Yendegaia National Park. Source: Tompkins Conservation

In March 2017 on the grasslands of the new Patagonia National Park in Chile, Kristine McDivitt Tompkins, president of Tompkins Conservation, and Chile’s president, Michelle Bachelet, signed a pledge to dramatically expand national parkland in Chile by approximately 11 million acres.

One million of those acres were from Tompkins – the largest donation of land from a private owner to a country in history. On that day Chile’s national parklands expanded by nearly 40% and a network of 17 national parks that span 1,700 miles from Puerto Montt in the north to Cape Horn at the tip of the Southern Cone, known collectively as La Ruta de los Parques (the route of the parks) was created.

Chile, and Patagonian Chile in particular, is one of the few places left on Earth that can be described as wilderness. A landscape of non-polar icefields, lakes, rivers, forests, coastal bluffs and untouched islands, here there are mountains that don’t even have a name yet. It is home to the Alerce trees, the second-oldest tree species in the world, that were there before the first wave of Spanish conquistadors arrived 500 years ago. There are puma, guanaco and, thanks to conservation efforts, Andean condors, Andean deer and Darwin’s Rhea.

“It was an emotional day,” says Tompkins speaking about the decree signing. “It was saying goodbye to the people we had worked with for 20 years that was emotional – and still is.”

The donation was part of the vision that her and her late husband Doug Tompkins had of restoring and conserving as much of nature as possible.

As a society, we are so far past the stages of delicate conversations or ‘good ideas’. What we need is the commitment of governments with the engagement of the private sector or philanthropy – Kristine McDivitt Tompkins, Tompkins Conservation

Both conservationists and former business leaders (Doug co-founded both The North Face and Esprit, while Kristine was chief executive of Patagonia), the two purchased 2.5 million acres of Patagonia across Argentina and Chile with the sole intention of donating them.

For more than 20 years they worked with their team to buy contiguous land, restore it, re-wild it and in the process created a national park larger than Yosemite to be handed over to the government.

For Tompkins, national parks are crucial in conserving and protecting nature. Not only do we need more, she insists, but we also need to protect the ones we have.

“Take US national parks. There’s $12 billion in deferred maintenance there.”

If the little wilderness that is left is to be preserved, then national parks will be a key starting point – and financing is urgently needed. So the Tompkins’ donation has not stopped there. It is the first step in a two-phase project that hopes to see the La Ruta de los Parques managed and preserved in perpetuity using the mechanism of Project Finance For Permanence (PFP).

Coalition

The Chilean PFP is the creation of the Pew Charitable Trusts, Tompkins Conservation and economic development agency Balloon Latam. These three have formed a coalition that is negotiating a 15-year deal with the Chilean government that would see it and other private donors invest more than $65 million in a fund to support the permanent management and sustainable revenue generation of anchor tourism parks within La Ruta.

Over that period, the funds would be disbursed to the Chilean government based on performance criteria being met, slowly decreasing over time as the government draws on newly created revenues and taps into its own budget to fill the funding gap.

What makes the approach unique is that it is a business negotiation that only closes on a single day once all the money has been raised, the government and coalition agree on a plan for national park management, and the long-term financing of the deal has become policy.

At that single closing, the parks will have available the full funding that they need to be permanently protected – the money only comes with policy change.

Kristine McDivitt Tompkins, president of Tompkins Conservation

“As a society, we are so far past the stages of delicate conversations or ‘good ideas’,” says Tompkins. “What we need is the commitment of governments with the engagement of the private sector or philanthropy.”

While perhaps one of the most innovative, this is not the first PFP – that was a project in the Amazon in 2002. There have now been PFPs in western Canada, Costa Rica, Brazil’s Amazon, Bhutan and Peru. Together the deals have preserved and permanently financed more than 275,000 square miles of land – more than twice the size of Germany

As concerns about biodiversity loss and increasing CO2 levels have grown, the replacement of the world’s pristine natural areas with industry, agriculture and human settlement has come under the spotlight.

Renowned US ecologist Edward Wilson has called for a global movement to permanently protect half the planet. This is not a whimsical suggestion to keep the Earth pretty, but is based on scientific concerns that we simply don’t know the point at which biodiversity loss will push the human race into extinction.

We don’t play offence; when we do, we don’t think about winning for the long term. PFPs, however, are about securing permanence in action and deed from governments and using money as part of the leverage to make it happen – Jeffrey Parrish, Chilean PFP

If traditional conservation methods have been unable to get us there, perhaps project finance for permanence can give find a new route.

