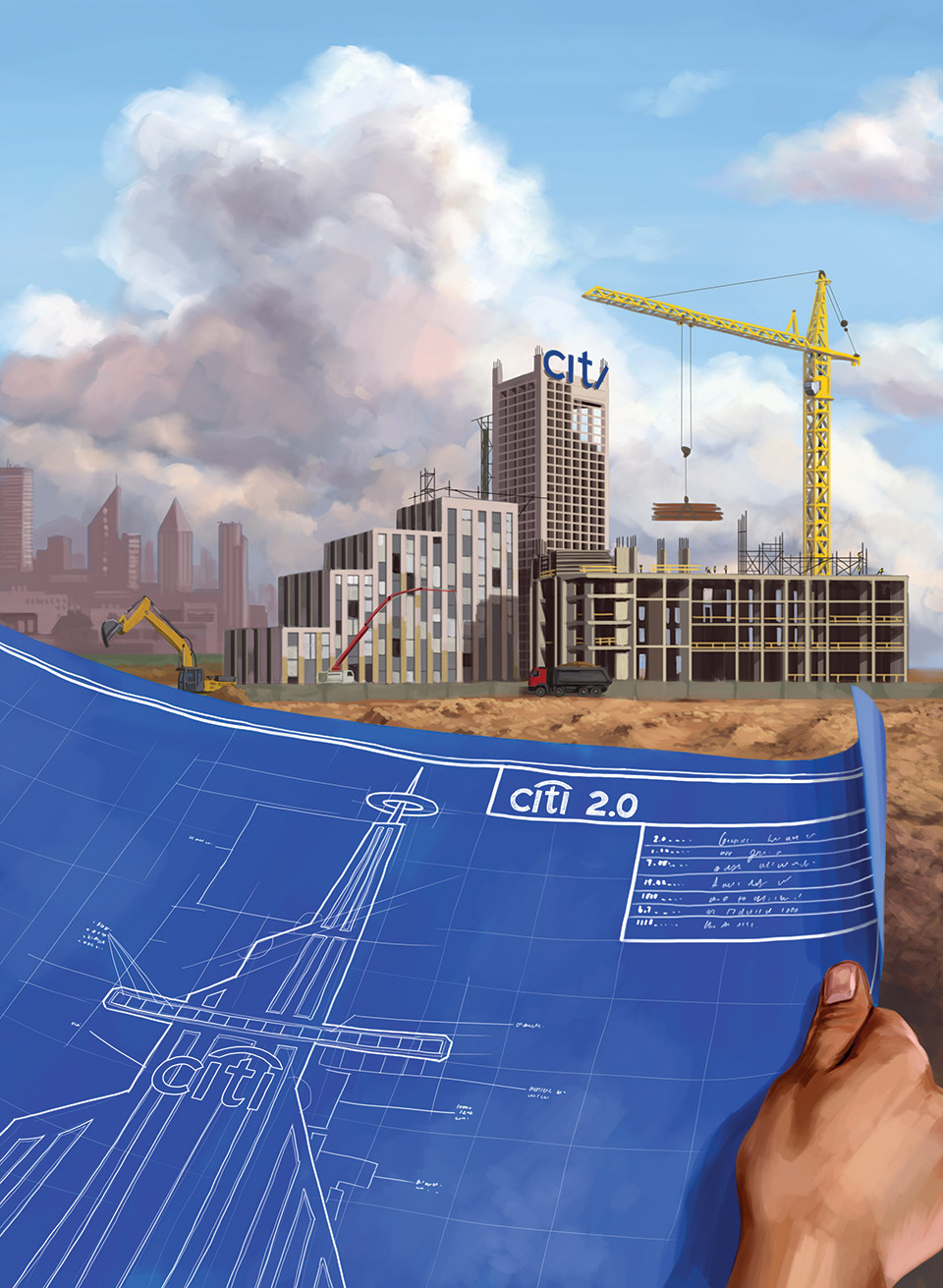

Picture the scene. After years of crisis management and recovery following its near-fatal collapse under the weight of toxic assets, Citi announces an organizational and management overhaul. It is part of becoming a simpler, more focused and better managed bank and it follows strategic decisions to shed non-core assets.

The bank, we are told, will retain its international network – “the one true competitive advantage we have,” an insider tells Euromoney. But it will strive to make more from the links between the few businesses where it is a clear leader, such as global transaction services, foreign exchange and rates for its corporate customers that operate across multiple countries.

Access intelligence that drives action

To unlock this research, enter your email to log in or enquire about access