|

|

You may have heard this before. Australia is emerging from a global crisis more swiftly and in better shape than almost anywhere else in the world, giving its banks and the corporates they advise a clear advantage in a barely recognizable ‘new normal’.

That sentence could equally have been written about the global financial crisis a decade ago or the Covid-19 pandemic right now. While, at the time of writing, the US has suffered 120,000 Covid-19 deaths from 2.23 million cases and the UK 42,150 from 300,000, Australia has had 102 deaths from 7,000 cases. Local community transmission has pretty much stopped.

And while Australia’s economy has unquestionably been badly hit, facing recession for the first time in three decades, with closed international borders and a fraying relationship with China, there is already a sense of recovery.

Alongside New Zealand, it is the only market where people are already talking about Covid in the past tense.

From the perspective of the many international investment banks that populate the Sydney and Melbourne city centre towers – and whose staff are gradually returning to them – Covid has created a lot of work. But it also required a willingness to adapt very quickly.

|

|

Anthony Sweetman, |

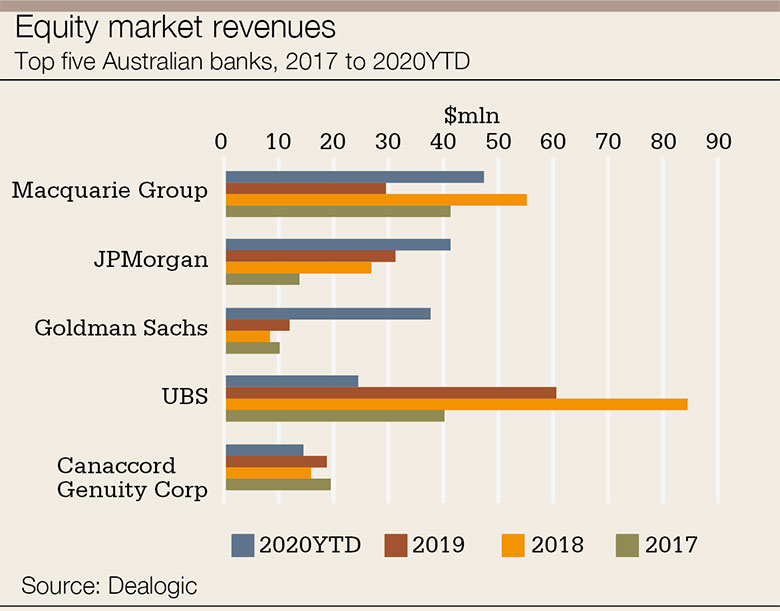

“Up until mid or even late February, 2020 was shaping up to be similar to last year,” says Anthony Sweetman, joint country head and head of global banking, UBS Australasia. “Strong levels of M&A driven by confidence and strong economic conditions, with a reasonable level of equity capital markets activity linked to that M&A and to other growth plans.

“That all changed very abruptly.”

It was the same for everyone else.

“Like every other investment bank, we tore up our pipeline in late February – and we had a fantastic pipeline,” says Tony Osmond, head of Citi’s banking, capital markets and advisory function for Australia and New Zealand.

Richard Gibb, chief executive of Credit Suisse Australia, also speaks of a pipeline at the start of the year that was “largely upended by Covid-19. We pivoted to where our clients had the greatest need.”

And fortunately, from the banks’ point of view, there was plenty of need. Many Australian corporates needed money and quickly. So quickly, in fact, that the world epicentre of equity capital raising in April was not New York or London but Sydney.

At least A$24 billion ($16.6 billion) of equity was raised there between the start of March and early June, and it happened this way because there was no other choice.

“A lot of these capital raisings were mission critical for the clients involved: literally in some cases – they would not have survived without them,” says Tim Joyce, co-head of Macquarie Capital for Australia and New Zealand. “It was by no means straightforward to raise that equity.”

Companies and banks had found themselves with a problem they just hadn’t seen coming: the economy was shutting down, they were running into trouble servicing their debt and it was extremely difficult to form any kind of conclusion about how long the problems might last.

But a plunging stock market appeared to be guiding them that the problem was here for the long term.