“We are in a situation where the destruction of world’s ecosystems is taking place at an increasingly rapid rate, so whatever can be protected now on an ongoing basis should be protected now,” says Larry Linden, founder and trustee of the Linden Trust for Conservation.

His foundation was one of the partners that put together Forever Costa Rica. It was a $57 million PFP funding package in 2010 led by Linden, the Gordon and Betty Moore Foundation, the Walton Family Foundation and The Nature Conservancy with the Costa Rican government. It permanently protects 1.3 million hectares of sensitive terrestrial habitat and one million hectares of critical marine habitat.

Linden is often credited with being one of the forefathers of PFPs. He worked on Forever Costa Rica while he was still in his former role as a managing director at Goldman Sachs, where he had helped lead the firm’s global expansion in the 1990s.

He saw the potential for adapting financial tools towards conservation.

There are puma, guanaco (above), Andean condors, Andean deer and Darwin’s Rhea to be found in Patagonia National Park. Source: Linde Waidhofer

“Project finance is a model well established in the commercial world where you have this one-time big investment for a factory or powerplant or dam. A lot of money goes in upfront for something that then lasts a long time,” he says.

“Contrast that with traditional conservation funding where you can miss a year of donations and a forest is gone,” says Linden. “Nothing is permanent in this world, but you can think of PFPs as ensuring this land will be there for at least the next generation.”

Jeffrey Parrish is the executive director of the Chilean coalition and fund having formerly worked at Wildlife Conservation Network and the WWF. He says the idea of permanence within conservation is something rarely discussed.

“We don’t play offence; when we do, we don’t think about winning for the long term. PFPs, however, are about securing permanence in action and deed from governments and using money as part of the leverage to make it happen.”

Each deal requires a large amount of time and resources to put together terms that will ensure the long-term protection and management of the proposed areas in line with both government and donor wishes.

“This isn’t just a wing and a prayer,” says Parrish. “For the deal to work, we need to have established exactly how the government will be supporting and investing the money into conservation, parks management and into Patagonia’s local communities. This is far beyond a rough estimate on the number of parks guards that will be needed.”

A financial model also has to be agreed upon so that funds will not be dispersed over the years if milestones are not met, as well as to protect against the unlikely event of a future Chilean administration having an anti-conservation agenda.

People are the biggest threat to, but also the biggest opportunity for, conservation – Sebastian Salinas, Balloon Latam

Brazil is an example of why such risk controls are needed.

In 1998, the then president of Brazil pledged to protect 10% of Brazil’s Amazon biome. The government worked with the WWF, the German development bank, KfW, the World Bank’s Global Environment Facility and the Amazon Fund (through the Brazilian Development Bank) to develop a public-private protected areas programme. It was called the Amazon Region Protected Areas (Arpa).

The programme was launched in 2002 and was designed to last for 13 years, protecting 60 million hectares, and ensuring financial resources for the management of those areas in the short and long run, while promoting sustainable development in that region.

The total endowment funding target was initially around $240 million.

But in updated studies of Arpa, participants noted that as administrations changed, it became a challenge to sustain support.

For example, in 2013 president Dilma Rousseff approved a new code that gave amnesty to deforestation on small properties in Brazil. The impact of that is beginning to show. Between August 2017 and July 2018, approximately 3,050 square miles of rainforest was destroyed (an area roughly five times the size of London) – the highest amount in a decade.

Now the future of the Amazon is even more uncertain under president Jair Bolsonaro. His administration has already proposed relaxing deforestation limits for farmers and opening up indigenous lands for mining.

Both the German and Norwegian governments have said they will reduce or stop financing one of the investment mechanisms for Arpa, the Amazon Fund, as a result of Bolsonaro’s inaction on the forest fires that plagued the Amazon in August and in response to threats by the Brazilian government to take over decision-making on the Amazon Fund’s proceeds.

“I’ve been working in this area for 30 years, and PFPs are one of the most durable mechanisms for conservation I’ve seen,” says Carter Roberts, president and chief executive of WWF in the US, which is spearheading PFPs around the world. “When you have disruptions in governments and their commitments to nature, any mechanism will be tested, which is why PFPs are performance based. We’re seeing this right now in Brazil.

“Absolute areas of deforestation in Brazil have decreased over the last 15 years as a result of creation of the national parks system, the financial incentives of the Forest Code and the soy moratorium,” says Roberts. “Now those rates are going back up, but off a far lower base. The protected areas within Arpa have fared better than others. But they still are at risk without incentives and signals from citizens, markets and investors – both in Brazil and around the world.”

