You see a lot in 31 years. And since joining Morgan Stanley in 1990, Ted Pick – co-president of the firm, head of its institutional securities group and one of the two likeliest successors to chief executive James Gorman – has seen it all.

He has been through the Long Term Capital Management meltdown of the late 1990s, the dotcom boom and bust of the turn of the millennium, Morgan Stanley’s own crisis in 2005 that forced out chief executive Philip Purcell and brought in John Mack, the great financial crisis of 2007 and 2008 that eventually forced out Mack and brought in Gorman, and the double downgrade by Moody’s in 2012. Speaking to Euromoney in August, Pick reels off the catalogue of woe with barely a pause for breath.

There have been times when it felt as though the firm was on the brink, but the end never came. Now, after a year in which Morgan Stanley not only coped with everything the coronavirus pandemic could throw at it but also transformed itself with acquisitions that have positioned it to attack new opportunities and further enhance its core attributes, the firm looks stronger than ever.

In absolute revenue terms, the firm’s investment bank is the fifth of the big five in the US – its long-serving bankers often make a virtue of its status as the scrappy player on the Street. But those revenues had seen a jump of 47% during the awards period of the year to April 2021, a bigger increase than at any bulge-bracket rival. Profits soared by 139%.

Return on equity in 2020 was 13.1% and return on tangible equity was 15.2% – higher than its rivals. Book value per share rose 12%, another outperformance, as was total shareholder return of 38%. To cap it all, Moody’s upgraded the firm to put it on a par with the best rated US banks.

Remarkably for such a strong M&A franchise, the firm increased its share of completed transactions – the only one of the top five firms to do so, according to Dealogic data. It also had its own deals to do. During the pandemic it announced and closed the $7 billion acquisition of wealth manager Eaton Vance, which took Morgan Stanley’s total assets under management to $5.4 trillion.

Winning in this business is by small margins, so you have to want to win

Ted Pick

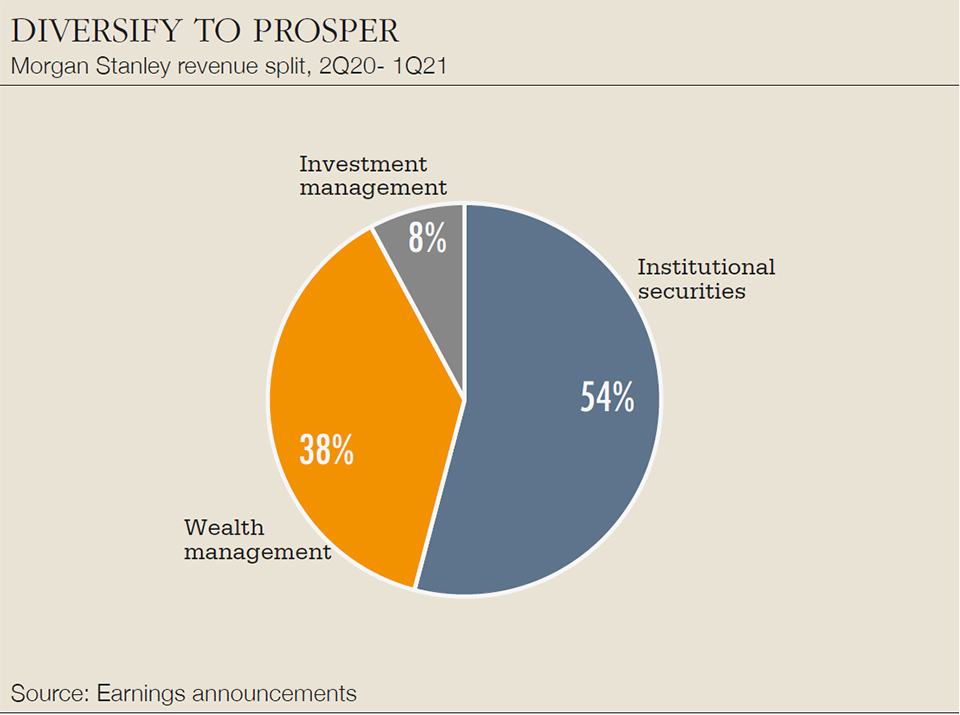

That followed hot on the heels of the acquisition of online brokerage E*Trade in a $13 billion deal that had been announced just before the pandemic hit and closed in the autumn of 2020. Both deals help to rebalance the firm away from the overwhelming reliance it had on lumpy investment banking revenues 10 years ago, when some three quarters of its business was capital markets, advisory and trading. Now it will be less than half.

