Spare a thought, please, for the poor US Securities and Exchange Commission, which must feel much of the time like it is damned if it does and damned if it doesn’t.

It has only just managed to put behind it the embarrassment of having its X account hacked, but now its latest regulatory move lays it open to accusations that it is closing the stable door after the horse has already been turned into glue.

The X incident, incidentally, involved someone pre-empting the SEC’s subsequent announcement that it would permit the creation of exchange-traded funds tracking the value (if that is the right word) of bitcoin, making it easier for small investors to sink their teeth into a whole asset class that JPMorgan’s Jamie Dimon has often said is a fraud.

Not to worry, though, as this week the SEC was back to protecting the little folk, this time from the ravages of special purpose acquisition companies (Spacs), by adopting hundreds of pages of final rules on the capital markets oddities.

You would be forgiven for having forgotten what they are, as they have not exactly been A Big Thing of late. But during the coronavirus pandemic – when Spac promoters spotted a way to capture cash that might in normal times have been destined for the conventional IPO market – they were very much en vogue.

In 2021, for instance, there were 613 Spac IPOs in the US, according to the SEC, accounting for 63% of all IPOs. And while the number collapsed in 2022 to just 86, those reached a record 73% of all IPOs.

All that is behind us now, of course. The world has moved on, perhaps to bitcoin ETFs, if not quite yet to actual IPOs. But that doesn’t stop a regulator from bravely stepping up to tackle the last crisis.

Investor protections

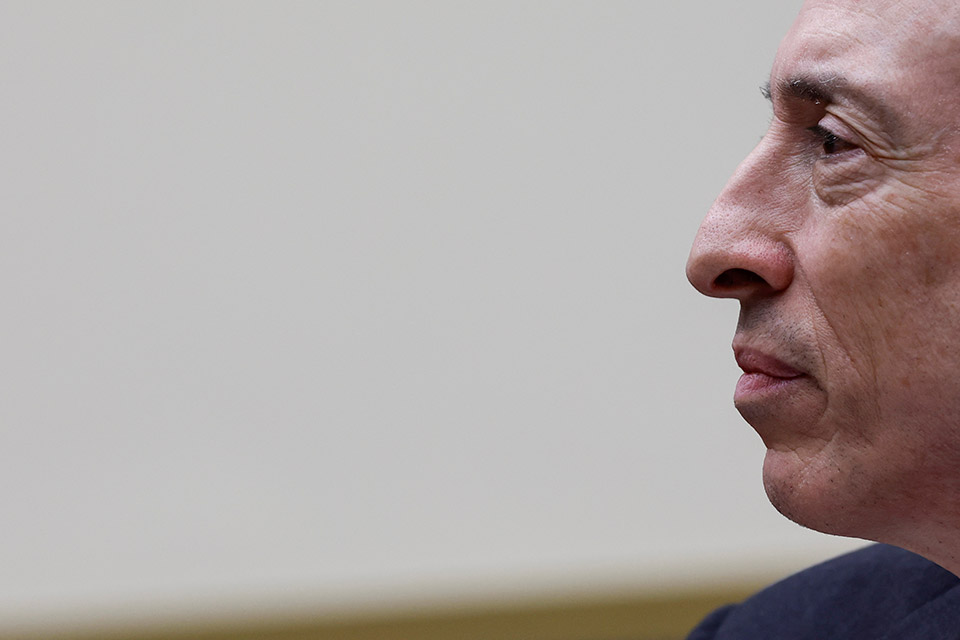

Gary Gensler, the SEC’s chief of police chairman, has had it in for Spacs for some time. And, in fairness, not without reason. Concerns about the bubble went far beyond the fact of some Spacs merging with companies that were subsequently found to have been less than transparent about their prospects and performance.

The bigger issue was about how Spacs had somehow managed to skirt many of the investor protections that their conventional cousins had to adhere to. As Big Gary tells it: “Just because a company uses an alternative method to go public does not mean that its investors are any less deserving of time-tested investor protections”.

Not much to argue with there.

And so the SEC has unleashed a slew of new requirements, many of which simply bring Spacs – and, for that matter, any shell companies – explicitly into line with rules that exist for other companies.

Some of them seek to do the same with relation to the de-Spac transaction, which is when a Spac merges with a private company and effectively takes it public, although previously without many of the same requirements when it came to information disclosure because technically the deal was treated as a merger rather than an IPO.

There is some substance in the new rules, and while the timing looks odd, it is not completely without logic

Buried among the rules are a couple of decisions that seem to stand out as particularly important. The first (starting on page 232 if you’re interested) stops Spacs from taking advantage of the Private Securities Litigation Reform Act (PSLRA) to argue for more leeway in the use of financial projections, and which is achieved by ruling that Spacs are now a form of blank-check company.

The other (page 360) is the decision not to exempt Spacs from the Investment Company Act under certain circumstances. This is the woolliest, because it is essentially a matter of judgement (“Whether a Spac is an investment company […] is a question of facts and circumstances”, says the SEC). But we have been here before, most notably with Bill Ackman and his famous Spacs and Sparcs.

Ackman, you may remember, came under attack from opponents who argued that his vehicles – and, by extension, the hundreds of other Spacs like them – were effectively investment companies because they were holding investor money and investing it in stuff like US Treasuries while they were hunting for a de-Spac deal.

Making a Spac a Spac

Anyway, the SEC has decided in the end not to rule definitively on this and instead give the market guidance on the kind of things that it thinks make a Spac a Spac – and these do not include doing things like investing in corporate bonds or buying minority stakes in companies instead of doing proper mergers.

There is some substance in the new rules, and while the timing looks odd, it is not completely without logic. The SEC has noticed that Spacs are not quite the force they were, but it points out that while the money committed to Spac IPOs was only 15% of all US IPOs in 2023, down from 50% to 60% at their peak, they did still constitute 43% of the total number of IPOs.

And it is hard to fault the regulator’s diligence, with the rulemaking and its related guidance stretching to 581 pages.

But not everyone agrees with the work. In her dissenting opinion, Commissioner Hester Peirce, a frequent opponent of burdensome regulation, said that the SEC had failed to identify a problem that the new rules would solve. She argued that they would contribute to the shrinking of the pool of public companies, and might even make disclosures less accurate, rather than more.

“The regulatory reaper came for Spacs and seems to have won,” she said.

And it does all feel so 2021.