When Jacob Palmstierna, reputation shredded, resigned from S-E-Banken in November it sent a clear warning to every ambitious young executive in Sweden: get out of town. Why work in a country where the pay is poor and careers are ruined for relatively trifling reasons, when Frankfurt and New York – London even – are so much kinder?

As Euromoney went to press, S-E-Banken, which dominates Scandinavian banking, was trying to regain its poise after losing a promising leader in the most embarrassing of circumstances. The timing could not have been worse: despite its enviable position at the very heart of Sweden’s business community, S-E-Banken needs strong management at a time of unprecedented upheaval in the banking industry throughout northern Europe.

It was only in April that Baron Jacob Palmstierna, at the age of 55, was named group chief executive – finally grasping the prize he had been working for all his life. But it was also in April that a minor civil court ruled against him in a tax dispute that was later to become the talk of the town.

|

Click for original |

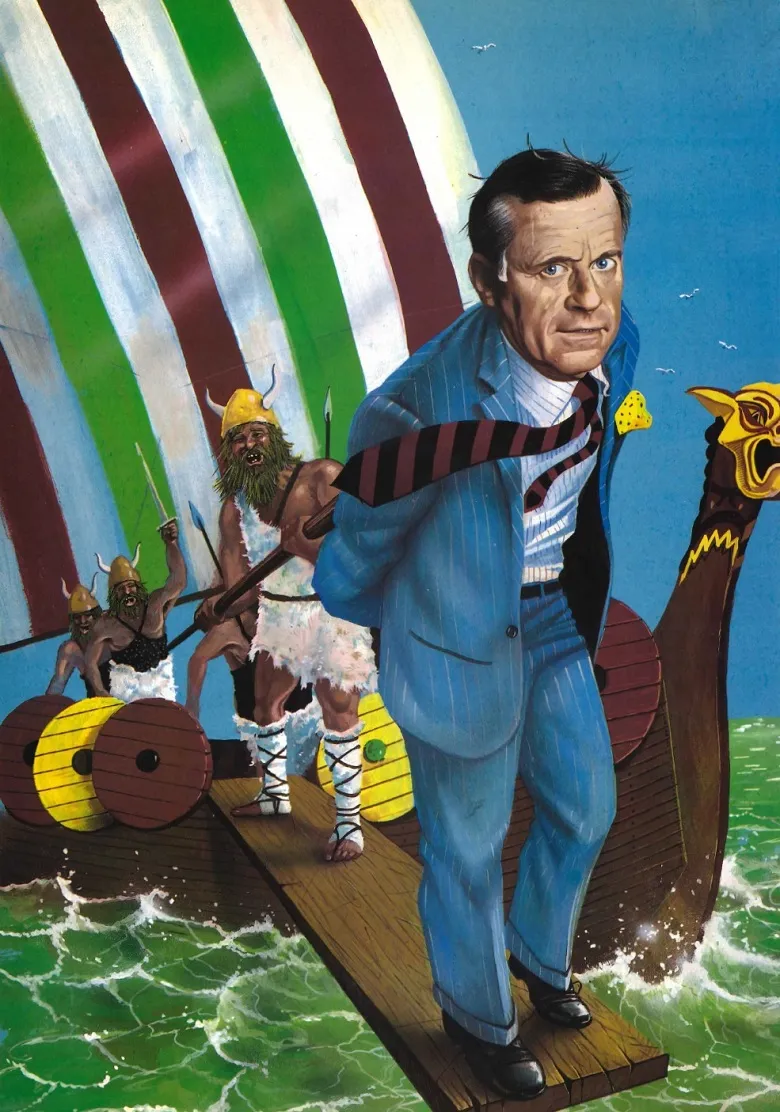

In a way, Palmstierna had been marked out as a future leader from the moment he joined S-E-Banken in 1960. Although he never used his title, he comes from an old aristocratic family and is related on his mother’s side to the Wallenberg dynasty.

André Oscar Wallenberg founded Stockholms Enskilda Banken in 1856 and it was run by his sons and grandsons in an unbroken line until merger with Skandinaviska Banken in 1971. The greatest of this progeny was Marcus Wallenberg, who by his death in 1982 oversaw a family empire that today still holds major shareholdings in most of the household names of Swedish industry, including Asea, Saab-Scania, Atlas Copco, Stora, Electrolux, Astra, Alfa-Laval and LM Ericsson.

