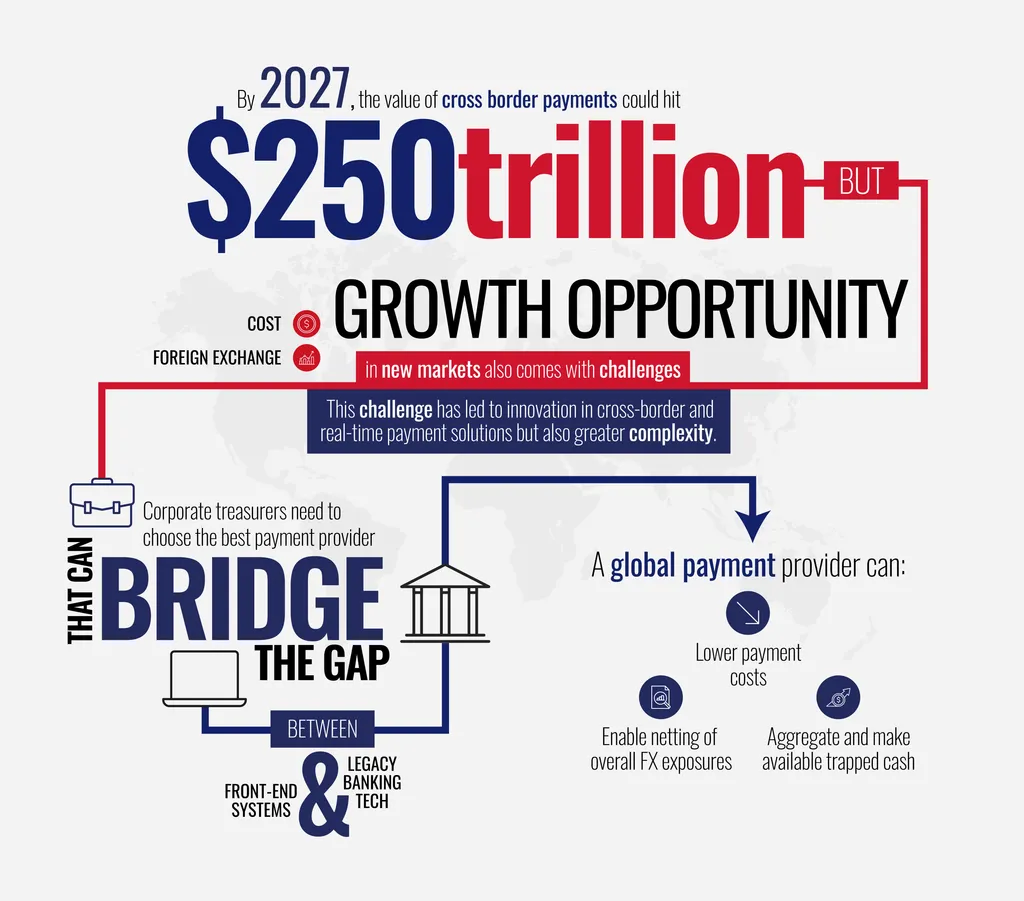

This growth opportunity also comes with the challenges, cost and risk of foreign exchange (FX). Corporate treasurers must choose the best payment provider to bridge the gap between front-end systems and legacy banking technology. This can enable netting of overall FX exposures, lower payment costs, and aggregate and make available trapped cash.

The 50 trillion cross-border payments opportunity

Cross-border e-commerce is booming. By 2027, the value of cross-border payments could hit $250 trillion.

September 7, 2022

Related

Corporate banking

Challenger banks redefine SME banking

Bolstering SME finance amid interest rate headwinds

Sponsored by CIB

Unleashing green growth through SME support

Sponsored by CIB