Few bank research reports attract as much attention as the whitepaper JPMorgan Payments released on February 15. Instead of new estimates on the number and extent of likely rate rises in 2022 or the impact on energy stocks of a war in Ukraine, ‘Opportunities in the metaverse’ looks much further forward – and could be much more important.

Its authors, Christine Moy, then managing director, global head of Liink, Crypto & the Metaverse at Onyx by JPMorgan, and Adit Gadgil, managing director, head of e-commerce and technology, media & telecommunications at JPMorgan Payments, produced the report to help businesses explore the metaverse and navigate between hype and reality.

More on the metaverse

But it leans into the former.

“We are not here to suggest the metaverse, as we know it today, will take over all human interactions,” the authors deadpan, before declaring that the opportunities presented by interactive, digital worlds seem “limitless”.

Just one data point from the report catches Euromoney’s eye. Roblox is a long-established online gaming platform for developers to create games built on immersive 3D experiences and for players to participate.

It now carries 60 billion messages a day. That is far more than the number of texts carried by leading phone companies.

The authors conclude that “the metaverse will likely infiltrate every sector in some way in the coming years, with the market opportunity estimated at over $1 trillion in yearly revenues.”

JPMorgan Payments also set up the Onyx Lounge in the Decentraland metaverse, where visitors are greeted by a portrait of Jamie Dimon and, for some reason, a roaming tiger.

The bank explains that the whitepaper is meant to be a conversation starter. Many clients have been asking how they might benefit from having a metaverse strategy. JPMorgan says it created the lounge to help its clients interact with the metaverse in a relatively simple way.

It’s shame, then, that entering Decentraland as a guest, creating an avatar and trying to find the place is such a dispiriting experience. Decentraland through Chrome or Firefox on a MacBook looks like a primitive game from the mid 1990s: slow, clunky, utterly disengaging, like a bad early prototype of Tomb Raider, but not as much fun.

But that’s just us. Why is JPMorgan there?

Massive scale

As long as augmented-reality technology develops as hoped, all kinds of commercial activity will likely take place in metaverses, with consumers buying goods, earning money for a day’s work, performing, teaching, paying to enjoy virtual concerts, and with businesses buying and selling higher-value products to each other.

Moy and Gadgil point out: “From a corporate perspective, there are opportunities to massively scale. Instead of having stores in every city, a major retailer might build a global hub in the metaverse that is able to serve millions of customers.”

The idea of digital twin cities is already well established, with real-estate brokers taking prospective buyers and renters of actual residential and commercial premises on virtual 3D tours before negotiating terms.

Students could buy education that is delivered in metaverses, hoping the experience will be better than on Zoom or Teams.

As well as the metaverse technology itself, this also requires cutting-edge payments and finance. And for a bank like JPMorgan, already investing billions of dollars each year on technology, a prime plot of virtual real estate in one of the earliest and biggest metaverses is a small stake to put down on a technology that could transform e-commerce.

That’s the bottom line for Moy and Gadgil.

The biggest concern for banks in the metaverse is not the risk of getting in too early in the wrong location or format, wasting a few million dollars, rather it is being left behind. By comparison, “the costs and risks of engaging early and consistently in order to build internal intellectual property, develop hypotheses about future business models, and identify ecosystem partners and collaborators are relatively low.”

The costs and risks of engaging early to build internal intellectual property, develop future business models, and identify collaborators are relatively low

Christine Moy, Adit Gadgil, JPMorgan

Already, JPMorgan estimates, $54 billion a year is being spent on virtual goods, almost double the amount spent on buying music. Non-fungible tokens (NFTs) collectively have a market capitalization of $41 billion.

The potential for advertising spending in metaverses as more people spend more time inside them and get used to buying things there is another big opportunity.

“We see companies of all shapes and sizes entering the metaverse in different ways, including household names like Walmart, Nike, Gap, Verizon, Hulu, PWC, Adidas, Atari and others,” write Moy and Gadgil.

There’s a lot of business already there for the taking.

JPMorgan’s Onyx Lounge does not, despite the breathless headlines, make it the first bank in the metaverse. But the bank lays out some thoughts on its role in providing payment solutions as embedded and interoperable stored-value virtual wallets, flexible single-pay or multiple-pay options, fast and secure checkout, and the ability to support more than 120 currencies.

