In an anonymous building facing St Paul’s Cathedral in London is the Emirate of Kuwait’s principal investment outlet, the Kuwait Investment Office (KIO). “They are by far the best informed investors anywhere,” said one London broker. “You call them first. They command a special kind of reverence.”

|

|

|

The London building of the |

With no shareholders, trustees or parliament to account to, a tightly-knit group of ministers in Kuwait and a handful of professionals in London can suddenly decide to spend $5 billion on a stake in British Petroleum or take over huge tracts of Spanish industry. What makes KIO so special is that no other major global investor is quite so wide-ranging or mysterious.

“The first rule is that there are no rules,” the KIO chief executive, Fouad Jaffar, once said. Since its inception in 1964, the KIO has built up an enormous web of closely guarded affiliates. Large, shadowy stock moves are often attributed to the KIO.

Its secrecy is almost obsessive. “No one must know we have spoken,” said a source close to the Kuwait Investment Authority (KIA) in Kuwait, the KIO’s official parent. “I don’t want to go to prison.”

Brokers react in the same tones. “No one talks about them,” said one. “They don’t like it and they are too important to lose.” Bankers haven’t forgotten the time a Citibank employee leaked KIO portfolio details to the Chicago Tribune. Citibank had all its KIO business withdrawn.

Both the KIO and the KIA refused to talk to Euromoney. But sources around the world gave a unique insight into their inner workings, including how power struggles in Kuwait have succeeded in maintaining the autonomy of the KIO in London, allowing it to build on its individual and flexible style.

The Kuwaitis, Euromoney also learned, have recently gained new self-confidence to expand beyond normal portfolio management, forging alliances with powerful industrial families, rather than relying only on brokers for information. In Spain, KIO is orchestrating consolidations, using such alliances. Meanwhile, the KIO is expanding in the Far East. In Japan, for example, the Kuwaiti finance minister has been negotiating, so far unsuccessfully, to take stakes in major Japanese corporations on a scale unprecedented for a foreign organisation.

“No one must know we have spoken. I don’t want to go to prison.”

So who are the forces behind the KIO? The key lies in the politics of the Kuwaiti ruling class. The KIO in London manages the bulk of the international money and is supposed to report direct to the KIA in Kuwait, which in turn reports to the Ministry of Finance. But the real command structure is much less clear. There is endless squabbling between different factions in Kuwait over how and where the wealth should be invested. The link between the KIO and the KIA is particularly weak.

Much of the KIO’s strength lies in the fact that it can act decisively by bypassing the bureaucratic elements of the KIA, making direct contact with important people close to the Kuwaiti royal family. Matters involving the royal family, all of whom bear the name Al-Sabah, are extremely sensitive in Kuwait, and are rarely talked about. But power in Kuwait tends to rest with those who have the Emir’s ear.

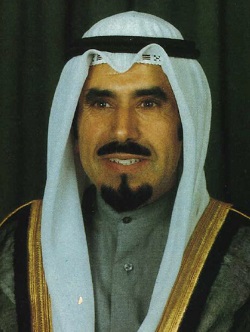

The oil minister, Sheikh Ali Khalifa Al-Sabah, is thought to be a particularly close supporter of the KIO, probably exerting more influence than finance minister Jasim Al Khorafi, who has responsibility for the KIA and so supposedly for the KIO. The Emir, Sheikh Jaber Al-Ahmed Al-Jaber Al-Sabah, who was a highly competent finance minister in the 1970s, takes an active role in the management of the funds. He approves major investments and discusses strategy. He is believed to have his personal account with the KIO in London.

Broad investment decisions are made by the board of the KIA, which, besides the finance and oil ministers, contains the governor of the central bank, an aggressive and very able royal, Salem Al-Sabah, who is rapidly climbing Kuwait’s hierarchy. Also represented is the KIA managing director Dr Fahd Al-Sabah. The disputes often revolve around how much autonomy the London office should have.

