by Rob Dwyer

|

A Brazilian changes reals for dollars |

Bank of America Merrill Lynch topped Latin America’s debt capital markets issuance league table for the first half of the year, according to data provider Dealogic.

The region saw 40% less issuance than in the same period last year – with the slump in Brazilian issuance to blame for lower revenues.

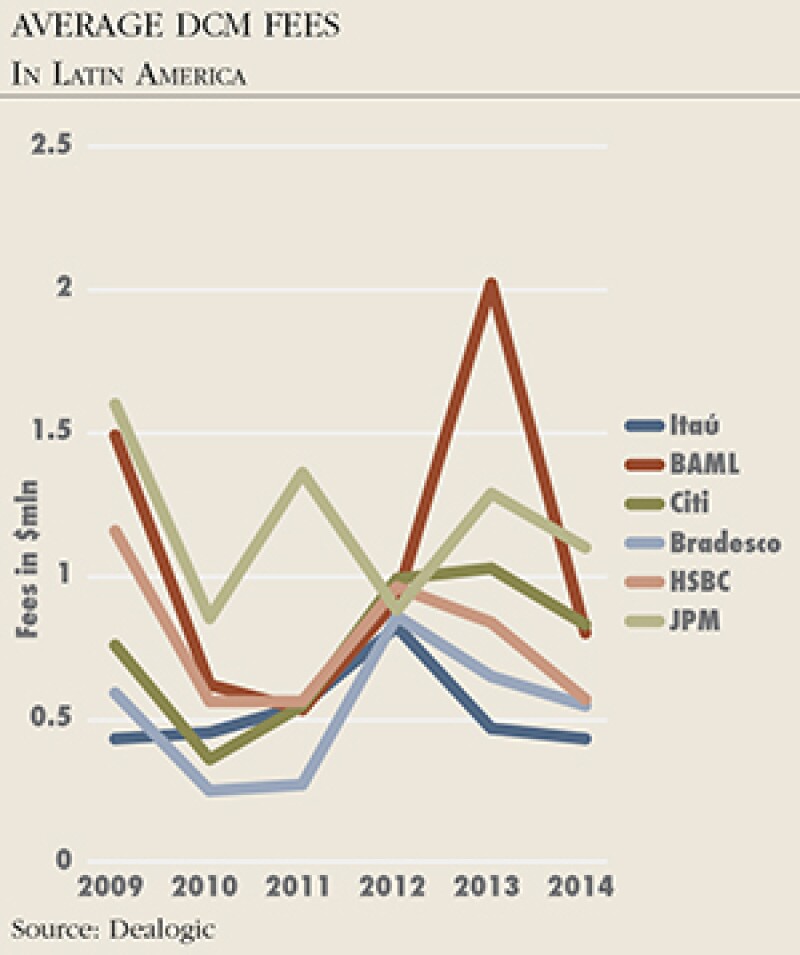

However, analysis of the underlying data also illustrates the challenges investment banks in the region have for profitability, for not only are volumes down but fees per deal have also fallen substantially in the aftermath of the financial crisis in 2009.

According to Dealogic’s fee data, BAML generated $1.49 million per deal for Brazilian issuers in 2009. By 2014 that average had fallen by 46% in nominal terms – to $800,000 per transaction.

The pricing pressures also hit other international banks. For example, HSBC saw average fees for DCM fall by 50.9% between 2009 and 2015 – from $1.16 million to $570,000.

Of all the international banks in the top 10 in 2009 only JPMorgan has maintained an average fee over $1 million: falling a relatively modest 31% to $1.1 million from $1.6 million.

The bank’s selectivity on higher value work has seen it lose market share in the same period, from a market-leading 15.1% of issuance in 2009 to a fifth-ranked 7.5% in 2014 – although in nominal terms the banks’ volumes have been relatively stable in a market that more than doubled.

|

$1.9 million BNP Paribas’ fees, the highest per deal in the region |

The only top 10 bank that increased its average fee over these five years was Citi, who earned $830,000 per deal in 2014, compared to $760,000 in 2009 – and interestingly the bank also managed to nudge up its market share in the same period (to 7.3% by volume, from 7.23%).

A Citi banker says this is because the bank has reorganized its investment banking platform to be less product-specific, “which enables discussions with clients about the range of corporate funding options”.

He argues this broader conversation – often taking place with more senior management – “shifts the emphasis away from pure transactional competition and makes clients less price-sensitive”.

Also noteworthy is BNP Paribas, which generated by the far highest fees-per-deal, at $1.91 million, and despite not having a presence in the market in 2009.

Compression

The reason for the compression in fees is clear: international banks have had to lower their fees in response to competition from locals. In 2014, Dealogic says that Itaú BBA’s average fee was just $430,000, lower than Bradesco BBI ($550,000) and Banco do Brasil ($800,000).

The local bank’s fees were broadly flat over the five years (Itaú’s average fee was exactly the same in 2009), showing that the competitive environment in Brazil has been one in which the international banks have had to lower fees closer to the locals, rather than the locals being able to increase fees to match that they claim to be a narrowing of the level of the service between.

The rich pickings have gone: for example JPMorgan managed to generate an average of $7.96 million per deal on seven transactions in Brazil in 2009 – even discounting for last year’s exceptionally thin annual volumes (Dealogic says the bank generated just $2.26 million on three ECM deals last year), the bank’s average fee in 2013 was still under half the 2009 base, at $3.06 million.

This pricing competition has also negatively affected the locals: BTG Pactual’s average fee fell from $4.45 million to $2.87 million. Santander has also suffered, with the bank generating just $1.84 million per deal from $4.67 million.

The same dynamic is apparent in ECM transactions: in 2014 Itaú BBA topped the league table and generated an average of $3.24 million per transaction – broadly flat to its $3.37 million per deal in 2009 (when it was ranked in sixth place).

Meanwhile, the fees for the international banks have collapsed: Credit Suisse’s average fell by 63.5% to $1.67 million from $4.57 million – a clear sign the market has gravitated to the lower local fee levels.

The figures illustrate why some banks, such as Barclays and Deutsche Bank have reassessed the potential of Brazil’s equity markets during this period and retrenched equity teams in the country.

Fallen prey

M&A bankers have also fallen prey to the race to the bottom in fees: the system average per deal falling to $1.85 million per deal in 2014 from $3.6 million in 2009.

Further reading |

|

However, in this segment even some of the local banks have seen a radical reduction in fees: Itaú generated on average $970,000 for each of its 62 deals in 2014, compared with $1.82 million on each of its 18 deals in 2009.

International banks have been forced to respond: Bank of America Merrill Lynch generated $2.17 million for every M&A transaction in 2014, compared with $3.23 million in 2009.

Citi again bucked the trend, increasing its average fee by 118% in the period, to $3.89 million from $1.78 million, while also increasing its market share to 5.97% (from 4.45%). However, the number of deals fell to just five in 2014, from 14 in 2009, showing the value that comes from working on larger deals despite the increased resources that covering these deals requires.