Immune

Building on lessons learned from other projects, the coalition is working to make the Chilean PFP as immune as possible to future administration changes.

The first part of the task has been to understand the costs of managing the parks – and what is at stake if their protection is not enduring. Ultimately, the Chilean government’s contribution will be 2.5 to three times the amount provided by the donors over the period.

Patagonia National Park. Source: Tompkins Conservation

Tom Dillon, head of the environment for the Pew Charitable Trusts, has worked on several PFPs, both at Pew and in his former position at the WWF. He says a big part of a PFP is the deep financial planning that makes it “very clear what the real costs are.”

Otherwise parks can be created on paper, but if governments can’t meet the costs to manage them, they won’t be protected long term. Then, he says, the role of PFPs has to show the value of the protected area.

“PFPs work by unlocking value, so if you are the president of Chile, for example, protected areas aren’t just important because they are nice to have and attract tourists, but also because they can serve as economic magnets for the southern part of the country, which is a region that would benefit greatly from sustained investment.

“This approach changes the way you think about protected areas, viewing them as undervalued assets,” says Dillon. “The more we understand and value the economic and health benefits from keeping certain percentages of nature intact, the more it will become a relevant topic for policymakers, and the longer the structure will stay in place.”

As part of the research for the Chilean PFP, Tony Hansen, director of the Global Infrastructure Initiative at McKinsey worked pro bono with a team to calculate the economic values of the proposed protected areas and how revenues could be generated to cover costs. His report identified $270 million in annual income that could be generated after 10 years, with 43,000 jobs created, primarily in the most financially stressed part of the nation.

Revenues for protected areas predominantly come from tourist fees.

“Some 90% of income that you get in national parks is from entrance fees, so it’s very important to get right,” says Hansen. “At present, Chile doesn’t charge at all of its parks.”

Charges might include different structures for local or international tourists, whether to charge a green visa entrance fee at immigration (like Belize) or to collect concession fees from operators within the parks. The concession revenues at Yosemite are $20 million a year for example, Hansen points out.

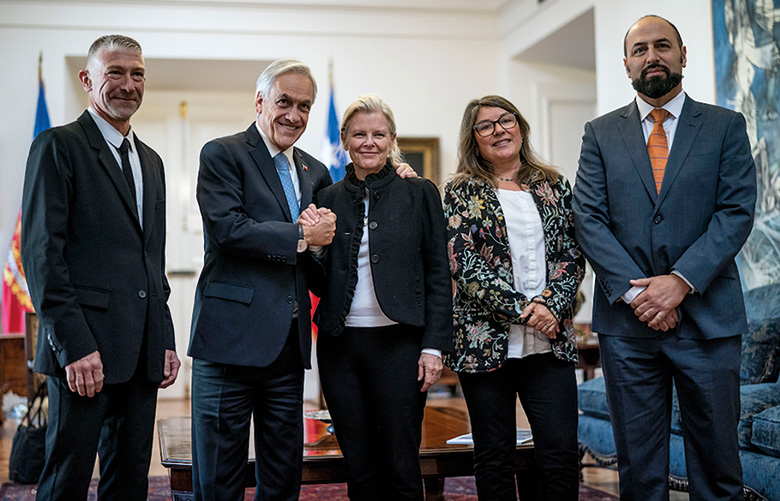

Chile’s president agrees to the funding of La Ruta in May. From left: Jeff Parrish, president Sebastián Piñera, Kristine Tompkins, Carolina Morgado and Francisco Solis

Within Chile’s 17-park system, there are eight anchor parks whose tourist revenues will support the funding for all 17 parks in La Ruta.

Nine parks will remain as wilderness.

“This requires a commitment by the government to put those revenues from parks back into the parks themselves, rather than the general treasury,” says Parrish.

Typically park revenues are at the discretion of governments to spend in any sector.

Local assets

Another key to ensuring permanence in conservation is working with local communities to ensure they see the parks as their own assets, which is where the Chilean institution, Balloon Latam, comes in.

“The PFP puts community development at the same level as conservation,” says Sebastian Salinas, executive director at Balloon Latam.

In this case, that meant spending six to eight months early on with the 60 communities to discover what it is they need and how to relate that to the environmental demands.