But while they represent diversification, both deals are also key to Morgan Stanley’s conviction that it can continue to eat into rivals’ share of investment banking revenues in the future.

Is there a secret to its success? The way Pick tells it, it’s down to two contrasting dynamics: the ways in which the firm has changed and the ways in which it has not. What has changed is that diversification and the ability it brings to deliver more avenues for its clients. What hasn’t is its relentless focus on the status of trusted adviser.

Pick’s elevated position – in February 2021 he was promoted to co-president alongside Andy Saperstein, who runs wealth management – has taken away none of his awareness of the cut and thrust of the day-to-day. At times he still sounds like the equity syndicate guy he was 20 years ago, when he would talk this journalist through a week’s roster of deals.

But he thinks more deeply about the broader industry now, as he must. As institutions now rise that can replicate many of an investment bank’s capabilities but without the regulatory burden, what role is there in 2021 for a Morgan Stanley? What role will there be for it 10 years from now?

These are not just thought exercises for Pick but urgent questions to which a firm like his must have answers. But he is in no doubt that what makes Morgan Stanley successful today is also what will make it successful in the future.

“The number one quality that we must have is credible intellectual capital,” he says, arguing that the pandemic experience, with its attendant explosion of video conferencing as the primary means of communication with clients, has only made this all the more stark.

“You get a shot on Zoom because of your Morgan Stanley card, but if after five minutes you are not credible, the client couldn’t care less about that.” It’s a Nixon/Kennedy moment, he says. Either you have game or you don’t.

Global footprint

Then there’s the necessity of a global footprint. “If we can’t articulate a view of how to pursue opportunities in onshore or offshore China or in post-Brexit European markets, it’s more difficult to show a global client that we are looking at the world through their prism,” he says.

For Pick the positives of the past year – the provision of huge policy support, hopes of a degree of control over the pandemic’s health impact and a more normalized Washington – and the negatives – the asset price bubbles that have resulted from that support, the fears of inflation and the geopolitical tensions that are playing out right now – are precisely what give a global investment bank the opportunity to help clients, either by expressing a view or hedging risk.

For that to be done effectively requires a complete suite of services more than ever, he argues. At Morgan Stanley that is captured by the concept of the ‘integrated investment bank’. “It is about the three legs of the stool – bankers, equities and fixed income – more than simply getting along,” he says. “It means working across one human capital partnership, one set of metrics.”

That integrated investment bank is what he thinks of as the engine of the firm. New ventures like Eaton Vance and E*Trade are the ballast that the engine drives, capital-light but with reliable, repeatable earnings that can be built upon and can, in their turn, feed the engine with new opportunities.

It isn’t quite what JPMorgan partner Russell Leffingwell had in mind when he was lobbying president Franklin D Roosevelt in 1934 for repeal of the Glass-Steagall Act that led a year later to the breakaway of the tiny Morgan Stanley from JPMorgan, which opted to stick with commercial banking. But the sentiment sounds exactly the same.

“The business of underwriting capital issues is and should be a byproduct business,” Leffingwell wrote to FDR. “It is occasional and sporadic. Nobody can afford to be in the business unless he has a good bread and butter business to live on.”

For 2021’s Morgan Stanley under Gorman, that bread and butter business is wealth and asset management.

The three Ps

Pick pushes to his teams the concept of three P’s. The first is preparation, which takes in everything from the firm’s keenly-followed series of corporate chief executive discussions with its analysts, to its experienced professionals programme, through which it has plucked more than 50 lateral mid-level hires from under-represented minorities in other industries.

