private banking survey results

When you talk to the global heads of private banking and wealth management, two regions dominate conversation.

The first is North America, and specifically the US, with its compelling mix of old wealth and new money generated by today’s innovator-tycoons. The other is Asia, a mix of fast-growing markets led by China, that every year mints a record number of billionaires.

What of Europe? The birthplace and once the heartbeat of private banking is now a bit of an afterthought in the world of wealth. Even leading bankers allow that imputation.

“Europe can often be seen as potentially less attractive” than the US or Asia, says Claudio de Sanctis, head of the international private bank and chief executive Europe, Middle East and Africa (EMEA) at Deutsche Bank. Compared with the other two regions, he adds, “it has slightly lower growth and is infinitely more complex.”

Christian Zahn, a partner at McKinsey & Company in Zurich, compares each region’s ability to move the needle on wealth: “The US is the largest market. Asia is the fastest growing. Europe is a set of large markets, which, however, is growing slower.”

And finally, Richard Sylla, professor emeritus of economics at New York University Stern School of Business, notes that “[Europe] gets overlooked. Other places caught up – the US overtook it, then Asia. It hasn’t declined. But it no longer has the monopoly on wealth management it once had.”

Is this fair? Is Europe indeed living in the past or is this the low point of an investment cycle, when the dead wood is cleared, giving new shoots room to grow. And if so, might the best days of Europe’s private wealth industry still lie ahead?

