Treasury

We offer exclusive data and insights on the world’s leading players in trade finance, cash management, payments and financial institutions through surveys and bespoke benchmarking reports.

Benchmarking

Corporate banking

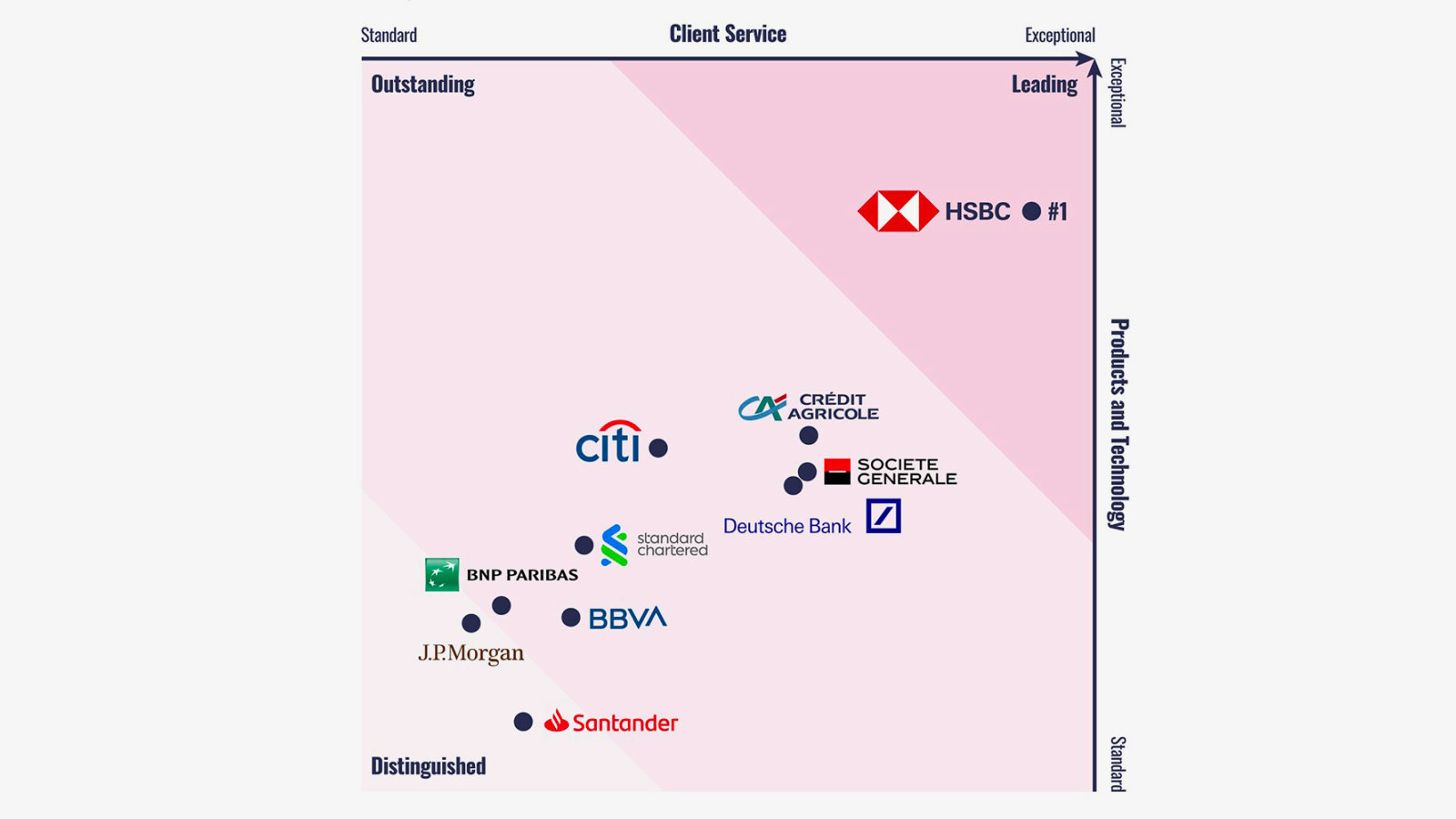

Cash Management survey

Trade Finance Survey

Trade Finance Survey 2025 Results

Market insights

Corporate banking

The API advantage

Corporate banking

The flat-pricing revolution for inclusive SME finance in Asia

Corporate banking

How banks and providers are accelerating corporate API adoption

Awards

Best practices

Capital markets

ISO 20022: The current view

Capital markets

ISO 20022: The implementation view

Capital markets