|

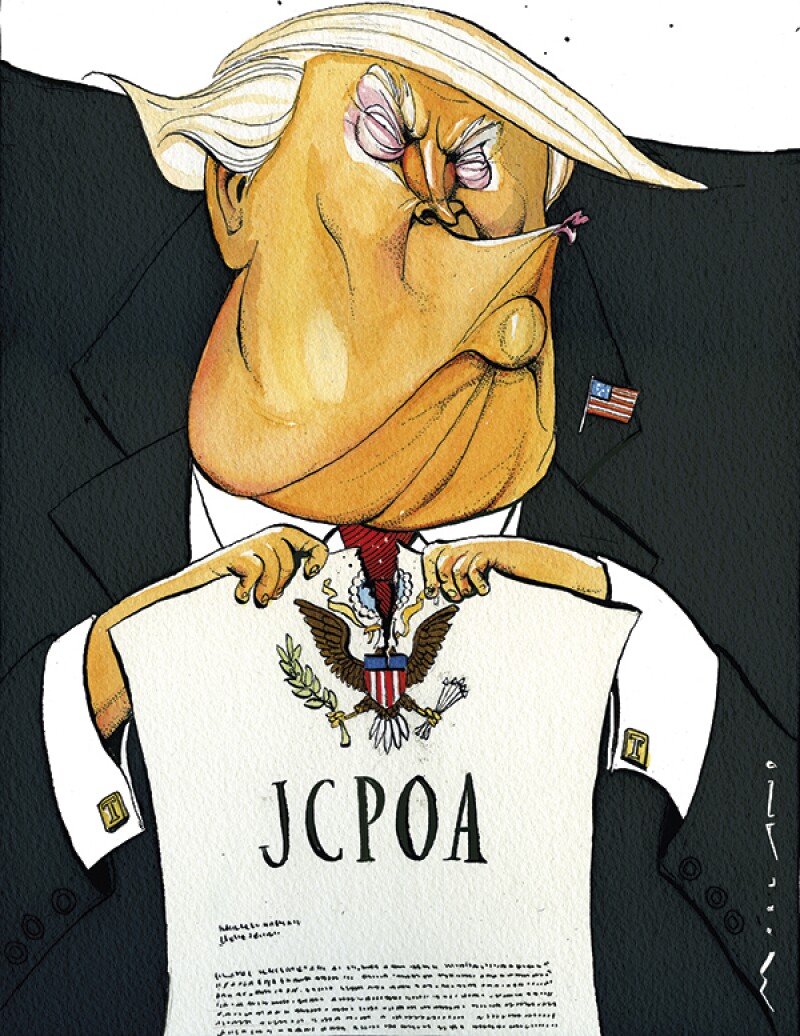

Illustration: Morten Morland |

"I have no knowledge of US politics, to be honest,” he says, wryly, as he reclines in his chair. “But my understanding so far is: Democrats say something, do something else and stab you in the back. With Republicans, it’s two ways – war or business.

“Jimmy Carter, Bill Clinton, Barack Obama: these are all complicated people with complicated solutions,” he continues. “They never resolve issues. At least, with Republicans, we have a clear picture.”

This is the view of a senior Iranian banker in his office in Tehran, as he tries to make sense of Donald Trump’s imminent accession to the White House.

Trump’s election is of vital significance to Iran’s banks because he has vowed to undo the nuclear deal signed last year, which removes nuclear-related sanctions on Iran and its banks in exchange for limitations on the country’s nuclear programme. The deal, the Joint Comprehensive Plan of Action (JCPOA), was ratified by Iran, the permanent members of the United Nations Security Council (the US, China, Russia, France and the UK) as well as by Germany and the European Union.