The second is partnership, covering collaboration between the firm’s units, engagement with its diversity and inclusion work, and consideration of its position within the communities in which it operates. And the collaboration part is helped by the way in which the firm’s veterans have rotated through the firm.

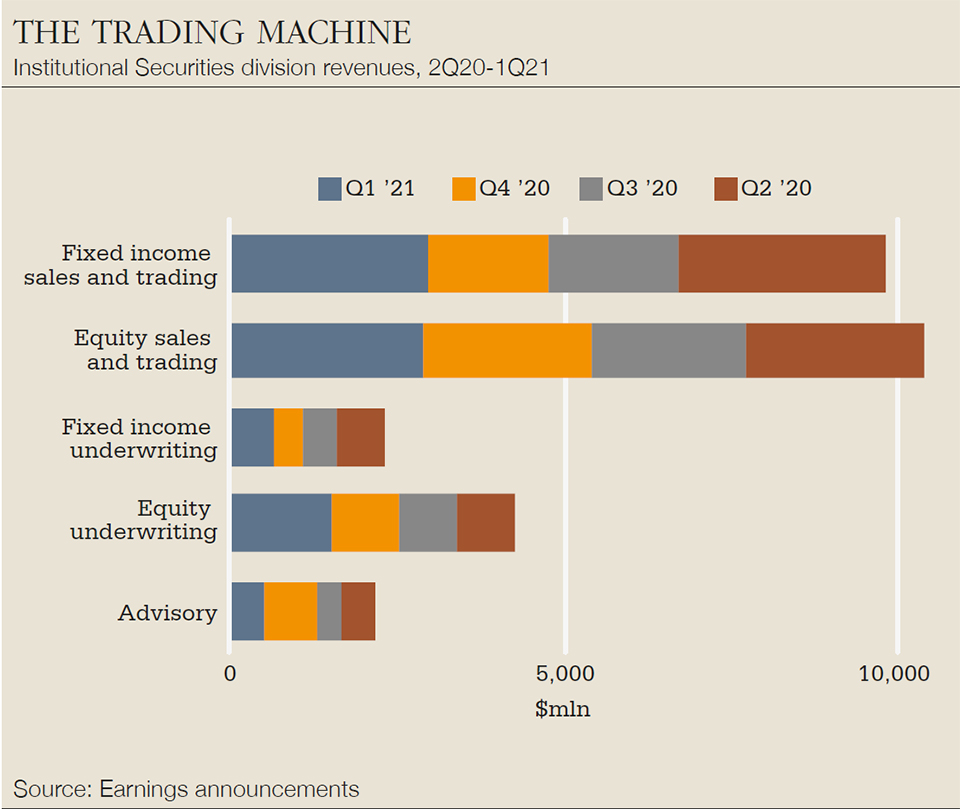

Sam Kellie-Smith, head of fixed income, has run equities in the past and worked with Pick and former president Colm Kelleher on the turnaround of Morgan Stanley’s fixed income franchise. That business, after having its headcount cut by 25% at the end of 2015, is now more profitable than ever. Now scaled for a quarterly run-rate of $1 billion, it notched up an average closer to $2.5 billion in the awards period.

Dan Simkovitz, meanwhile, is a veteran of the investment bank but is now running investment management, as well as being named this year as co-head of firm strategy and execution alongside Pick. Saperstein has done a stint in institutional securities. Alan Thomas, one of the firm’s co-heads of equities, used to work in fixed income. And so it goes on.

The last of Pick’s P’s is passion. “Winning in this business is by small margins,” he says, “so you have to want to win.”

Nowhere is that winning more evident than in Morgan Stanley’s formidable roster of deals during the period covered by Euromoney’s awards, covering every theme that emerged and playing a critical role in reopening many sectors.

The bank completed nearly 300 M&A transactions, of which about half were for financial sponsors, and it was on seven of the 10 biggest deals. It had the biggest market share in deals over $10 billion from the mid-March pandemic dislocation to the end of 2020, including the first $20 billion-plus deal of that period, the merger of Samba Financial Group with National Commercial Bank in Saudi Arabia.