Investment power has shifted back and forth between Kuwait and London. The KIO in London had, from 1964 to 1984, sole responsibility for investing the Gulf state’s money abroad. The KIA was established in Kuwait in 1984 as a result of pressure from the Kuwaiti national assembly, which demanded tighter control of the coffers.

|

|

|

Approval of major investments comes |

The KIO in London was felt to be getting out of control. In 1982 the stock exchange questioned the KIO closely about its dealings with a Manchester stockbroker, Halliday Simpson. A large suspense account was creaming off profits from client orders and paying them into personal accounts. The stock exchange report revealed that some orders, apparently made on behalf of the KIO, were passed through an “Open Account”, and profits from those deals were paid into a private account at Lombard Odier in Switzerland in the name of Jean Bernrd Tissot. The KIO released a statement denying any wrong-doing on the part of its staff.

Later, in 1985, the Kuwaitis discovered that KIO had invested in Arthur Bell, a Scottish whisky distiller, against Kuwait’s moslem laws.

The KIA was formed to have over-riding authority over all Kuwait reserves. It was intended that it take detailed control of the fund management. The KIO offered to refer back all portfolio decisions to the KIA for approval. But, predictably, it was soon accepted that KIA was in no position to handle sheaves of telexes arriving from London requiring instant attention. The process would have to be gradual.

Then, in 1985, the Kuwaiti stock market crashed dramatically. This strengthened the KIO’s hand. It was able to point out that with British fund managers it was far better qualified to manage the Emirate’s money than chaotic financiers in Kuwait. Meanwhile, the national assembly in Kuwait embarked on a post-crash witch-hunt, aimed at members of the royal family. Shortly afterwards the national assembly was dissolved and, with it, Much of the KIA’s support. This reinforced the authority of the London office. Since then, while KIA had slowly taken responsibility for managing the more passive aspects of Kuwait’s reserves the KIO has gained more freedom to embark on the more adventurous investment strategies.

The KIO runs the lion’s share of the Reserve Fund for Future Generations (RFFG), investing 10% of the Emirate’s internal oil revenue as a nest egg not to be cracked open until 2001. It also has a smaller portion of the State General Reserve (SGR) on which it has an open brief. The Kuwaitis last published basic statistics on their reserves in 1985. Working from these, most estimates put the two funds at around $60 billion and $30 billion respectively, of which around two-thirds is invested globally, mostly by KIO. However, many in Kuwait were sceptical about the 1985 statistics. Some sources close to the KIO in London believe that the sums under management may be substantially greater than is popularly believed.

While the two funds are supposed to be distinct, sources in Kuwait say that KIO probably allocates holdings according to their performance at a later date, so the two funds can effectively treated as one.

The chairman of the KIO is Sheikh Fahd Al-Sabah, a minor but charismatic member of the royal family. He is said to have been in a key force in keeping the KIA at arm’s length. His main role is to act as link man between London and Kuwait, although recently he is said to have been less active.

Beneath him is the deputy chairman and chief executive, Fouad Jaffar, and two Scottish accountants, Bruce Dawson and David Buchanan. Dawson, in particular, is regarded as indispensable in Kuwait. All three have been with the office since its inception and have now taken on a more managerial role, often travelling abroad to gauge strategy and seek out emerging markets. A fourth senior decision-maker, Peter Defty a former institutional salesman from W Greenwell, has just left the London office. He is going to Spain to pursue private projects but it is also likely that he will set up a KIO subsidiary there.

“The best thing about them is that they are decisive and reliable. When they say something, they mean it.”

With such a small team of major decision-makers, the KIO can be very quick on its feet when it sees a large profit opportunity. It is by far the most flexible of all the large funds. The KIO employs only about 30 investment managers, a tiny number relative to the size and activity of the funds. They are given areas of geographical responsibility. Often, there are a few Kuwaiti nationals in the London office, over for a period of training. They are chosen for their anonymity. The KIO dislikes hiring names, preferring to train its own staff. They are highly paid, so there is virtually no staff turnover.

City brokers sing the KIO praises. “Very bright, very impressive,” said one. “Unlike many investors,” said another, “they don’t throw their weight around; they are polite and friendly.” A third added: “The best thing about them is that they are decisive and reliable. When they say something they mean it.

The KIO is generous to its brokers. “If you do them well,” is the general opinion, “they will do well by you.”

The London office has come a long way since it used to invest modestly in a few gilts, US Treasuries and blue-chips in the mid-1960s. The KIO’s assault on Spain, which began in earnest during the summer of 1986, is its most sophisticated and aggressive yet. It gives new meaning to the phrase “active portfolio management”.