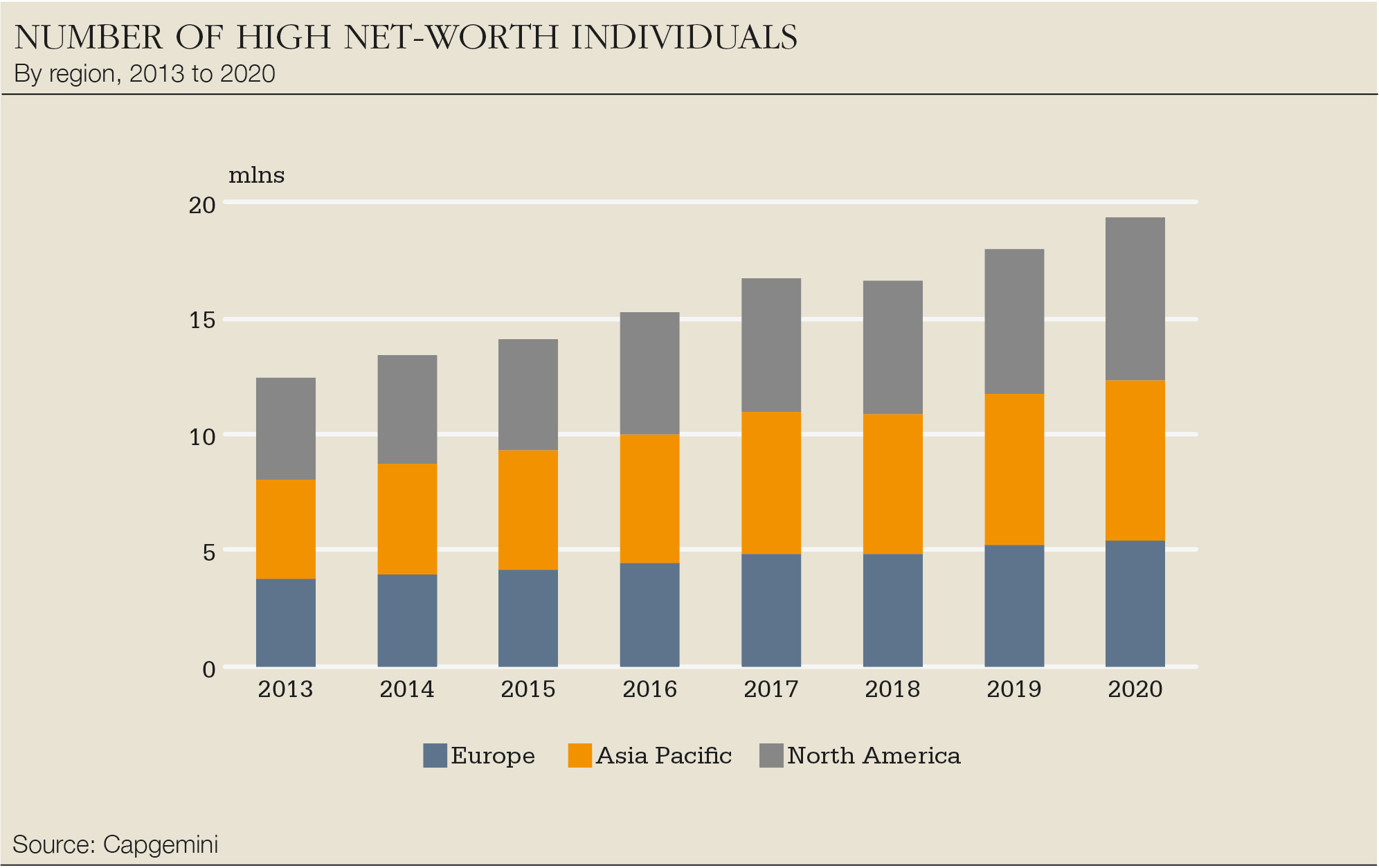

Data helps to answer that question. In its latest World Wealth Report, Capgemini put the number of high net-worth (HNW) individuals in Europe – people with at least $1 million in liquid assets – at 5.4 million in 2020, comprising 26% of the world’s total. That compares with 6.9 million and 33.1% respectively in Asia, and 7 million and 33.7% in North America.

In 2013, Europe’s share of the global HNW population was 27.7% versus 31.4% in Asia and North America. So the gap is widening.

