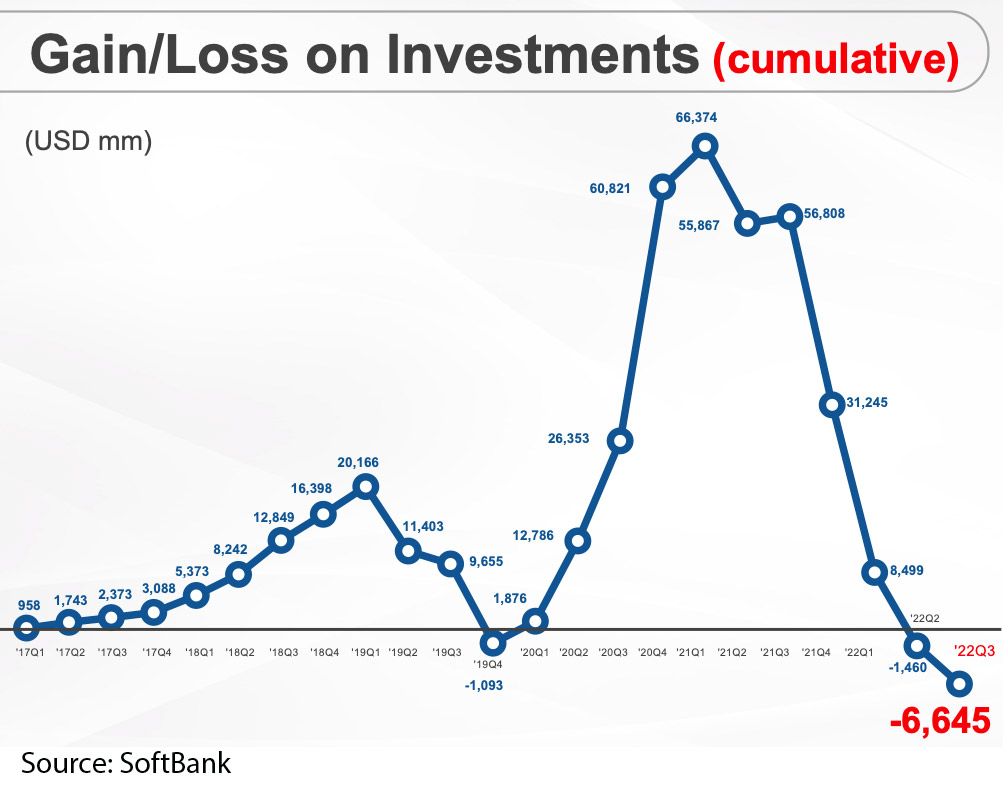

There is a chart in SoftBank’s latest earnings presentation that, in its sharp rise and lurching fall, brings to mind the straight flanks of Mount Fuji, only considerably steeper. One finds this massif in a chart called ‘Gain/loss on investments (cumulative), Vision Funds’.

This week [results were published February 7] showed a $5.2 billion loss on investments for the Vision Funds for the quarter, the misery of which is only alleviated by the fact that it is not as bad as any of the previous three.

Access intelligence that drives action

To unlock this research, enter your email to log in or enquire about access