy. Central to its plan is the development of a new Silk Road, connecting northwest China and central Asia to Europe, and a maritime route that joins the sea-lanes of the South China Sea and the Indian Ocean.