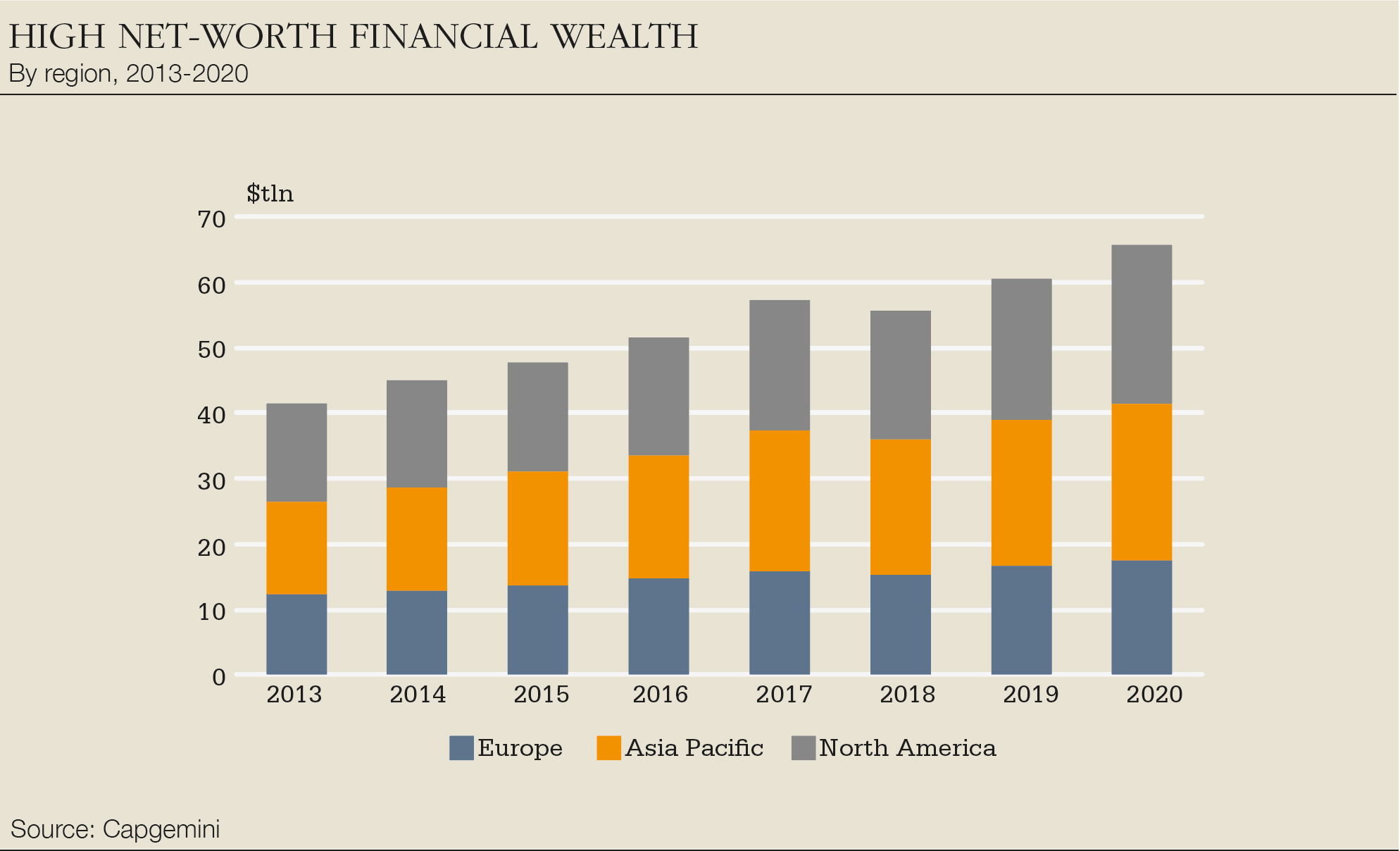

Europe’s share of overall wealth has also dipped. The region accounted for 22% of the $79.6 trillion in wealth owned by all global HNWs in 2020, down from 23.6% in 2013. It got a lot richer over that period, but wealth grew at a far faster pace in Asia and North America.

In 2020, HNW wealth expanded at an annualized rate of 4.5% in Europe. Yet that trailed both the US (which posted 12.3% growth) and China (13.5%), in a year when a record number of billionaires were created worldwide – 412, according to Hurun’s latest Global Rich List.

The pandemic had an impact. Capgemini blames Europe’s “greater exposure to negatively impacted industries” such as fashion, tourism and retail.

But this also shines a harsh light on the region’s inability to foster high-end innovation. Europe’s politicians complain about the monopoly power of US-based big tech, but a longstanding car-producing region has failed to champion an electric vehicle firm to rival Tesla in the US or Nio in China.

Origins

It can be easy at such moments to forget that Europe is where private banking was born, going back to the 15th-century Medici Bank, owned by the super-wealthy Italian financers of the Renaissance, and the Fuggers, the wonderfully named German banking family who once dominated Europe’s copper market.

If you look at the true nature of the service … Europe remains a major source of demand

Patrick Odier, Lombard Odier

Even today Europe boasts some grand and very old names. Hamburg’s Berenberg Bank (founded in 1590) and the London pair of C. Hoare & Co (1672) and Coutts (1692), are all still alive and kicking.

“If you look at the true nature of the service – the bespoke wealth planning and management type of private banking that is at the origins of the industry – Europe remains a major source of demand,” says Patrick Odier, senior managing partner at Switzerland’s Lombard Odier, the private bank his family founded in 1796.

There are many good reasons to believe in the future of Europe as a whole and its private banking and wealth management industry.

For one thing, it is rich and growing richer by the year. It has a handful of global cities filled with innovative firms of all sizes. Its wealthier citizens like to keep the bulk of their money tied up at home in family firms and local stocks and real estate.

Despite the ructions of recent years, it remains politically, financially and economically stable. In data and research firm Vision of Humanity’s 2021 Global Peace index, Europe boasts 13 of the world’s 20 safest countries.

Once Covid recedes, the wealthy of the world, enamoured by Europe’s compact nature, great schools, cultural wonders and adherence to the rule of law, will return. Finally, there’s the vast pool of wealth set to be transferred between generations, creating opportunities for ambitious and well-placed wealth management advisory firms.

It is Europe’s time to shine

Robert Cielen, Credit Suisse

Plenty of people want to see the region regain its position at the heart of private banking.

“It is Europe’s time to shine,” is the response of Robert Cielen, head of international wealth management Europe at Credit Suisse, when told Euromoney is researching a story about the region. And Gérald Mathieu, head of private bank Europe at Barclays, says: “It’s music to my ears when we discuss the importance of Europe.”

In terms of growth in the sector, it is easy to turn one’s gaze toward east and west. US banks are busy headhunting entire private wealth teams as money migrates to new places, from Florida to Wyoming. Global banks are pilfering talented relationship managers from one another to serve the needs of Asia’s growing army of first- and second-generation wealthy.

But it’s happening in Europe too, and in every big market.

“In two years, we hired 75 people in wealth management to cover our entrepreneurs and families segment,” says Vincent Lecomte, chief executive of BNP Paribas wealth management. “Because [mid-sized company] entrepreneurs are exporters, they need to get a full range of corporate banking services, such as cash payments and credit, and a personalized approach for their private wealth.