More narrowly, focusing on ways to help metaverse game and content creators monetize their products, JPMorgan says: “Our enterprise-grade and secure Ethereum virtual machine-based zero gas fees blockchain platform reduces the complexity, costs and risks involved with building bespoke infrastructure and determining which blockchain protocol to build on in a time of rapid innovation and uncertainty”.

Moving money across blockchains, converting between metaverse tokens and bigger cryptos – often with an intermediary step through stablecoins – as well as in and out of fiat currency, remains difficult and expensive.

That’s why JPMorgan is here trailing its full suite of payment services that support multiple payout methods, account structures, micro loans and account validation.

It’s the future.

Moy won’t see it at JPMorgan, the bank she worked at for nearly 20 years, though, latterly pioneering tokenization of financial assets, working on JPM Coin and advocating that it should bank regulated crypto companies such as Coinbase and Gemini.

Just a week after unveiling the Onyx Lounge, Moy announced her departure to pursue a “new opportunity”.

There are no details yet, on what she calls “my next world building adventure”, but it’s not going to be in conventional capital markets. Moy ended her message with the rallying call of the NFT and crypto community: #wgmi, or we’re gonna make it.

Things move fast in the metaverse.

Liquidity

Metaverses are emerging from online gaming, especially so-called massively multi-player online (MMO) games, that have for over a decade now evolved their own economies.

In the so-called play-to-earn gaming model, people that spend a lot of time in these games earn rewards. These can then be invested in game assets – land, cars or space-ships – that in turn come with both potential income, such as rent, as well as expenses, such as tax, maintenance and repairs.

“In some of these games you might have $20 million of liquidity a day moving around,” Daniel Gee, managing director of Pello Capital, a UK-based digital wealth manager, tells Euromoney. “If you look at growth companies listed in the UK, there’s no more than 100 stocks that have higher daily turnover than that.”

The JPMorgan paper reports that the GDP of Second Life, one of the earliest metaverse games, hit $650 million in 2021.

Games have developed a model where developers take proceeds from the sale of scarce finite resources paid in the game currency and transfer that into the governance currency held in the treasury of the decentralized autonomous organization (DAO) that controls the game.

The game becomes a corporation that pays out to its shareholders. Promoters like to claim that the community of participants – players and independent developers – can control the game and that the customers own the business.

It’s its own topic. But it is one thing for players to vote on new characters in a game, quite another to vote on fundamental game design and game economics. The biggest stakeholders in any DAO and its treasury tend to be the game’s first inventors and developers.

The difference with the metaverse is that the financial flows emerging along with all that in-game economic activity will no longer be trapped within each separate online world. Rather, thanks to blockchain, cryptocurrency and decentralized finance (DeFi), earnings generated and value spent can flow more easily both between separate metaverses and between metaverses and the real world.

Metaverse game currencies can be staked outside the game and set to work for yield farming.

Ertha is a play-to-earn metaverse game that hasn’t even been released yet. The developers are already selling NFT-based ‘land’ within the game world. An anonymous user acquired the entire Rome NFT, including landmarks such as the Sistine Chapel and Colosseum, for £120,000.

In-game resources provide a return on the owner’s investment

Timo Lehes, Swarm Markets

“Beyond simple ownership rights, the game confers staking rights on those who hold NFTs” says Timo Lehes, co-founder of Swarm Markets, a decentralized exchange. “In-game resources provide a return on the owner’s investment, which allows for the collection of taxes, fees and other forms of revenue.”

Inside most games, asset owners seek to generate passive income by renting out their assets in those few hours of the day when they are sleeping or not playing.

Metaverse economics, sometimes called metanomics, mirror the wider DeFi financial world. Renting your spaceship in a game easily translates into staking the token in a yield-generating DeFi protocol.

Lehes says: “The metaverse is still in its early days, but the market is there to be taken advantage of. Staking is becoming an increasingly important aspect of this, and investors are taking heed.”

Opportunities

Is there a role for established banks?

Gee says: “There are similarities between traditional banking and crypto, but they are at different points in their cycle. BATS and Chi-X automated market making years ago. Hedge funds were novating assets in the early 2000s. That’s similar to staking crypto assets for yield farming. People want income. But banks aren’t providing a yield today.”

It is the flow of money between fiat currency and crypto, including metaverse native tokens, that is capturing the banks’ attention.

Performers such as Ariana Grande, Travis Scott and Wiz Khalifa are selling tickets for concerts in metaverses as well as associated merchandise with ownership designated by NFTs. There’s a role here for credit cards that translate between fiat currency and crypto and, in addition, the potential for concert promoters and event organizers to transfer their skills to the metaverse (especially if new vaccine-resistant variants of Covid emerge) and earn money in new ways.