Share prices have recovered somewhat, balance sheets are recapitalized and companies are returning to their pipelines, with M&A featuring pretty prominently – Tony Osmond, Citi

Osmond at Citi says his pipeline “was replaced with clients’ immediate needs: liquidity, dealing with bank covenants and near-term bank refinancing.”

The questions he and his colleagues were being asked by clients boiled down to: could they lend them money and could they help them raise money?

“Because the crisis happened so quickly and because our clients had to shift from being on the offensive in orderly markets to being on the defensive, all of a sudden we had to shift our focus,” says Osmond.

“All of the investment banks, Citi included, were faced with this wall of intensity: a race to try to understand what balance sheets looked like and how to get capital most efficiently. We did six months of work in a couple of months.”

In some sectors, a company’s whole viability was on the line.

“There are some clients in the impacted industries such as travel, tourism, leisure and hospitality that needed to recapitalize and restructure their balance sheets,” says Simon Rothery, chief executive of Goldman Sachs Australia.

Examples include Webjet, which Goldman helped to restructure its balance sheet through the public market.

Structural help

One result of the Covid-19 crisis was to demonstrate just how much equity can be raised here in a short space of time, if it’s absolutely essential to do so.

“Structurally in Australia we have a real advantage: the ability to do placements which can be in and out of the market in one day; we have the rights issue path; and we have regulators that have been very willing to help,” says Rothery.

On the regulatory side, a key moment was the decision by the corporate regulator, the Australian Securities and Investments Commission (Asic), and the stock exchange, ASX, to lift the cap of 15% of issued capital that can normally be raised in a single placement to 25% in recognition of the trouble ahead.

Each raising had its own complexities and challenges, and getting investors to step up in March was by no means straightforward – Tim Joyce, Macquarie Capital

Many corporates in Australia have taken advantage of the change.

That’s fine, but investors still had to be convinced to pour money into companies in a drastically declining market – the rebound we’ve seen in asset prices since March was by no means a foregone conclusion back then.

“A number of companies moved quickly to raise equity at what, in hindsight, has turned out to be near-market lows and during the highest period of volatility,” says Sweetman.

Equity issues such as the NAB placement, a $3 billion institutional placement accompanied by a $1.25 billion share purchase plan to retail investors, showed how issuers have been “very conscious of making sure existing shareholders are rewarded for their loyalty,” says Rothery.

Goldman Sachs and Macquarie ran the bookbuild.

“If you look at NAB,” Rothery continues, “the support came from their existing shareholders: long-only Australian asset managers, industry super funds, sovereign wealth funds. We did see huge hedge fund demand as well, but hedge funds have been getting smaller allocations in these deals.”

Particularly important has been Australia’s pension sector, worth A$3 trillion ($2 trillion) before the Covid crisis hit valuations; it is among the largest asset pools in the world despite Australia’s relatively small population.

|

|

Simon Rothery, |

“Through our compulsory superannuation scheme there is a huge pool of savings here in Australia that has been going into these transactions,” says Rothery. “Every single one we have done has been heavily oversubscribed. There is a huge wall of money.”

Joyce at Macquarie agrees.

“There was a period six weeks ago when more equity was being raised by Australian listed companies than in any other market in the world,” he says. “That spoke to the fact that we have the fourth largest superannuation system globally and the 10th largest equity market. There is an efficient system for raising equity quickly, and that combination of things meant that investors stepped up and supported equity raisings for companies that needed the money.”

That doesn’t mean that any of these deals were foregone conclusions.

Flight Centre Travel Group, a retail travel agency, was among the first companies to be hit, seeing its share price fall from A$40 to A$9. The A$700 million placement and rights issue it launched in April through Macquarie Capital and UBS was required in order for it to survive.

“I don’t think it has been as vanilla or straightforward as it might have looked,” says Joyce, speaking of capital raisings broadly rather than just Flight Centre.

Macquarie has been involved in A$10 billion of the A$24 billion of equity issuance since the beginning of March.

“Each raising had its own complexities and challenges, and getting investors to step up in March was by no means straightforward.”

Still, not every capital raising was about survival. Seeing the willingness of investors, others have just taken their chance.