“We are leveraging our local presence in Europe to serve entrepreneurs in Germany, France, Belgium, Italy, the Netherlands and Spain,” he adds. “Europe is our home region. EMEA represents around 70% of our total assets. We are further increasing our market share based on our integrated model.”

Credit Suisse has made a series of senior hires over the past year, appointing Gabriele D’Agosta head of private banking Italy in May 2021, and has opened new wealth management offices in the Italian cities of Brescia, Parma and Padua.

Margins in the wealth management market are good and it remains attractive especially for established players

Choy-Lin van der Hooft-Cheong, ABN Amro

Choy-Lin van der Hooft-Cheong, ABN Amro’s chief commercial officer, wealth management, points to the 15-strong team of specialists the Dutch lender is hiring in Germany as part of an entrepreneur and enterprise (E&E) model that combines corporate banking and wealth management.

“We are hiring in all markets in which we are active,” she says, noting that the E&E model, active in Holland and France, is being rolled out in Germany and Belgium. Bethmann Bank, ABN’s private wealth division, recently opened new branches in Wurzburg and Wuppertal.

And this list isn’t just the preserve of Europe’s leading names.

“Several large global banks, especially from the US, are drawing up strategies to go much deeper into Europe,” says McKinsey’s Zahn. “At the same time, the Europeans are looking to go deeper into Europe with different approaches than in the past.”

JPMorgan Private Bank is now represented in Stockholm, Amsterdam, Copenhagen and Luxembourg, for example.

But the Europeans are fighting back. Deutsche’s de Sanctis reckons one of the German lender’s strengths is its integrated model, combining corporate and investment banking (CIB) and wealth management.

“In Europe ex-Germany, our Bank for Entrepreneurs is a complete offering, delivering integrated wealth management and commercial banking to large family-owned SMEs,” he says. “We now approach the entrepreneur as a single coverage unit and say: ‘Let’s talk about your overall needs as one single entity, then let’s figure out how I can provide overall, holistic services to you.’

“We were extremely lucky: our predecessors created this business on the ground. I would never have the means today to create a corporate banking capability outside Germany if I didn’t have it.”

Deutsche has rolled out its entrepreneur bank in Italy, he says. Spain and Belgium are next, with a broader European rollout to follow this year and next.

Europe is more vibrant than ever in terms of innovation

Victor Matarranz, Banco Santander

Other lenders have taken note of Deutsche’s model and are seeking to emulate it.

Credit Suisse has built a 40-strong team of advisers delivering a range of investment bank and wealth management solutions to entrepreneurs keen either to raise capital against existing assets or to sell all or part of a family business.

“We’re focusing on Germany and Italy, both of which are strongly driven by mid-sized companies, and also the UK, Spain and France, albeit it to a lesser degree,” says Cielen.

He says the Swiss bank is “in certain cases, looking to lend to clients but with due caution. We only lend in instances where we have deep and longstanding relationships, allowing us to build further on these long-term client relations.”

BNP Paribas is another bank shifting its resources around, with a remit, notes Lecomte, to “accelerate” its commitment to German entrepreneurs and families.

A year ago, he says, the bank unveiled an internal wealth management/CIB collaboration designed to meet the “holistic” needs of clients who want “world-class wealth management, corporate finance and real estate services.”

The Paris-based lender is the number-one bank for real-estate advisory, property management and asset-management services in France and Germany, and is top five in the UK.

“We have access to entrepreneurs across Europe,” Lecomte adds. “We’re expanding our presence in several countries, including Germany. We made a massive move in that direction over the past three years. In Germany, we are the first ‘non-German’ full-service bank.”

This is where a BNP Paribas or a Deutsche will always have an advantage over local rivals. They can offer it all to the next generation: a full suite of private banking and CIB services, as well as the softer stuff that adds long-term value, from trusts and wills to advice on foundations and philanthropy.

Innovation

The past 12 years have not been good to Europe. Its debt crisis continues to rumble on. Then there’s Brexit, migration challenges, rising populist nationalism, economic torpor and the current standoff with Russia over Ukraine.

The region isn’t innovative enough. Paris is the only European city in the upper echelons of the Innovation Cities Index 2021, where it squeaks into 10th place. But spend time in London, Berlin, Stockholm or Prague and you find great startups and mid-sized growth firms, spanning products from artificial intelligence to electric planes.