Conference companies might one day host events in the metaverse.

Already, branded clothing and trainer makers are selling digital versions of their products for gamers to dress their avatars in.

The potential is obvious: buy an NFT of the latest trainers for your in-game persona as well as a real pair to wear in the street.

Where is that transaction going to take place?

Those of us who have grown used to the Web 2.0 world of the last 20 years might guess on Amazon. But it’s not easy to spend crypto there or buy NFTs. Yes, there will still be logistics and fulfillment in the real world, but it will be different in the virtual.

Perhaps there will be a new Amazon or Amazons in the metaverse, based on fulfillment for NFTs. Perhaps Amazon equivalents will not be needed in these ultimate direct-to-consumer virtual economies.

Michael Wagner is co-founder and chief executive of Star Atlas, a space-themed video game metaverse, which like many of its kind is based on exploration, territorial conquest, as well as activities such as mining, refining and building. Players join one of three factions – humans, aliens or robots – to devise strategies for and work towards economic and political dominance.

Mining is a common theme in metaverse games with an obvious echo of cryptocurrencies.

Star Atlas already exists in traditional browser form but the key underlying technology for coming augmented reality versions is the latest in hi-fidelity game development, Unreal Engine 5.

Star Atlas rests on the Solana blockchain and has two currencies: Atlas, the native token for payments inside the game of which the supply can increase, and Polis, the governance token for its developers, whose supply is fixed.

While the game is being built initially by developers and publishers running a conventional corporate business structure, over time its community of players and third-party developers should shape and part-own it through a DAO, with votes on future developments going to holders of Polis.

Wagner explains how Star Atlas financed through token sales the setup of a costly AAA-game development and publishing business without venture capital backing.

We eliminated the necessity to pursue traditional capital acquisition through equity raises, and instead were able to bring products to market that generated income rapidly

Michael Wagner, Star Atlas

He tells Euromoney: “We are fortunate to have deep expertise in operations within the blockchain ecosystem, having launched two technology companies centered around digital assets. As a result, we eliminated the necessity to pursue traditional capital acquisition through equity raises, and instead were able to bring products to market that generated income rapidly. Star Atlas revenue is approaching $200 million, trailing 12 months, with the majority of that attributed to NFT sales.”

The company has grown from four founders at the start of 2021 to 250 people today.

Star Atlas sold digital artwork from the game, including posters and music made for it by among others, DeadMau5, the Canadian electronic music producer also known as Joel Thomas Zimmerman.

Star Atlas is building software development kits for developers to create their own new features, and which should earn it a share of their revenues.

Wagner is a former financial analyst who worked in private wealth management and valued companies and their cash flows for family offices and high net-worth investors. Euromoney seizes the chance to ask what, for us, remains the key question.

What is the metaverse?

“The metaverse is not clearly defined at this stage, as it is still in its formative years,” Wagner says. “While it will ultimately be many things, my broadest interpretation is that of an alternative economy within a digital environment. It is the next generation of the internet. I consider the metaverse to be analogous to that of an independent sovereign state, similar to the way countries are governed. In contrast to traditional games with closed economies, we need to consider factors such as fiscal policy, monetary policy and foreign policy in the way we structure the Universe of Star Atlas.”

So, for example the game’s two currencies, Atlas and Polis, can each be traded on decentralized exchanges and even converted for fiat currency on the FTX exchange for international investors and Okcoin for US citizens. They could also be staked into DeFI protocols for yield framing.

“But we are structuring the economy with incentives to retain the native currency, providing further support for the currency itself,” says Wagner. “This is on par with a country’s desire to minimize capital outflows from its fiat currency into another country’s fiat currency.”

The dedicated Reddit boards hum with rumours on what’s coming up in Star Atlas.

Wagner says that scheduled this year: “We are targeting two major releases within our web-based minigame, and a major full production release in Unreal Engine 5, which we call the Volant Studio Showroom.”

But the game is just the start. It draws people in but the metaverse expands beyond the game.

“There will be many applications, including social experiences, e-commerce, education and gaming, to name a few,” Wagner says. “Being a blockchain game alone does not create a metaverse. However, a metaverse will very likely encapsulate a blockchain game. The open, sustainable economy underlying a metaverse is a key differentiator.”

Wagner and others like him are building long-term projects, looking five to 10 years forward.

Haptic suits were built for wearers to feel sound from games and TV shows. That technology is also advancing.