Sebastian Salinas, executive director at Balloon Latam

Professionals from outside the communities and abroad are brought in to work side-by-side with local projects. They work on issues such as developing marketing strategies, creating services for the tourism industry, helping restaurants expand and incentivizing sheep farmers to stop killing pumas.

It can be as simple as understanding that a trail in a national park can also serve as a firefighting route and therefore needs to be adapted for more than hikers.

“People are the biggest threat to, but also the biggest opportunity for, conservation,” says Salinas.

All too often in conservation the work with communities tends to be “a mere token”, adds Parrish.

“It can end up being ‘here’s a job I created for you’ rather than listening to local communities and developing jobs that are wanted,” he says. “It also rarely happens at scale, meaning that local communities don’t see parks as an asset that belongs to them.”

Once they do, however, then they quickly become stewards of the land, which can again deter changes in government policy down the line.

As final part of the deal package, funding will also be committed to advocacy for parks within Chile. As Parrish points out, much of the population of Chile lives in Santiago, several hours’ flight from the parks.

“Patagonia is very distant and its communities often forgotten,” he says, “so we are building into the deal nationwide advocacy and education – so that the parks belong to all Chileans.”

Suitability

As the model for PFPs becomes more refined with every deal, the question arises of whether the projects are the best tool to reach the ambitious target of 30% to 50% of global land and ocean being protected within the next 30 years. PFPs are not suitable for every country, Linden points out.

“There needs to be high standards of governance in the country and rule of law,” he says. “If you’re putting money in now and betting on future behaviour, you have to be sure that future behaviour is going to happen.”

Donors may be willing to put their money in upfront in about two-thirds of the world’s countries, he adds.

Tompkins says she would take part in other PFPs, so confident is she in their model and she is emphatic that other philanthropists should follow suit.

Despite being softly-spoken, 69-year-old Tompkins makes no bones about her opinions on the responsibility of philanthropy. She is a recipient of the 2017 Carnegie medal of philanthropy, and she echoes Andrew Carnegie’s sentiments when she says: “To die with money in one’s pockets would be immoral”.

She adds: “It’s not OK to sit on your great wealth and do nothing, or to run your large business and do nothing. Too few people are taking action – and that is no longer a luxury we can afford. It is nothing short of moral bankruptcy. And to those who think they are going to be fine because they’ll just head to Mars, I say: ‘Let me help you pack.’”

What is encouraging about the Chilean PFP is that it is creating an opportunity for philanthropy in Chile, where such altruistic giving is still emerging. Environmental conservation is especially limited because there aren’t tax breaks (donors are actually penalized for environmental donations) as there are for the arts, health and education.

It is hoped that the PFP will provide an opportunity to change this and engage with some of the wealthiest individuals in the country. The fund expects that up to half its anchor donors will be Chilean.

“In this way, the deal becomes a gift from Chile to the world rather than from the world to Chile,” says Parrish. “That is meaningful, that is permanence.”

He says that conservation NGOs have to take some responsibility for “not galvanizing more philanthropic money”.

“We have been guilty of being short-sighted and ‘small-thinking’, and that’s partly a result of how conservation has evolved: with many mouths to feed fighting for crumbs,” says Parrish. “We don’t present big ideas, and because we have been relying on three-year cycles of funding, we also haven’t pushed for longer-term goals, yet there are donors who would willingly give $10 million to projects that had long-term large, positive and measurable impacts.”

It has been Wilson’s criticism too (hence his call to protect half the Earth) – that conservation needs a large global goal rather than focusing on progress and process.

“[People] need a victory, not just news that progress is being made… It is our nature to choose large goals that, while difficult, are potentially game-changing and universal in benefit.”

The large-scale conservation that PFPs support could help reach that goal. Roberts says the WWF network is in discussions with five countries including Colombia, two sub-Saharan African countries and two countries in Asia about PFPs.

“For natural capital, there are places that loom large because they provide the world with a disproportionate amount of the world’s food, water, climate stability and biodiversity – the Amazon, coral reefs, the Mekong, the Congo and the Himalayas,” he says. “We really need to focus on keeping those places intact in order to secure our future and manage risk.”

Political will in these places is going to be crucial of course. Fortunately in Chile, president Sebastián Piñera has an appetite for large-scale actionable projects and has made this PFP an administration priority.

He is also under international pressure to show a commitment to conservation.

In December, Santiago plays host to the United Nations Climate Change Conference, COP25, yet Chile is the ninth worst country in the world when it comes to funding its own national parks.

Ecologists, conservationists, philanthropists and Chilean communities are hoping the proposed PFP will be that public commitment.