Since the 1971 merger to form S-E-Banken, Wallenberg blood hasn’t been a prerequisite for rising to the top of the management ladder – Palmstierna’s immediate predecessor, Hans Cavalli-Björkman, for example, isn’t a family member. But it certainly doesn’t hurt and Marcus Wallenberg encouraged Palmstierna, introducing him to many of the overseas contacts he had cultivated during a lifetime’s gadding around the globe. The grooming of Palmstierna seems to have intensified after the suicide of one of Wallenberg’s sons, Marc, who was managing director of Stockholms Enskilda and took his life at the time of the merger.

The problem was that Palmstierna wore all this rather poorly. Överlügsen (overbearing) and dryg (dry) they called him at the bank. He would snub the oldest of friends. “I knew him when we were children,” says one Swede, “but when I saw him at a party recently, I had to prod him to get him to acknowledge me. He knew all right, it’s just that he had become a big fish and I’m a rather smaller fish.”

“Even in his college days he was overbearing and arrogant,” reports a man who attended the same classes. (Palmstierna did not return calls made in reporting this story, unlike a wide range of top figures in Swedish finance and industry.)

|

|

|

Palmstierna: |

Later in life, Palmstierna did try to turn on the charm; he was ordered to do so by Cavalli-Björkman, reports an executive close to both men. But to many colleagues and customers, the charm appeared only skin-deep. “He smiled, but he never smiled with his eyes,” says one former client. “A cold man. I didn’t want to be near him,” adds a man who left S-E for other pastures.

(Cavalli-Björkman himself brims with good humour and good nature, say his friends. Indeed, to his great delight, Cavalli-Björkman is chairman of Malmö football club. Selection for the post is tantamount to an accolade from the people of that working-class town. “It would never happen to Palmstierna,” says one source. “He wouldn’t be able to talk to the players.”)

Others have found different things to dislike about Palmstierna. Some of the more conservative tongues in Sweden’s banking community wagged about his personal life – he was planning to marry on December 9 for the fourth time. “Four wives isn’t appropriate for a senior banker – not four,” according to one senior banking source. And then Palmstierna committed the ultimate sin in the eyes of many Swedes – he appears to have a lot of money.

Yet Palmstierna may not be an especially wealthy man. He does own more than one house in fashionable parts of Stockholm and he inherited an ancestral castle and estate, complete with staff, at Maltesholm in the south of Sweden. But that doesn’t necessarily mean that the estate makes money – possibly the reverse, some bankers close to Palmstierna suggest. When Sweden announced tax reforms recently, and Palmstierna was interviewed by journalists, “he seemed more interested in whether he would be able to make deductions for repairs to his castle than in the broader issues”, says one writer.

|

|

|

From scion to supreme |

Three divorces and a number of children most likely haven’t helped his exchequer, either. His salary at the bank was probably in the region of Skr2 million to Skr2.5 million, some $300,000 to $380,000. Not large by international standards, especially when Sweden’s high cost of living and even higher taxes eat into it. None of this matters to the Swedes, however. Bankers, journalists and officials at the public prosecutor’s office studying Palmstierna’s case all described him to Euromoney with the unacceptable adjective in socialistic Sweden: rich.

For years, though, Palmstierna managed to shrug off this widespread jealousy and ill-feeling towards him. He was placed on the board of Stockholms Enskilda Banken as early as 1970 and made the board of the merged S-E-Banken in 1977, further indications of Marcus Wallenberg’s approval. Palmstierna’s personal discipline helped; not even his fiercest critics fail to mention his capacity for long hours of hard work, year in, year out. He looked the part, too: a nonsmoker, he kept himself fit and lean with tennis, the approved sport at S-E-Banken (Marcus Wallenberg was once a Davis Cup player for Sweden).

Palmstierna was a diligent, decisive, multilingual manager. “He would always return your calls quickly and he never let work pile up. He worked on every detail,” says one colleague. On a recent occasion, S-E-Banken disputed a technical detail in the way Euromoney compiles its annual Euromoney 500 rankings of the world’s largest banks. And it was Palmstierna who went personally to the New York headquarters of Bankstat, the Bankers Trust database unit that provides the rankings, to discuss the technicality. Adds the colleague: “If he had more warmth in him, he would be one of the best executives in the world. All this would be easier for S-E if he weren’t such a star.”