To facilitate its purchases, KIO first bought into an affiliate, taking a 37% stake in Torras Hostench, a major paper manufacturer. Soon after, KIO orchestrated a stock offering for Torras, the biggest ever in Spain, which netted $460 million for the company’s reserves.

KIO usually maintains a strictly “hands off” attitude to the companies in which it invests, rarely even appearing at shareholders’ meetings. Yet occasionally it will take a direct management stance. KIO put a board representation into Torras as the first step to convert it into a holding company for the KIO’s Spanish operations, allowing the KIO itself to retain its customary low profile. In other words, the Kuwaitis are following their usual pattern in Spain.

KIO’s style is first to identify a nation which it believes has good economic prospects, and then gradually buy a cross-section of shares, usually concentrating on large block stakes in key industries.

In Europe, the KIO is believed to have around 15% of its total funds in the UK and another 10 % in Germany, yet it is thought to own virtually nothing in Italy.

The KIO finds a vehicle for its operations. When the KIO identified UK property markets as an investment area, it bought the St Martin’s Property Group to act through. Likewise, when it decided greatly to expand its South East Asian portfolio it bought 25% of Hong Kong brokers EM Sassoon and injected an estimated $50 million of capital into it. The KIO’s extensive network of affiliates is one of its most closely guarded secrets.

Some BP directors are known to be unhappy with their new shareholder.

There is a debate in Kuwait about whether it is advisable for KIO to seek active management control in its investments. In 1982, the Kuwait Petroleum Corporation (KPC), via the KIO, paid $2.5 billion for Santa Fe, a US west coast oil explorer. The resulting attempt to run a large US corporation is now viewed as something of a disaster. Similar mistakes were made in some Latin American acquisitions.

But now the Kuwaitis have become more confident. In Spain over the last year, the KIO has been uncharacteristically aggressive in gaining board membership on several other large Spanish corporations, notably Explosivos Rio Tinto (ERT), Cros and Banco Central. KIO and its associates have 12.5% of Banco Central and in the region of 40% of ERT. Moreover, it has gone into business with some of Spain’s new entrepreneurs such as Javier de la Rosa, now chairman of KIO-controlled Torras Hostench, and two cousins, Alberto Alcocer and Alberto Cortina, known collectively as Los Albertos.

The KIO, via its Swiss subsidiary SGM Management Services, entered into a joint venture with Los Albertos, forming a company called Cartera Central, which it is using as a vehicle to exert influence on Banco Central, so bypassing a law prohibiting foreign control in Spanish banks. KIOs share in Cartera Central is a minority 49%. Both the management of ERT and Banco Central resisted the KIO’s attempts to gain board representation. The Kuwaitis hired de la Rosa to negotiate on their behalf.

It work, although sources in Kuwait suspect that fund money is sometimes used for such purchases.

The Spanish programme bears the hallmark of the Kuwaiti oil minister. Both the Kuwaiti Petroleum Corporation and its fertilizer subsidiary are keen to continue their expansion overseas. KIO is trying to forge a merger of the fertilizer interests of ERT and Cros. It is believed that the real target of KIO’s 12.5% stake in Banco Central is probably Compania Española de Petroleos (CEPSA), a large oil refiner in which Central has a controlling stake. There are also rumours that KIO is eyeing another major Spanish refining group, Petromed.

This aggressive action must have worrying implications for the board of BP in which the KIO has almost a 20% stake, even though the Kuwaitis have promised not to interfere managerially.

Some BP directors are known to be unhappy with their new shareholder. Sir Peter Walters, BP chairman, has told Sheikh Ali Khalifa, the oil minister, that BP would not like the stake to be increased, but has not been able to reach any agreement on a maximum figure.

Such moves can also be neatly dovetailed with the KIO’s role as a portfolio manager.

Although it bought the paper firm Torras Hostench as a vehicle to make fertilizer and other oil-related acquisitions, the KIO has also identified paper as a good long-term portfolio holding. Besides Torras, the KIO has bought small stakes in a number of other Spanish paper companies.