“Europe is more vibrant than ever in terms of innovation,” says Victor Matarranz, head of wealth management at Banco Santander. “It offers the combination of capital in search of yield and very smart and educated entrepreneurs who want to capture opportunities in an underserved market. I have never seen so many entrepreneurs and investors gathering in Madrid hotels.”

There’s a lot of old money still, but it’s changing

Max Clary und Aldringen, Erste Bank

And, contrary to perceptions, it still creates a lot of new wealth.

“There’s a lot of old money still, but it’s changing,” says Max Clary und Aldringen, head of private banking and wealth management at Erste Bank in Vienna. “True, Europe doesn’t create as many big new companies as the US or Asia, but it does create a lot of startups.”

Assets are by and large cheaper than in other mature regions.

“Europe has slightly lower multiples than you find in the US or Asia,” adds Matarranz, “so if you are looking to buy wealth management assets, you still get good value. This combination of big and still-growing markets, allied to reasonable multiples, makes it a very attractive place to be.

“If you have a good position, it’s still a place where you can compete and grow market share. We will deliver high double-digit growth in our private banking business in Europe. There is a lot of liquidity and people looking for investment opportunities.”

Global investors have taken note. They are drawn to the attractive valuations, the dynamic young firms and next-gen Mittelstand owners keen to divest family-owned firms with great products, intellectual property and networks.

Add to that a coming wave of inward investment from wealthy families, private equity and venture capital, keen to propel a creaking region into the 21st century. We are just at the start of that process, with venture capital investors, having ploughed billions of dollars into US industry and Asian startups, now keen to do the same to Europe.

Non-European investors are looking for diversification, notes de Sanctis: “They are very interested in the venture capital space. They see it as being the next big area of interest. The US has its high-tech champions; so does Asia. Now it’s Europe’s turn.”

Entrepreneurs have been a key source of growth for centuries in Europe… That still holds true

Gerald Mathieu, Barclays

The interest in Europe is certainly there.

“Institutional investors from North America, Latin America, Asia and the Middle East are keen to explore co-investment opportunities with family-owned European businesses,” says Odier. “This fits nicely into the current process of diversifying out of traditional asset classes. Europe remains a tremendous source of investment opportunities.”

Matarranz adds: “For Latin Americans, Madrid has become the place where culture, family, lifestyle and investment opportunities around real estate and new ventures collide. No other place in the world can offer that.”

Lecomte points to the wealthy Asian and Middle Eastern families busy ploughing capital into European real estate, despite many being unable to travel: “They are focusing on European real estate. We give advice on property they want to acquire and finance, so it’s a one-stop shop for them.”

Europe is also an attractive and relatively safe place to live.

“The package European cities can offer is financially, economically and culturally rich,” says Grant Parkinson, head of consumer, private and business banking, Europe, at Standard Chartered. “It’s a mix of investment opportunities, lifestyle, education and family security. The flow of clients from emerging markets will continue, and that will offer significant growth.

“Around 300,000 Hong Kong residents are expected to leave over the next five years,” he adds. “They are headed to Singapore or the UK and Europe. That is driven by geopolitical shifts and a desire to establish a presence in a jurisdiction with a strong rule of law.”

Europe has also emerged as a leader in environmental, social and governance issues. It is comparatively politically stable. It has suffered through Covid, but unlike parts of Asia, it’s open for business again.

“Margins in the wealth management market are good and it remains attractive especially for established players, with personal relationships underpinning client retention and high fixed costs acting as barriers to entry,” says ABN Amro’s van der Hooft-Cheong.

Europe is complicated. It needs to find a place and purpose in the 21st century. It still lacks a unified set of financial, fiscal and economic rules. Former US secretary of state Henry Kissinger’s famous inquiry: “Who do I call if I want to call Europe?” is as true today as it was in 1973.

Yet it’s still a place of great dynamism, full of ideas and innovators.

“Entrepreneurs have been a key source of growth for centuries in Europe,” says Barclays’ Mathieu. “That still holds true.”

No wonder so many global private banks are not giving up on Europe but doubling down.

Europe’s advantages

“Europe is still big,” insists Victor Matarranz, head of wealth management at Banco Santander. “There is a lot of growth elsewhere, but Europe is still between a third and a quarter of the global private banking market.”

Claudio de Sanctis, head of the international private bank and chief executive Europe, Middle East and Africa at Deutsche Bank, notes: “The reality is that Europe has a lot of savings, a lot of entrepreneurs. The HNW and UHNW [high and ultra-high net-worth] population is higher in Europe than Asia, and the number of mid-cap millionaire entrepreneurs is also very high.”