Palmstierna’s all-business attitude fitted well in the all-business atmosphere at S-E-Banken, which Swedes frequently contrast with the demeanour of executives at Svenska Handelsbanken, the second largest bank in the nation. “Go to dinner with the Handelsbank people and you can talk art and culture and music. Not at an S-E-Bank party,” says one well-placed source.

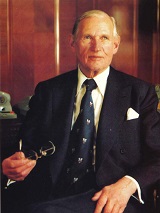

Handelsbanken officials even do what would be unthinkable at S-E-Banken – publish books for popular consumption. Honorary chairman Tore Browaldh, for example, has written several volumes of candid memoirs, while vice-chairman Jan Ekrnan has a volume of salmon fishing in northern Norway to his credit. Browaldh is also noted as a jazz pianist and composer – his works include a number called “Riksbanken Blues” (Central Bank Blues).

Just how good a banker Palmstierna has been is difficult to determine because S-E-Banken’s distinctly strange top-management structure makes it hard to isolate individual achievements. S-E-Banken has no fewer than four chief executives, one each for the regional offices in Malmö, Gothenburg and Stockholm, with a fourth for the head office, also in Stockholm, which is responsible for multinational clients, international activities and various staff functions.

The chief executives form an executive management board chaired by one of the four. The chairman of the management committee sometimes, but not always, also carries the title of group chief executive. On top of the whole structure comes a group chairman – Curt Olsson, for several years now.

Olsson retains some executive functions: he it is who attends meetings at the Riksbank, for example, not Palmstierna (or, for that matter, Cavalli-Björkman during his period as chief executive.) This complicated structure, however, should not obscure the importance of the group chief executive’s post — Palmstierna had risen to the most powerful job in Scandinavian finance.

International activities, which have been the primary focus of Palmstierna’s career, have had their ups and downs. S-E’s London unit had post-Big Bang troubles, like everyone else, and S-E’s unit in Switzerland has had a series of problems involving its commodity lending and foreign exchange operations. Operational profits of the group’s banking business outside Sweden fell 52% to Skr79 million in 1988, although they are expected to recover sharply this year.

What can be said with clarity is that Palmstierna has been for some years a member of a senior management team that has built a magnificent bank. Earnings per share have risen in each of the five years from 1984 to 1988. Return on assets was more than 2% in 1986 and only a hair short of 2% in the following two years. Return on equity, after standard tax, has been better than 20% for the past three years. By the reckoning of London-based IBCA, which analyses bank performance, S-E has been the most profitable bank in the world in the past three years – an achievement that must have made Palmstierna’s chest swell as he stepped up to chief executive this year.

|

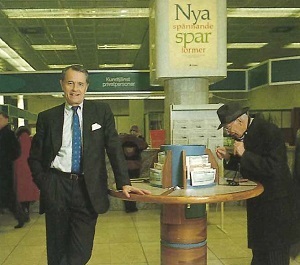

| The house that brought Jacob down: Palmstierna paid 3,000 kroner a month in rent to live here. |

How irritating, then, to have a tax problem niggling at the bank of his mind at the moment of triumph. The case concerned a house that Palmstierna rented from the bank during the years 1980 to 1987 for Skr3,000 per month. Renting houses under sale-leaseback arrangements with an employer is common practice and perfectly legal in Sweden. (The house was nominally owned by a property company, but this was because of a nuance in Swedish banking law and the arrangement was wholly legitimate.) The problem was that the tax court deemed that Skr3,000 was not an economic rent for the house – it was a pleasant villa in the Djursholm district of Stockholm. Therefore, the court said, Palmstierna was receiving a taxable benefit, and ordered him to pay approximately Skr250,000, about $38,000, in back taxes covering five years – the court could not go beyond five years because of a statute of limitations. Palmstierna lodged an appeal.

Palmstierna had not mentioned the house on his tax return. This was a mistake. Had he done so, the tax authorities might have assessed him for additional tax but there would have been no room to suspect deliberate concealment. “It’s not a major thing,” says an executive who is a friend of Palmstierna. “It’s a very small amount. If he had just written it down, they would have probably accepted the Skr3,000 and that would have been that.”

(At least one other S-E executive – chairman Olsson – has been challenged in the past by tax officials over a house rented from the bank. In Olsson’s case, he put the house on his tax return but did not state there was a benefit to him because, he said, he believed the rent was economic. The tax officials disagreed and quietly assessed him more taxes.)