The KIO has also built up strong links with some of Spain’s most influential commercial families. These are thought to include the Areces family which controls El Corte Ingles, one of Europe’s largest retail operations, and the March family, which controls the March Group. The KIO uses these allies to build up large stakes. In its bid for ERT, the KIO bought around 9% of the stock but it was then revealed that its affiliates had acquired another 30%.

Brokers which have become known KIO affiliates are sometimes partially discarded to maintain the veil of secrecy. One Spanish ally, Beta Capital, was said to have seen its KIO business diminish for that reason, although the KIO has now bought a stake in Beta Capital. So established has the KIO become in Spain, in such a short time, that many would not be surprised to see it set up a separate office, possibly in Barcelona.

The pattern of moving in with the Establishment is repeated elsewhere. In Malaysia the KIO has so far been mainly buying through a London broker, but it is now believed to be forging links with the influential Quek family in Singapore. “They like to deal with people, not companies,” said one observer.

(Article continues below box)

| Will the North Sea flow into the Gulf? |

|

As Euromoney went to press, the KIO was holding nearly 20% of British Petroleum and had refused to give an undertaking to stop buying. It had declared, however, that the stake was “for investment purposes only”, and that it had no intention of interfering managerially. Both BP and the UK Treasury have said that the explanation satisfies them. Should it? BP is one of Britain’s biggest companies. Questions in Parliament have suggested that Arabs are invading the North Sea. On the face of it, the BP investment is typical of the KIO’s style. It holds several block stakes in other flagship companies, for example 24% of Hoechst in Germany and 8% of Sime Darby in Singapore. It bought BP cheaply and in size when an issue flopped, another characteristic of the wealthy but quick-footed KIO. In cash terms, though, BP is far bigger than any of the KIO’s other investments. If the KIO buys the second and third tranches of the partly paid shares in August 1988 and April 1989, it will have shelled out over $5.7 billion, representing about 10% of Kuwait’s total international funds. In that case the KIO would have staked about 20% of its entire equity portfolio in one UK company. It already has large UK investments, probably adding up to another 10% of the equity portfolio. The BP stake is totally out of character with the KIO’s overall investment strategy, which is to diversify strongly to the Far East, and to smaller economies like Spain. The Kuwaiti dinar, in which the funds are accounted, is based on a basket of currencies, of which sterling makes up a tiny part. Why is the KIO so keen on BP as to stretch even its considerable resources? BP is undoubtedly a sound financial investment. Bought at the depths of the Crash, the partly paid shares have already risen 10%. But what would happen if the KIO tried to realise this gain? When the British government tried to sell a similar volume of BP shares it had to arrange a complex syndication. The subsequent heavy underwriting losses have made BP unmentionable in investment banking circles. “We gave no commitment, so if people make assumptions that is their fault.” Probably the KIO would look around for a block buyer, which might not be friendly to BP. In the past the KIO has shown few scruples when it comes to turning a profit. It infuriated EXCO, one of London’s biggest money brokers, when it sold a 22% block of EXCO’s shares to a Malaysian businessman, Tan Sri Khoo Puat, just 24 hours after buying them, taking $10 million profit from the deal. The Bank of England was upset. The KIO’s chief executive, Fouad Jaffar, was quoted as saying: “We negotiated a fair price in good faith. We gave no commitment, so if people make assumptions that is their fault.” The second reason for the KIO’s interest in BP is even more ominous. It is not unusual for Arab oil producers to buy oil- related stocks. The KIO has long had large slices of car manufacturers, including Daimler-Benz and Volkswagen. The Kuwaitis tried to put its own men on the board of at least one of these companies, but were blocked by the Germans. But the Kuwait Petroleum Corporation (KPC) has for some years been diversifying. In 1981 it bought the Californian oil drillers, Santa Fe, for $2.5 billion. KPC then became known as the eighth sister of the world’s great oil companies. In the last three years it has created a chain of 5,000 petrol stations across Europe, punningly named Q8. The British market still represents a gap in KPC’s expansion. Over the last year in Spain, the KIO has built up its fertilizer holdings and is now believed to be bidding for two large oil refineries. The Spanish acquisitions were made in the name of the KIO, with KIO fund managers joining the boards, in some cases elbowing aside the existing management. Normally the KIO does not interfere with its investments, rarely appearing even at annual general meetings. However, sources in Kuwait say the Spanish purchases were masterminded by KPC. The oil minister, Sheikh Ali Khalifa Al-Sabah, has a particularly close relation- ship with the KIO. The BP purchase was probably conceived in the same nest. With the Gulf War raging 60 miles away, on a quiet night the rumble of artillery is audible in Kuwait Ciiy. Last year an Iranian silkworm missile hit a Kuwaiti oil loading facility, causing extensive damage to electrical equipment, and a sabotage effort came very close to blowing up a natural gas storage plant. Most Kuwaiti oil is still refined in Kuwait. But what if the war spread, and Kuwait desperately needed to refine its oil in Europe? Or what if the war ended, and Kuwait no longer needed Britain’s favour? The Kuwaitis gave their promise not to interfere with BP to the British secretary of state for foreign affairs, David Mellor, when he visited Kuwait in December. Mellor’s main purpose in that visit was to decide how much strategic help Britain was going to give Kuwait to protect its oil flows. Talk about supplying minesweepers came at the same time as assurances about BP. It is unlikely that the Kuwaitis will attempt a complete takeover of BP. The British government could probably prevent that. But Kuwait might plead changed circumstances and insist on having some say on how BP is run, perhaps indirectly, in return for a promise not to sell to a predator. |