Moreover, wealth is spread evenly, with its focal point a long, curved corridor of urbanization stretching from Manchester to Milan. This so-called ‘Blue Banana’ model of prosperity, coined in 1989 by French academics, still holds up to scrutiny today.

A partner at a global consultancy says if he ran a private bank, this is where he would focus his attention and resources. “There are a handful of wealth super-centres spanning multiple cross-border regions,” he notes, pointing to the example of Lake Constance, which borders Germany, Austria and Switzerland, and is proximate to France and Liechtenstein. “It’s full of wealthy entrepreneurs,” he says. “A lot of wealth lives there.”

Europe is also full of ‘sticky’ family wealth that is more loyal to a single and longstanding wealth provider than is typically the case elsewhere.

Asia risks

Although Asia is full of fast-growing markets – China, Thailand, Indonesia and India – they all come with worrying risks. In private wealth terms, Asia is dominated by two de facto offshore centres, Singapore and Hong Kong. Outside these hubs, the rule of law is less entrenched, making it hard for the rich to flesh out a viable long-term wealth plan.

Financial loyalty is also thin on the ground. Asian HNWs tend to bounce between providers in search not of better service but a better price, forcing banks to chase quantity in terms of assets under management, not quality. “Asia has specific business prerequisites that people sometimes underestimate,” notes Christian Zahn, partner at McKinsey & Company. “Europe offers lower growth but higher stickiness.”

So, if speed of earning money with clients matters more, invest in Asia. If you seek continuity of business and slower-but-steady revenue growth, you’re more like to find it in Europe. Notes one senior private banker: “If you are an international wealth manager, you have to be interested in Asia as it is growing, but you are also taking on risks that could endanger your palette of services.”

…

Mittelstand – the once in a generation opportunity

The collective push to expand into private banking in Europe can be explained by a single word: Mittelstand.

Germany has around 3.5 million of these small and mid-cap firms, defined as those with revenues of up to €50 million and no more than 500 employees. Millions more are based in other German-speaking nations, plus northern Italy and the Benelux countries, and many are now at an inflection point in their development.

Some Mittelstand firms are well run and capitalized, producing goods and services suited to a cleaner global economy. They are run by a new generation of family members or external managers and are built to compete on the world stage.

But many are run by entrepreneurs well beyond retirement age. Perhaps there is no next generation to take the reins. Or there is one, but they aren’t capable or have no interest in the family business.

Either way, these firms need access to fresh capital. Local savings banks – such as Germany’s Sparkassen and Austria’s Volksbanks – served and funded them for decades. But they now need not just a bit of money, but a lot. They must gain scale or diversify into new sectors to compete with ambitious corporates from China and elsewhere.

Speaking in January, Klaus Hommels, founder of Zurich-based venture capital firm Lakestar, said it would cost up to $9.6 trillion to build the next generation of Mittelstand firms.

Robert Cielen, head of international wealth management Europe at Credit Suisse, adds: “We expect a considerable amount of wealth-generating liquidity events over the next decade.”

He reckons a big chunk of the 70,000 very large global firms without a succession plan in place are based in Europe.

Leaning on local

This presents a once-in-a-generation opportunity for banks able to bundle corporate banking, investment banking and wealth management services. A huge sum of private wealth is set to be transferred between generations in Europe. Information provider Wealth-X puts the total at $3.58 trillion between 2021 and 2030.

For somewhere as wealthy and connected as Europe, it’s a surprise to discover how many entrepreneurs are not served by a big private bank.

“Many don’t have a primary provider,” says a wealth manager, who admits his firm “hasn’t done enough” to reach out to them.

In part, this is because a lot of business owners still lean on a local bank for all their wealth needs.

“They think: ‘That bank supported my business from day one and never let me down, so I’ll stick with it,’” the manager adds.

Cielen says: “There is a huge range of entrepreneurs with a €200 million to €500 million enterprise value, and they are often overlooked or just ignored.”

But it doesn’t follow that the next generation will stay loyal to a family bank. When wealth is transferred between generations “up to 80% of it is lost by the incumbent financial provider,” reckons one London based wealth adviser. “The reason is they haven’t focused on all the members of a family. They don’t have the capacity.”

This opens the door to private banks that have already reached out to one or more family members who will either inherit personal wealth or a business or both.