“At some point, the line blurs between the digital and physical worlds,” Wagner says. “If users wearing a haptic suit can touch something in the virtual world and feel it as if in the real world, it is quite possible this environment will become their favoured digital shopping experience. We envision the metaverse creating the largest labour force the world has ever seen, with people employed from their homes in one country to deal in virtual stores with consumers from another country whose avatars have walked into a metaverse shopping zone.”

How big is he aiming?

“We see the entire global population as our audience.”

Competencies

And that’s why businesses like JPMorgan are spending on virtual real estate.

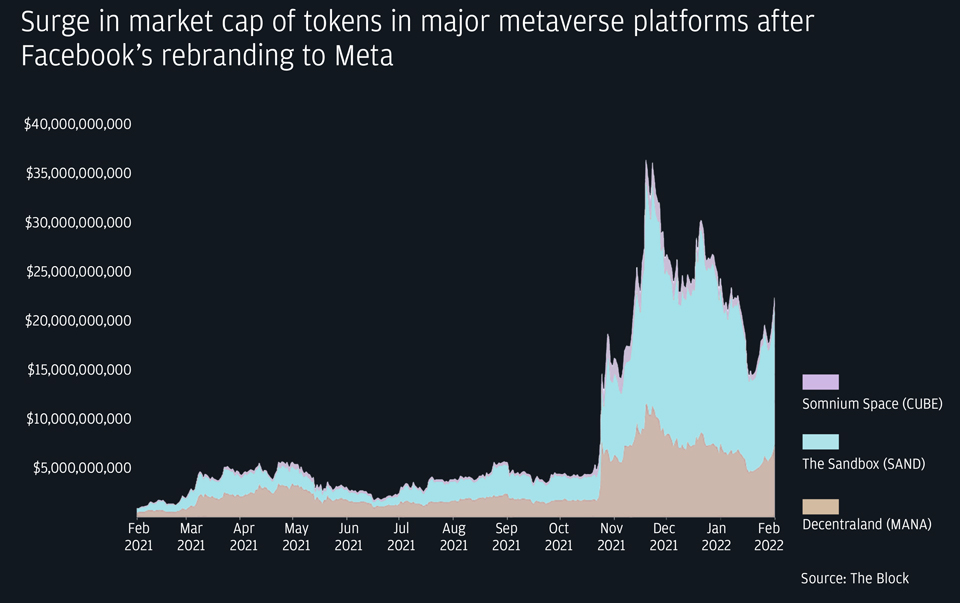

Sales of real estate in the four big metaverses, Sandbox, Decentraland, Cryptovoxels and Somnium, exceeded $500 million last year, according to analysts.

Portion, a blockchain-based auction house and collector community for rare high-end physical and digital art, recently paid MANA425,000, equivalent to approximately $1.2 million, for “Portion District”, near Decentraland’s Genesis Plaza.

Soon after, The Plein Group, of luxury fashion designer Philipp Plein, paid $1.4 million for a plot in Decentraland that will become Plein Plaza and house luxury retail stores, entertainment, NFT drops, an art museum, hotel and luxury residences.

Where there are high-value assets, there will be secured lending, collateral valuation, secondary market trading: all the stuff that banks love and know how to do.

“This is where our long-standing core competencies in cross-border payments, foreign exchange, financial assets creation, trading and safekeeping, in addition to our at-scale consumer foothold, can play a major role in the metaverse,” say Moy and Gadgil.

Banks have to be where the action is. And, even allowing for the torrent of hype, with three billion people already playing games online, a lot of financial action will be in metaverses.

“Web3 is all about community,” says Gee. “Users own their own data, content and brand. No one in banking really understands community. A lot of banks are looking at this and realizing they have no idea how it works. But people are voting with their feet. Their customers are going there. That’s what 60 billion messages a day on Roblox tells you.”

Metaverse funds and exchange-traded funds are taking off as end investors and fund managers try to pick the stocks that will benefit most.

On February 9, the metaverse earned the ultimate validation of its own special purpose acquisition company (Spac). Hiro Metaverse Acquisitions I (HMAI) raised £115 million through an IPO on the London Stock Exchange led by Citigroup. Some of Pello Capital’s clients invested in it.

How these new decentralized web 3.0 economies and the financial flows around them develop and interact with fiat money in the real world, nobody knows: not even the people building them. But widespread adoption already seems to have started, even before the augmented reality technology is fully proven and made accessible.

That suggests it’s going to be big.