After the big strategic acquisitions of 2020, when Morgan Stanley spent $13 billion on E*Trade to add a new self-directed channel to wealth management and then $7 billion on Eaton Vance to bring greater fixed-income capabilities to investment management, the firm’s older businesses shone in 2021.

In the first nine months of the year, investment banking revenues were 60% higher than the same period in 2020, while advisory revenues more than doubled.

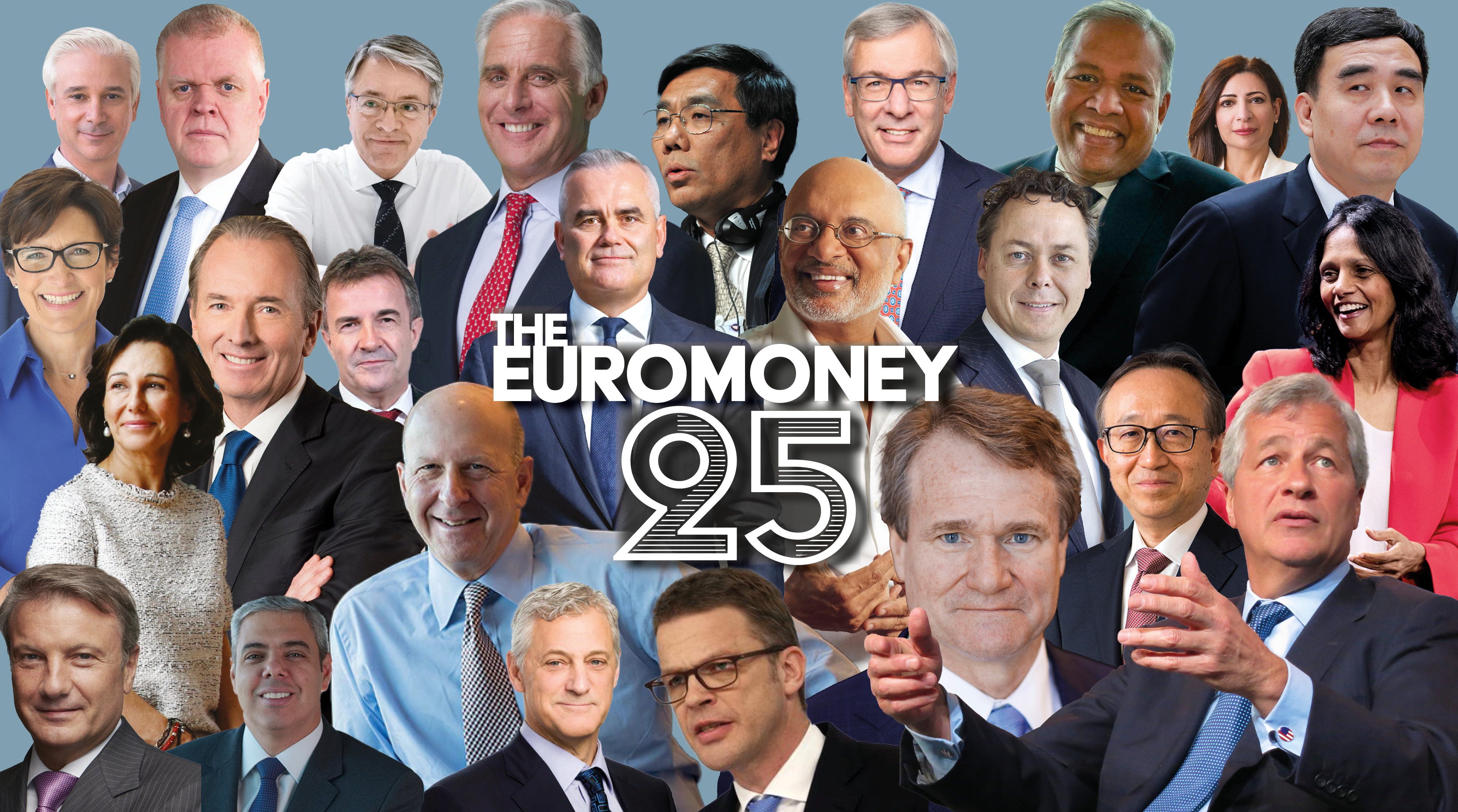

Thanks for your interest in Euromoney!

To unlock this article: