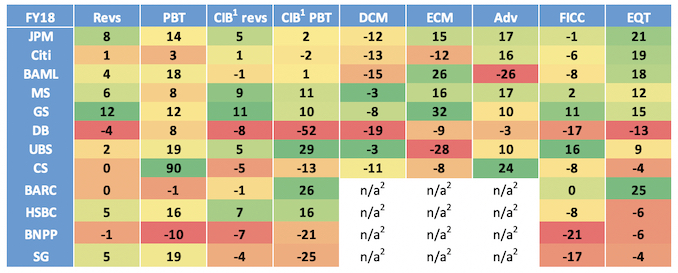

FY18 vs FY17 % change heatmap

1 CIB is ICS+IB at GS, IS at MS, GB+GM at BAML, CIB at JPM, ICG at Citi, CIB at DB, CIB at BARC, IB at UBS, GBM at HSBC, GMIS+F&A at SG, CIB-related at CS, CIB at BNPP

2 BARC, BNPP, SG and HSBC do not break out DCM/ECM/Adv revenues

Source: Euromoney, bank results announcements

What they said about…ADVISORY (Percentage change figures are 4Q18 vs 4Q17, then FY18 vs FY17)

Bank of America Merrill Lynch (-7%, -26%): Slightly up in 4Q, but lower for the year.

Access intelligence that drives action

To unlock this research, enter your email to log in or enquire about access