It shepherded key deals to completion even as the pandemic was hitting markets. AbbVie’s acquisition of Allergan completed in May 2020 and included a $38 billion fully underwritten bridge facility that it provided with partner MUFG. The merger of T-Mobile US with Sprint saw Morgan Stanley advise T-Mobile owner Deutsche Telekom on a deal that closed in April.

The advisory business is once more fundamentally about judgement and experience, which plays to our strengths

Susie Huang

It reopened the IPO market in the US with the $1.9 billion flotation of Warner Music Group, following that up with a lead and stabilization role on the $2.5 billion IPO of Royalty Pharma. It dominated the biggest follow-on deals, leading PNC’s $13.3 billion exit of its holdings in BlackRock and the $20 billion synthetic secondary monetization of T-Mobile US by Softbank.

And while it didn’t chase the frenzy of IPOs for special purpose acquisition companies (Spacs), it made sure it was at the centre of the merger activity that follows them, notching up the number-one spot in sell-side Spac merger advice.

But some of its greatest challenges were in work for the worst affected industries. It was active bookrunner on a slew of equity, equity-linked and debt offerings for Southwest Airlines. It was the only bank to be joint financial adviser, joint global coordinator, joint sponsor and joint broker for the €2.7 billion rights issue for IAG. It led bonds, convertibles, bridge facilities and equity transactions for cruise line Royal Caribbean.

Deals such as these are where the firm’s bankers see its strongest credentials, because they mark what are critical moments for their clients. Navigation of market windows, flexibility on product selection, associated work in FX – everything becomes heightened in moments of maximum stress. Advice becomes the differentiator.

“I think of advisory as having come full circle,” says Susie Huang, co-head of global investment banking. “Now that market information is readily accessible to everyone, including our clients, the advisory business is once more fundamentally about judgement and experience, which plays to our strengths.”

Mark Eichorn, co-head alongside Huang, elaborates on the integrated investment bank concept that Pick refers to. “It means an arm around the shoulder of the client to assist in any type of corporate finance challenge,” he says. “It means we will tell you what happened the several other times we saw a similar set of facts in a complicated M&A transaction. It means we will help you raise equity with our number one equities sales and trading and retail distribution franchises, recently enhanced by the addition of E*Trade. It means we will help you with your concern about a move in commodities with a view from our leading commodities research team.”

He doesn’t see a return to the monogamous relationships between decision makers and the great advisers of the 1980s, however, but believes boards and management teams will increasingly see the value of a trusted adviser that is attached to a broader platform.

Tight-knit structure

The fact that Morgan Stanley is not the biggest firm on the Street gives it an edge in being nimble, its people believe – an edge that is only accentuated by the longevity of its teams and their ability to pivot together when the circumstances require it. Like bamboo scaffolding in typhoon-prone cities, this is a tight-knit structure but one with flex.

And it will need to be. Eichorn sums up the outlook and the belief: “There are going to be moments of real tectonic change in our industry and I like our chances.”

What gives him, or any of his colleagues, that kind of confidence? The answer lies in how Morgan Stanley has itself evolved over time without diluting its core appeal, which is its ability to provide trusted expertise. Its bankers talk of how they sit at the intersection of clients and the sources of capital, but rather than considering their business at risk of disintermediation as a result, actually think the opposite. The scope of the firm’s business, added to and complemented by franchises such as E*Trade, Eaton Vance and Solium, the employee stock plan administration firm it bought in 2019, provides an ample bulwark against the interlopers, they say.

There are going to be moments of real tectonic change in our industry, and I like our chances

Mark Eichorn

“I hope that we will in fact be the ones to disintermediate certain parts of our existing business by leveraging our unique portfolio of assets,” says Eichorn. “We have the leading wealth franchise, the number-one electronic trading offering, the number-one equity sales and trading franchise, and a solid and growing fixed income trading business.”