Who tipped off the tax authorities about Palmstierna’s house (or whether officials dug out the information themselves), no one knows – or rather, is saying. Certainly someone – similarly unidentified – tipped off the press and in July all Sweden began to read about the case under such headlines as Pinsampt Palmstierna (How embarrassing, Palmstierna).

|

|

|

S-E chairman Curt |

At this stage, Palmstierna made two errors in tactics. First, he said that he did not know that was not an economic rent. Yet a senior Swedish executive points out: “That’s a rent for a small apartment in a shabby part of town, so his statement didn’t sit very well.” And second, Palmstierna withdrew his appeal of the tax-court ruling, seemingly in the hope that the affair would die away, although he continued to maintain his innocence of any tax fraud.

Had Palmstierna pressed the appeal, he would have had at least two points in his favour. First, he could have argued that he would not be living in such a big house but for the fact he had to carry out bank-related entertaining in the dwelling, and therefore the Skr3,000 per month was an economic rent for that part of the house needed for his personal use. Second, he could have pointed out that the bank had not mentioned the house in the annual return on salary and benefits that it is obliged to lodge with the tax authorities. The bank’s omission, under Swedish law, would not have absolved Palmstierna from the personal obligation to declare all his income, but it certainly would have helped his case. Palmstierna’s tax returns were prepared for his signature by bank accountants.

In the event, as soon as the appeal lapsed, the file on the matter was sent to the public prosecution system, as is standard practice in Sweden. It arrived on the desk of prosecutor Bengt Strömberg, who took a high moral view. A man in Palmstierna’s position, Strömberg later told Euromoney, “has to be like Caesar’s wife”. Yes, but isn’t Skr250,000, over a five-year period, a trifle? “It’s just a funny little sum, but sometimes very rich men are mean. They are eager about every shilling. ” Isn’t it rather unusual for a regional prosecutor – a relatively senior official – to take a case involving such a small sum? “It is rather unusual. I took it because it’s Palmstierna.”

In one of the oddest episodes in the affair, Strömberg dispatched the police to S-E-Banken headquarters on September 21 to search for papers. The bank was outraged, saying the prosecutor could have telephoned and it would have sent the papers without any fuss. Instead, there was maximum fuss: journalists learned about the raid and before police left the building at least 20 newsmen from radio, television and the print medium were crammed into the bank lobby.

|

| Prosecutor Bengt Strömberg – “I took the case because it’s Palmstierna” – may yet proceed to criminal court. A possible sentence: one to six months in jail. |

Strömberg insists he didn’t tip off the journalists. “We tried to do it in secret, but some of the journalists were good researchers and found the information on our open register [which contains details of searches of houses and offices].” And he maintains that the raid was not a big affair – two rather elderly policemen, not in uniform, and a lady accountant. “I don’t think Palmstierna has the right touch with the press. Most journalists have low salaries and aren’t sympathetic to rich men.”

Strömberg says the purpose of the raid was to find out if Palmstierna’s tax discrepancy was the result of a mistake or whether it was deliberate evasion. As this magazine went to press, he had not decided whether to take Palmstierna to a criminal court. But he was willing to speculate on the possible jail sentence a criminal court conviction in a case of this nature might bring. “One month, two months, three months, six months,” he said, with a smile. Strömberg is a friendly man who smiles frequently.

The Swedish press found the raid extremely unusual and began to wonder if there was more to the business than met the eye. Palmstierna, asked just that question on September 22 by the Time-like newsweekly Veckans Affärer, said: “No, there is nothing else. It is precisely only this.” Palmstierna appears to have said something similar to the S-E-Banken board. On October 10, the board gave him a vote of confidence which was announced publicly by chairman Olsson.

From that moment, developments unravelled very quickly for Palmstierna. The day after the vote of confidence, the property company that had held Palmstierna’s house called the bank. A journalist, the company said, was making enquiries about a second Djursholm house that Palmstierna had rented from the bank in a similar arrangement between 1977 and 1980. When the bank began to search for papers relating to this, it found the documents were already in the hands of the police who had made the raid.

|

| After the vote of confidence, up popped the matter of house Number Two. |

When questioned about the second house, Palmstierna reportedly said he hadn’t remembered that it had been rented by him under a sale-leaseback arrangement. He knew the house itself, of course – his second wife lives there now. Palmstierna bought the house back from the bank at the end of the lease arrangement and moved into the 1980-1987 house that was the original focus of the affair. (Palmstierna’s third wife now lives in that house.)

