|

Authors |

|

|

Shaun Osborne Global Foreign Exchange, Scotiabank |

|

Eric Theoret Global Foreign Exchange, Scotiabank |

For more insight, view Scotiabank’s FX Market Reports |

|

The policy response to the Great Financial Crisis of 2008/9 has been characterized by aggressive and extraordinary central bank measures in a bid to boost growth, curb deflation risks and stabilize financial systems. As expected, returns on ‘safe’ assets have diminished and investors have been forced along the risk curve to obtain more satisfactory returns.

The Institute of International Finance (IIF) recently noted that around $10 trillion-worth of government bonds (for example, Japanese, eurozone, Swiss, Danish and Swedish debt) now offer negative yields and no end appears to be in sight. With interest rates in many jurisdictions already at, or near, record lows, a recent Bloomberg report noted that “market implied rates in 20 of 33 countries tracked by Bloomberg, representing 40% of world GDP, show traders expect even lower borrowing costs in six months”. The search for yield will only become more desperate as low or negative nominal yields become more entrenched in government, and even corporate, debt.

Stylized investment strategies have become more common among currency traders as portfolio management techniques spill over from equity investors. Common thematic investment approaches to currency speculation reflect value investing (buying ‘cheap’ and selling ‘rich’ currencies, according to some metric), momentum strategies (buying winners and selling losers) or, quite commonly in the early/mid 2000s, carry trades (where investors buy a higher yielding currency and fund that position by selling a lower yielding currency). Indices measuring the performance of these strategies allow us to observe changes in FX investor behaviour in response to the changing economic and market landscape.

Carry strategies proved popular and were consistent money makers for investors in the low-volatility period leading up to the financial crisis – until the downside of the higher risk/higher reward trade-off became apparent. The more aggressive the reach for yield, the more exposed investors become to a range of risks – market, credit, liquidity. Sometimes, exposure to these risks occurs simultaneously, as we saw in the Great Financial Crisis.

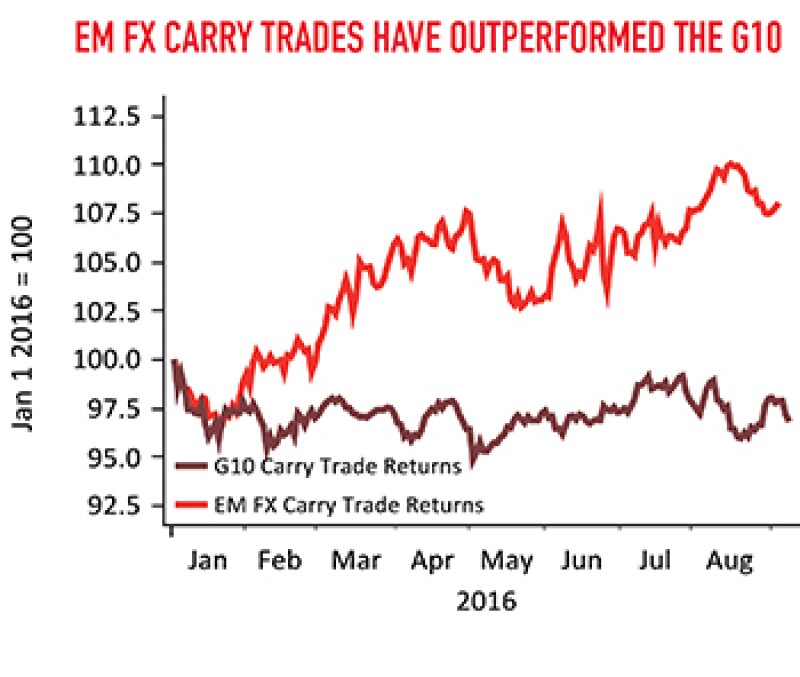

Last year, the correction in commodities prompted focus on terms of trade-centric strategies – selling commodity producer currencies whose terms of trade were deteriorating (Canadian and Australian dollar etc) and buying commodity consumer currencies whose terms of trade were conversely improving (US dollar). The commodity trade has been a dud this year, however. Instead, FX investors are making winning bets on carry trades again after this strategy lost money in 2015 and had a patchy start to 2016.

|

Source: |

Investors are being forced to cast a wider net to capture attractive yields, however, with nominal and real yields in many developed markets near zero or worse. Large, relatively liquid, emerging bond markets are attracting more interest from international investors, due to their positive (but low single-digit) returns.

At least some of the FX market’s firepower has had to be concentrated on developing markets to generate the positive carry returns seen this year. Bloomberg data show very strong, net (currency appreciation and interest earned) returns for investors going long Brazilian real and South African rand, for example, via a short US dollar position. Since the start of this year, a buy-and-hold approach using this strategy has produced a cumulative excess return of 25%, according to Bloomberg data.

In contrast, a G10-centred carry trade strategy has delivered weaker returns. A long AUD position funded via an equally weighted basket of USD, EUR and JPY is barely positive on the year to date, for example. Selling the SEK to fund a long NZD does better, returning around 11% year to date, however.

Carry trades thrive in the kind of low-volatility environment we are seeing now, particularly when yields of the funding and target currencies are diverging. However, experience suggests that this strategy is prone to sudden stops and significant reversals. This may be especially relevant for emerging market-based carry trades with US Federal Reserve policymakers suggesting that monetary policy may be tightened again in the coming months.

IIF research* highlights the fact that emerging markets are prone to weakness or crisis when the Fed is tightening policy. This is especially the case when the policy tightening is in its early stages or when market participants are concerned that the adjustment in monetary policy may be more significant (in terms of how quickly or significantly monetary policy will be tightened).

Scotiabank expects the Fed to tighten policy by 25 basis points in December and implement three additional ¼ point increases in 2017. With market pricing barely reflecting the risk of one 25bp tightening over the next 12 months, a tightening of the scale we anticipate may well have repercussions for markets moving into 2017 – volatility would likely increase, forcing investors to reduce exposure to emerging markets and carry trades especially. Currencies that benefited most from attractive yields so far this year – the Brazilian real, the Russian rouble, the Turkish lira and the South African rand, for example – may be most at risk of correction.

* Determinants of Emerging Market Crises: The Role of U.S. Monetary Policy, Robin Koepke

™ Trademark of The Bank of Nova Scotia and used under licence. Important legal information and additional information on the trademark may be accessed here.