There is no doubting the KIO’s expertise as a straightforward portfolio manager. It has retained such wide control over the funds because it has consistently outperformed the majority of banks that the KIA has syndicated RFFG investment mandates to. Last year, Kuwait made more money from investment income than it did from oil revenues.

The Kio’s greatest skill is to act independently of the market. By nature it tends to be contra-cyclical. This stems from 1973 when massive oil price rises gave the KIO a sudden surge in investment power. The oil price rise also depressed the markets, and the KIO found itself buying when everyone else was selling. As a wealthy long-term fund it had no qualms about holding stock if the market kept falling. Consequently, it did very well and has never forgotten the lesson.

In the months before the October 1987 crash, KIO was thought to a net seller of UK equity, in a general belief that the market was overvalued. The sales included the Hays Group for $240 million, and over £260 million of holdings in Trafalgar House, Hanson Trust, Norfolk Capital and Norton Opax.

Immediately after the Crash, the KIO used this cash to move quickly and buy a 19% stake in BP, an issue no one else wanted. The KIO was also said to be a buyer in the aftermath of the Kuala Lumpur stock exchange crash in early 1986.

This time round the KIO was acting more by instinct rather than any sure knowledge that a crash was coming. Sources around the world report that like everyone else, the Kuwaitis were caught out on their shorter term holdings. “If they knew of it they would have certainly done things differently,” said one broker.

There is a similar pattern whenever the KIO moves into a new country. Take Malaysia. The KIO’s first move was to buy an affiliate, to keep tabs on local portfolios and facilitate purchases. Viewing southeast Asia as a growth region, KIO bought a 25% stake in Hong Kong brokers JM Sassoon, injecting around $50 million of capital.

Then, via Sassoon, which, thanks to the KIO, is now a of the Singapore stock exchange, and the London brokers Hoare Govett, James Capel and Vickers da Costa, the KIO started its Malaysian onslaught. It bought into Sime Darby, Malaysia’s largest industrial holdings group and the biggest plantation owner, steadily building up an 8.2% stake. It has also struck at the second largest plantation group, Harrison Malaysian Plantations. In small countries, liquid stocks are particularly important to big investors in case things go wrong.

The KIO was said to be a buyer in the aftermath of the Kuala Lumpur stock exchange crash in early 1986.

But KIO also has a mixed bag of holdings in minor Malaysian plantations, as well as trading firms and manufacturing companies. “Some of these are quite speculative,” said one broker. “They like to take the odd flyer and they occasionally get their fingers burnt.” Often the KIO will buy a small stake initially and then triple or quadruple it if it thinks it is on to a winner.

The KIO also has a 20% holding in the Hong Leong Company (listed in Hong Kong) and therefore an entrée into the Dow Heng financial group, which is affiliated to Hong Leong. Apart from this, the KIO is thought to have little interest in Hong Kong.

For some months, the KIO has steadily been slimming down its once dominant US portfolio and moving more into the Far East.

