| Download full report | |

|

The full report is available for download in PDF format. |

| Download PDF | |

Published in September, the Survey found an overwhelming thrust in financial markets towards environmental and social (E&S) issues. But market participants also recognize that they have a long way to go. Their practices are likely to alter, what they invest in is likely to change, and in many cases they will need to acquire new skills. And filling that gap will require new products, new techniques and new knowledge.

Leaping out from the survey is the fact that capital markets have understood that they need to pay attention to E&S issues ‒ and, indeed, are embracing the idea.

Of the 1,000 market participants surveyed, from 15 countries in the Americas, Europe, the Middle East and Asia, 94% of investors and 93% of issuers said E&S issues were either “very important” or “somewhat important” to their organization. Those saying “very important” made up over 60% of the total in both cases.

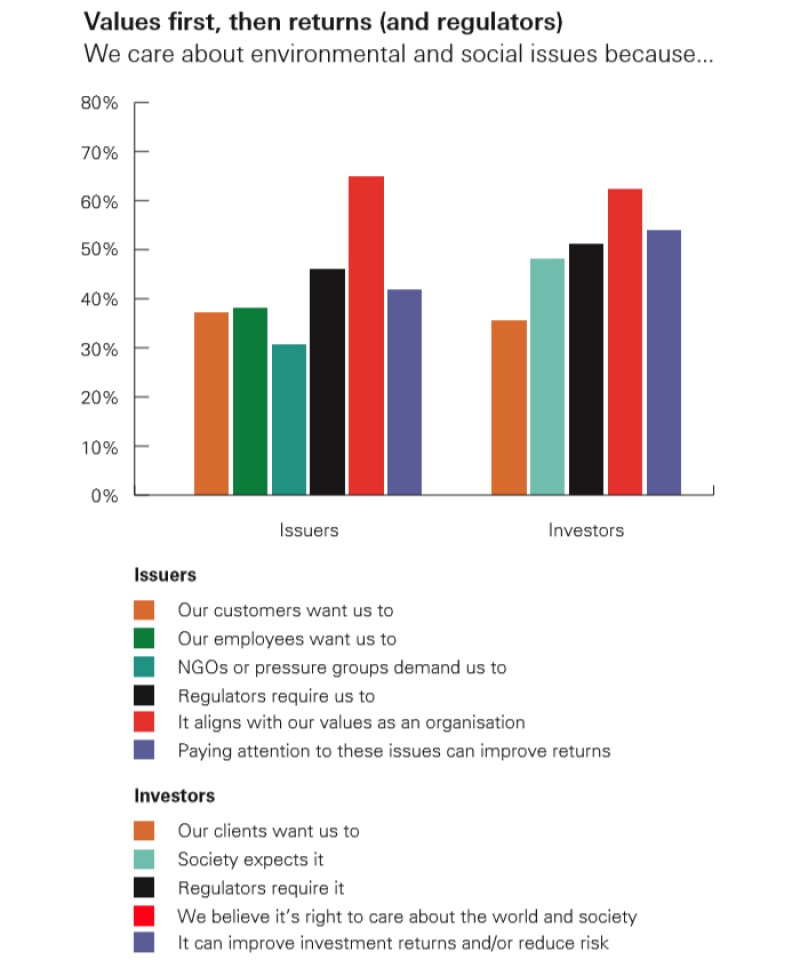

The dominant reason why investors and issuers say they care about E&S issues is their values ‒ they simply believe it’s right to do so. This is the leading reason in virtually all the territories studied in the survey. In the few places where another factor is more important, values comes a close second.

Climate brings new capital needs

But these values have changed. For anyone trained in conventional financial markets, the figures are startling. “A few years ago, people were thinking ‘it’s a niche, it’s not serious’ ‒ they didn’t have to look at it,” says Jean-Marc Mercier, global co-head of debt capital markets at HSBC in London. “A broader audience is now open to conversations about it.”

What has brought about that upheaval in attitudes is a shift in society at large. Both investors and issuers report that several groups of stakeholders ‒ customers, NGOs, their employees, and even their own regulators ‒ want them to take account of E&S issues.

And the leading driver for that social transformation is climate change. Issuers were asked in the survey: “Will climate change begin to affect your business or activities?”

Remarkably, 38% of issuers globally say it is already affecting them. Another 30% say climate change will start to affect them in the next 10 years, while 15% expect this between 10 and 30 years from now. That leaves only 15% who are not concerned, or don’t know what to expect.

And issuers do not plan to sit still. The survey asked whether, over the next five years, they expected their organization to change its allocation of capital in response to environmental or social issues. A mere 6% replied “Not at all”. All the rest believe they will be investing capital differently within the next five years. For 25%, the reallocation would be “substantial”.

Lost in translation

Financial markets are interactive. That capital will have to be redeployed with the consent of investors. The likelihood, demonstrated in the survey, is that investors will be encouraging, and highly interested in the results. Indeed, 67% of issuers say their shareholders care about their environmental performance.

The survey asked not just about shareholders, but about bondholders’ and bank lenders’ attitudes to the organizations they invest in ‒ relationships that are often overlooked. Issuers believe bondholders and lenders care almost as much as shareholders about their environmental and social impact. But when it comes to how that interaction is conducted ‒ the quality of the communication ‒ the status quo leaves much to be desired.

|

When investors were asked if anything was holding them back from pursuing environmental, social and corporate governance (ESG) investing more fully and broadly, 61% said there was. The survey suggested 10 possible barriers investors might be experiencing, and all of them were chosen by significant numbers. The most common barriers were shortage of expertise or qualified staff, cited by 27%; lack of attractive investment opportunities (26%); and lack of ESG data comparability across issuers (26%).

What this means is that there is a huge amount of work to be done ‒ in education, communication and analysis ‒ so that these knowledge gaps can be filled. If there is a lack of attractive investment opportunities, the banks ought to be finding out from investors what they want and trying to deliver it.

“Sustainable finance products can be relevant to all our clients,” says Mercier. This is where innovation comes in. Financial products, metrics, models, ratings, are all means of communication, in which the nature of an investment can be fitted to the risk and return appetite of an investor.

When investment requirements change ‒ as they are doing because of climate change, and the new consciousness of environmental and social issues in general ‒ new means of communication are needed.

“It’s not something for the future,” says Christian Deseglise, head of central banks and global sponsor of sustainable finance for HSBC’s global markets division in New York. “The future is today.”

| Download full report | |

|

The full report is available for download in PDF format. |

| Download PDF | |