Palmstierna might have survived the second revelation, which duly reached the press in the middle of October, had it not been for a further revelation — of a third house.

On October 25 the newspaper Dagens Industri reported that Palmstierna had purchased that house, also in Djursholm, and rented it to the Mexican government for use as an embassy. The rent was Skr30,000 a month – 10 times the rent of the 1980-87 house for a property not very much bigger.

In many quarters, this was seen in black and white. “Jacob Palmstierna misled the board of S-E-Banken,” moralised Veckans Affärer. “By not placing all his cards on the table at the board meeting of October 10, he lost his credibility.”

It wasn’t that black and white. Palmstierna’s transaction was perfectly legal and quite common: under the Swedish tax code, taxpayers can receive the rental income from one property tax-free. The house was nothing to do with the bank, and some directors reportedly saw no reason for Palmstierna to disclose the transaction to the board on October 10. As for the high rent, this could be explained in part by the fact that Palmstierna sold the house back to the Mexicans at the end of the rental agreement at a below-market price. In other words, he appears to have given up a capital gain on the sale price of the house in return far an above-market rental income.

|

|

|

Palmstierna’s |

These subtleties were lost. As far as the general public was concerned, Palmstierna had said that he didn’t know that Skr3,000 was an uneconomic rent for one house, at a time when he knew perfectly well he was receiving Skr30,000 for another. “That’s awfully hard to explain to the ordinary person,” says one banker. In addition, the Mexican house made Palmstierna look like a man who gave detailed attention to the intricacies of his tax affairs – a distinct contrast with the man who had not known much about rental levels in Stockholm and had forgotten about an earlier rental agreement.

There were still Palmstierna supporters on the S-E-Banken board, but not enough. Pehr Gyllenhammar, chairman of Volvo and a man given to public statements about the need for high ethical standards, reportedly was among those who had lost patience.

And Olsson felt personally embarrassed, his friends say – after all, when asked by a magazine reporter on September 24 whether any further Palmstierna property dealings would emerge, he had said: “I find it difficult to imagine what could turn up.” Says one source: “Curt was very upset.”

On November 14, Palmstierna made the inevitable resignation statement: “My name has become such a burden because of past events that I no longer represent an asset to the bank.” Thus he joined a long list of major Swedish figures whose careers have been marred in recent years by public hullabaloos over allegations of improprieties on tax returns or expense forms – the list includes former Chief Justice Per-Erik Nilsson, former Justice Minister Ove Rainer, film director Ingmar Bergman, and former chief of the Swedish Debt Office, Lars Kalderén. (One scandal has been running contemporaneously with the Palmstierna affair this year: Kjell Brandstrom, ex-head of Industrivarden, an Investment company close to Handelsbanken, has been accused of expenses irregularities during a former employment, a charge he strongly denies.) Almost always the sums involved have been small, and in many instances the victims of these ordeals have been found innocent. “But once the evening press and the evening television news get their hooks into you, you’re always the loser,” says one.

This national sport, in some eyes, isn’t entirely healthy. Bengt Rydén, chief executive of the Stockholm Stock Exchange, even risks opprobrium, to say so publicly: “I’m totally confident,” he said in a recent speech, “that everybody in this room would be found lacking if subjected to the same scrutiny as Palmstierna.”

Others see the string of scandals as an outgrowth of the political atmosphere in Sweden, which has been ruled by social democratic governments almost without pause since 1932. “The long-term political aim has been to keep the differential between shop-floor worker and chief executive to a minimum,” says one prominent Swede. “They’ve done pretty well. It accords with what we call Swedish jealousy.”

Certainly Palmstierna’s downfall will do no harm to the finance minister, Kjell-Olof Feldt, who is piloting a wholesale reform of Sweden’s tax system. After 1991, no Swede will have to pay more than 50% of his income in tax – current top rate is 72%. A person earning Skr250,000 in 1989 will pay approximately Skr130,000 in tax, but this will fall in stages to Skr90,000. A new demonstration that the government is tough on high-flying executives can do no harm in the selling of the package to the electorate.

