|

View the Euromoney 25 |

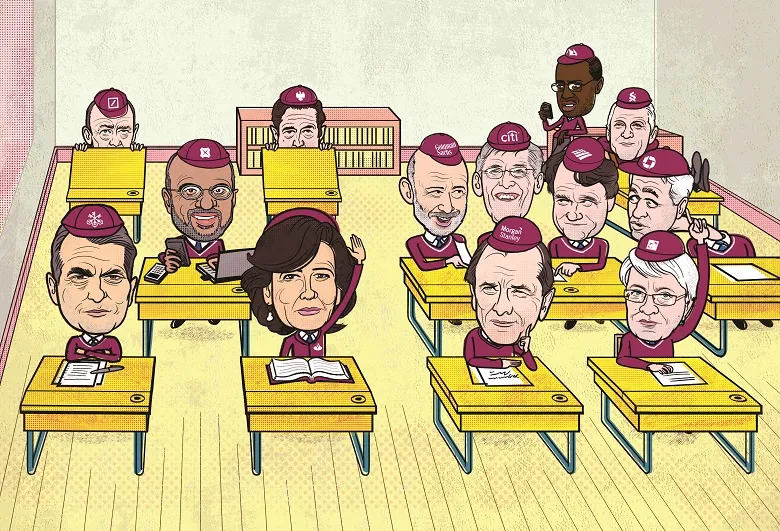

Welcome to the Euromoney 25. For this issue of Euromoney we have chosen a group of banks from around the world and assessed their performance. Think of them as progress reports. You can see the entire series here.

Which institutions make the cut is, of course, subjective. We have chosen them based on their international focus and because we think that collectively they reflect the state of play in the global banking sector. Most are global firms (and they represent two thirds of the global systemically important banks), but we have also chosen more regionally focused institutions from Latin America, Asia and the Middle East to reflect the increasing importance of these markets.

Some big banks don’t make it because we considered their businesses too dependent on one country. Although, for now, we have not included banks that have the majority of their business in Africa or central and eastern Europe, we do include a number of banks that have substantial operations in those regions.

To reach our assessments of each firm we have used our network of contacts at these institutions and in the wider industry. The reports do not follow a template. For some firms, we have focused on one strategic objective of the year; for others we have looked at their overall position.

We have also collated publicly reported financial data on all the institutions, which we have used to plot their relative performance. You will find this data after the 25 individual reports.

The 25 banks are Bank of America, Bank of China, Barclays, BBVA, BNP Paribas, Bradesco, Citi, Credit Suisse, DBS, Deutsche Bank, First Abu Dhabi Bank, Goldman Sachs, HSBC, Industrial and Commercial Bank of China (ICBC), Itaú Unibanco, JPMorgan, Morgan Stanley, MUFG, Qatar National Bank, Royal Bank of Canada, Santander, Société Générale, Standard Chartered, UBS and UniCredit.

Taken together, we believe our reports on the Euromoney 25 add up to a revealing snapshot of the state of play in global banking.

What can we learn from the data we have collated? That these banks are generally well capitalized, but that capital levels are not as consistent across the top firms in the industry as you may expect. Based on transitional common equity tier-1 (CET1) ratios at September 30, 2017, the best capitalized bank has a ratio of close to 17%, the least capitalized just 10.9%. The median CET1 ratio of the Euromoney 25 is 12.9%.

Return on equity, a core measure of performance, is much easier to generate if you have an emerging market focus and a strong domestic base in one of those markets. Four of the top five are Brazil’s Bradesco and Itaú, and China’s ICBC and Bank of China. The median ROE is 9.4% – not far off the average cost of capital for bigger, global banks today.

In the first nine months of the year only one truly global, non-EM-focused bank – JPMorgan – managed to generate a return on assets of greater than 1%. The median ROA was 0.87%.

Five banks had revenues to September 30, 2017 greater than $50 billion; of those five, four produced profits before tax of more than $20 billion in the first three quarters. Aggregate revenues for the Euromoney 25 were $761 billion, total profits before tax were $262 billion and the median cost-to-income ratio was 58%.

What can we learn from the many conversations the Euromoney team had with chief executives and CFOs during December? The tone of the discussion was cautiously positive. Most bank leaders think they have gone through the toughest part of repositioning their businesses. Most believe they have the ability to grow revenues in the coming years.

But they know any such progress is likely to be slow and limited. And even some of those running the better-performing businesses think it will be hard to move the needle much on better returns on equity. A target of 10% to 11% is the new normal, if not yet the new actual. They hope for a return to volatility or, more likely, an era of regulatory forbearance that might provide a boost to earnings.

One last thing we learnt: who would be a banks analyst? What becomes abundantly clear when collating data across 25 global institutions is the difficulty caused by reporting differences. As a group, the US banks are without doubt the clearest, even if Morgan Stanley and Goldman Sachs eschew the convenience of long quarterly time series in favour of showing comparisons with just the previous quarter and the year-ago period. European banks are, for the most part, close to consistency, but fiscal year differences at the Canadian and Japanese banks need navigating.

As you might expect, performance measures vary wildly. Return on equity unhelpful? Opt for tangible instead. Return on assets not looking great? Let’s go with return on regulatory capital or some such.

We will repeat the entire exercise in 12 months’ time, but we will also be returning to these institutions regularly to update our assessments throughout the year – while of course continuing to provide coverage of the many other banks that play an integral role in the global financial markets.