Aggregate all that and the result is to elevate Morgan Stanley’s advisory and capital markets work to something far greater than its standalone capabilities, however impressive they may be in themselves. The tone set at the top of the firm is that Morgan Stanley is not about to stand still and watch itself be made irrelevant.

The pandemic year saw it not just capture the opportunities that were afforded to it and all its peers by virtue of unprecedented central bank stimulus that lifted all boats but also reshape the scope of its operations to better fit the future. And in some of the most challenging conditions: the Eaton Vance deal was put together almost entirely on Zoom.

Unlike some peers that often seem to be travelling in the opposite direction, the experience of the last 12 months shows that Morgan Stanley has the engine to make such evolution possible. Pick acknowledges that the denominator in the industry – the aggregate investment banking revenue wallet – will settle back to a level below the extraordinary results seen in 2020, with growth probably reverting to its typical rate of one to two times nominal GDP growth.

What he spends more time thinking about is expanding the numerator, Morgan Stanley’s share. For much of its recent history, the firm has trended at 8% to 9%. By 2020 it was at about 13%. This year that is ticking up to around 15%, Pick reckons. Competitive to his core, he knows there is plenty more to do.

“If you’re at 15%, there’s 85% you don’t have.”

In case of emergency, exit via Door C

There are blots on the copybook. Two stand out and for different reasons: the blow-up of Archegos Capital Management in March 2021, which ended up costing Morgan Stanley $911 million, and the failed IPO of Ant Group, the Chinese financial technology firm whose $35 billion flotation was unceremoniously scrapped in November 2020 when Beijing blocked the deal, for which Morgan Stanley was a sponsor.

Both are sensitive situations that the firm’s bankers remain reluctant to discuss in detail even now. That they are pained by them is obvious. But Morgan Stanley is nearing full control of its own brokerage joint venture in China and must work with the country’s administration as it finds it. Its bankers say they remain bullish on their business there, even if there have been rocks thrown into the pond.

The failure of Ant’s IPO might have seemed at first to be an isolated disturbance in that pond. But events since then – as China’s regulators have set about pursuing policies that seem aimed at lessening the country’s dependence on other markets, be those in capital, skills or data – have cast the blocking of Ant’s deal in a different light. Through that lens it is less one bank’s clumsiness and more part of a larger narrative that outsiders must learn to understand.

Might Morgan Stanley have foreseen that? The firm’s rivals say it should have, at least in part. Its own bankers prefer to stress its careful navigation of a difficult episode that has resulted in it maintaining an important client relationship.

Archegos is in some ways even closer to home, particularly for Pick, with his background in the equity side of the firm and having been responsible for rebuilding its prime brokerage business in the wake of the financial crisis. But the firm’s now stellar equities franchise also made the loss easier to bear. The business posted more than $10 billion in revenues in the 12 months to the end of the first quarter 2021, making the Archegos hit – “money well spent,” in the words of Gorman – hardly an existential threat.

This then may be the flipside of the integrated investment bank. While being multifaceted presents more opportunities for success, it also creates more difficulties in navigating different interests. In the case of Archegos, Morgan Stanley had to consider those corporate clients whose stock it held as collateral. Had it ignored those concerns, its costs might have been smaller.

In any case, the reaction to the fallout for the bank was more to do with its approach to disclosure than the loss itself. The bank might have deemed it not to be sufficiently material in an accounting sense to warrant disclosure until it presented its quarterly earnings, but analysts hate surprises.

Pick now sees the episode as one to learn from with humility. Considerations of client cash levels, parallel leverage and concentration will doubtless be stepped up a gear. The firm has appointed new heads of prime brokerage after former head Ed Keller took a leave of absence in a move that the firm said was related to a health issue rather than to the Archegos affair.

But Pick is equally adamant that the answer when such things happen is not a knee-jerk shift. “The key is not to choose door A or door B, if door A is to ignore the lessons of a particular episode or door B is to overreact and change the strategic direction,” he says. “The answer is door C: let’s recognize when things have not gone well and learn from them – but stay committed to having the largest prime brokerage.”