Meanwhile, S-E chairman Olsson is left to pick up the pieces after Palmstierna’s departure. “There is some damage to the bank, I must admit that,” he told Euromoney the day after his chief executive’s resignation. “But we will have plenty of opportunity to repair that. It is more a question of confidence in Palmstierna than of confidence in the bank.” The S-E-Banken, he acknowledged, had made a mistake in not including details of Palmstierna’s house on the papers returned by the bank to the tax authorities. “From the legal point of view, that is a minor offence. We might be subject to attention from the district attorney, but the consequences would be small.”

As for Palmstierna, Olsson said: “He is very energetic. He has represented the bank inside and outside Sweden brilliantly. I want to emphasise that Palmstierna did not in any way do anything wrong at the bank. He has lived up to all his obligations here. The only mistake he made was not to put this house on his tax form.”

|

|

|

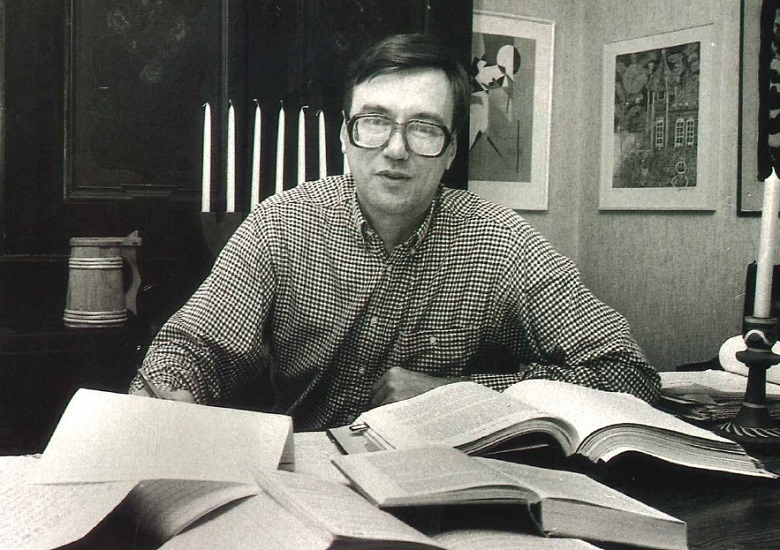

“New, exciting ways to save” is roughly what |

Late last month, Olsson ended the search for a replacement for Palmstierna by naming Bo Ramfors as both chief executive and chairman of the executive management committee. Ramfors will retain his existing responsibilities as regional chief executive for Gothenburg, shuttling between there and Stockholm. Rutger Barnekow, chief executive for Stockholm region, becomes Ramfors’s deputy.

Ramfors is well-respected and has 10 years at Hambros in London to his credit. Before his selection, it was thought possible that Olsson himself could step down from chairman to chief executive, but that would have disturbed the delicate peace treaty between Peter Wallenberg, Marcus Wallenberg’s surviving son and deputy chairman of S-E-Banken, and Volvo’s Gyllenhammar. (Towards the end of his life, Marcus Wallenberg shuffled some of the family holdings with Volvo and effectively selected Gyllenhammar as the next ruler of the family empire over son Peter. In a fight following his father’s death, Peter showed more steel than anyone had suspected. Both Gyllenhammar and Wallenberg wanted the chairmanship of S-E and compromised on the widely respected Olsson.)

Ramfors won’t have an easy time. S-E may be very strong but it sits in a region where financial deregulation is moving very fast – Sweden, for example, is expected to allow foreign banks to set up branches in 1990; permission to buy stakes in Swedish banks is expected to follow. S-E will also have to ask itself the same question as every other northern European bank: is it big enough to compete in the 1990s?

Den Danske Bank and Copenhagen HandelsBank of Denmark, for example, last month decided they weren’t big enough and agreed to merge. Days later, Svenska Handelsbanken bid for Skänska Banken of Malmö in a deal that would make Handelsbanken as big as S-E in asset terms — around Skr300 billion. (At the end of 1988, the Handelsbanken group weighed in at Skr238 billion in assets, against Skr289 billion at S-E.)

And likely as not, as the new chief executive at S-E-Banken wrestles with that kind of strategic conundrum, he will have at the back of his mind the uneasy feeling that some little slip in his personal finances, however trifling, will ensure his appearance on the front page of the newspapers that very evening.