In January this year, the Kuwaiti finance minister, the managing director of KIA and the chief executive of the KIO went on a tour of the Far East. In Japan they met the prime minister, the finance minister, the president of Sony Corporation and the chairman of Nissan.

It is natural for Arab oil-producing nations to take an interest in car companies, because they are oil-related. “An expensive ticket to gauge future oil demand,” as one player put it. KIO has had an 18% stake in Daimler-Benz and has held over 10% of Volkswagen for several years.

The KIO is believed to have had a stake in Nissan for many years and has attempted to increase the holding before, only to be blocked. Sources in Kuwait say that the visiting team once more failed to persuade the Japanese authorities to allow them to buy large stakes in major Japanese corporations.

The KIO first started building up a sizeable Japanese portfolio around 10 years ago. Since the Crash, it has bought 23% of New Tokyo Trust and 7.1 % of Crescent in Japan. It is probable that KIO was also interested in buying Japanese property, which so far has been off limits for foreign buyers.

The touring party also visited Australia, where the KIO has had holdings in mining and industrial groups for many years, Singapore, where it has already built up a presence, and Indonesia where the Kuwaitis’ principal interest probably lies in good prospects in the oil sector.

Like many large investors, the KIO gets interested when it sees an opportunity to gain a large stake. It has been known to pay issuing houses a premium in return for a guarantee of the whole placement. The BP purchase was typical of the KIO moving fast when it saw the opportunity to buy in bulk.

It did same thing in July 1985 when an issue of Hanson shares flopped, and it bought 8% of the company. When the KIO bought Torras Hostench, that company was in the process of resurrection from receivership. The KIO is keener on buying large blocks than most investors because it has such a small staff. This also accounts for its absence from shareholders’ meetings. It is keen on Spain partly because of the nature of the market. Many of the banks and industrial groups hold large blocks of stock which they are keen to divest.

Sometimes the KIO acts more like an arbitrageur than an investor.

With an open brief on long-term investments, the KIO has a particularly heavy weighting on property. One estimate put its property investments in Spain, almost entirely high quality agricultural tracts, at over $1.8 billion, probably double its other equity stakes in the country. It is also among the biggest commercial property owners in London. Via its subsidiary, St Martin’s Property Group, it owns, for example, the South Bank arts complex. In Malaysia it has an interest in the biggest property developer, City Developments, through its holding in Hong Leong.

Targets for consolidation are another KIO favourite. It is, for example, still a 14.5% shareholder of the Royal Bank of Scotland, which was the subject of a furious takeover battle between the Hongkong and Shanghai Banking Corporation and Standard in 1982. Both bids were quashed by the UK Monopolies and Mergers Commission.

However, Royal Bank still remains a tempting plum and the KIO is still a major shareholder. The KIO has recently been buiIding up small stakes in at least five major Spanish banks.

Sometimes the KIO acts more like an arbitrageur than an investor. The 22% stake in EXCO sold within 24 hours is the most famous example. Recently KIO has been taking an active interest in British unit (mutual funds) where a wave of restructuring seems probable.

While there are obvious commercial reasons for such a large investor keeping its intentions out of the limelight, the KIO has other reasons for secrecy. The Kuwaitis are highly sensitive to political criticism, abroad and at home. Keeping a low profile means that less concern is generated in the west about growing Arab influence. And at home it means less protest from the anti-western Islamic fundamentalists, who are becoming increasingly influential in Kuwait.

In Kuwait, the KIA is now chiefly responsible for investments, loans and aid in the Gulf region, money belonging to the $30 billion State General Reserve (SGR). The KIA also has responsibility for portfolios outside fund managers. As well as the major Kuwaiti investment houses, these managers include Dresdner Bank and Commerzbank in Germany, Chase Manhattan and Morgan Stanley in the US and the Industrial Bank of Japan. Most of the major European banks also run KIA portfolios. Kuwait is a strict enforcer of the Arab black list, boycotting those banks with Zionist links.

The KIA manages an international portfolio of its own. However, London brokers who have dealt with both the KIO and KIA say there is little comparison in terms expertise. “The KIA just doesn’t seem to as well informed,” said one broker. “It tends to take most things I suggest without too many questions.” The KIA was, for example, one of the large mystery buyers of Fiat shares in the otherwise ill-fated placement in September 1986.