Opportunity strikes

“The interesting thing is half the equity raisings have been recapitalizations, companies that needed to raise or would have breached covenants; and the other half has been for opportunistic or growth purposes,” says Rothery. “Boards and management teams recognize this is going to be a difficult period but there will be a lot of opportunities for their business.”

Also, equities are not the only game in town. Bankers have reported a lot of advisory work – the sale of Virgin Australia is a case in point, with Goldman advising Bain Capital on a bid, Moelis & Co advising BGH Capital and Macquarie advising Brookfield, while Morgan Stanley is advising administrator Deloitte.

But debt is equally active and perhaps somewhat under the radar.

|

|

Tony Osmond, |

“From our point of view we have been just as busy, maybe busier, doing debt raisings than equity,” says Osmond at Citi. “That doesn’t get as many headlines.”

This is partly for corporates but also for government, where Citi has helped to raise A$19 billion for the federal government and has issued bonds for every state in Australia, most of them at least twice.

“Australian investors have a greater aversion to debt than many other countries,” says Osmond.

In Australia most listed companies don’t have debt greater than three times ebitda, while in the US, up to five times is commonplace. Correspondingly, the early moments of the crisis in Australia were characterized by support from Australian equity investors to recapitalize balance sheets, while the US saw a greater proliferation of debt raisings and convertibles. The activity in DCM is very welcome, but generally investment banking revenues are far more tightly linked to ECM and M&A activity than debt.

So what of M&A? Is that dead in the water?

Opinions vary. Domestic M&A can obviously go ahead, but logically the closing of borders (an Australian minister said in June he did not expect international flights to resume to Australia for the rest of 2020, barring trans-Tasman flights to New Zealand) would seem to rule out any possibility of cross-border M&A.

“Predicting M&A activity is difficult given the uncertain economic outlook and travel restrictions,” says Sweetman.

He says there has been some talk of prioritizing business travel as flights gradually open up, “but I’m not sure how many executives would want to travel it if it involves two weeks in quarantine at either end.

“There are some industries where you can do everything remotely, but in most cases people looking at significant transactions want to be physically present at some point looking at businesses and assets and engaging with people. I suspect it will result in M&A being somewhat limited.”

History repeats

Most agree. But there is a nagging sense of history repeating itself here: of Australia coming out of crisis in far better shape than most of its peers, with a steadily rising currency, share prices almost back where they were before the crisis in many industries and with companies newly flush with equity.

“Absolutely, cross-border discussions are going on,” says Osmond.

Most of them are things that were already in contemplation, he says. Are new opportunities going to be created by this crisis?

“The answer is ‘yes’, but it is probably a bit early,” he adds. “But given Australia recapitalized early, most balance sheets are in pretty good condition and that will put them at an advantage.

“There is now a sense of optimism,” he says. “Share prices have recovered somewhat; balance sheets are recapitalized; and companies are returning to their pipelines, with M&A featuring pretty prominently.”

I would expect a pretty strong level of activity out of private equity both domestically and regionally over the next six to 12 months, but I think we will need to see certainty on valuations and the market outlook before M&A takes off – Richard Wagner, Morgan Stanley

Some find that a little premature.

“It is a little early to be saying: ‘Hey, look at Australia, we’ve done well and we have some advantages here in terms of capital and investment,’” says John Pickhaver, co-head of Macquarie Capital for Australia and New Zealand. “It’s true that the Australian system has functioned well in response to the crisis, but it is still early days, and conversations about buying assets are nascent.”

Richard Wagner, Australia chief executive at Morgan Stanley, thinks the domestic story is sufficient for the moment.

“I don’t necessarily see a huge amount of outbound M&A opportunities,” he says. “There will be enough for companies to focus on domestically. I would expect a pretty strong level of activity out of private equity both domestically and regionally over the next six to 12 months, but I think we will need to see certainty on valuations and the market outlook before M&A takes off.”

Distinctive market

Covid-19 notwithstanding, Australia is an interesting investment banking market, mature but in a state of consistent evolution.

It is well covered and profitable, and continues to attract new players, such as Jarden, the New Zealand investment bank, which has hired some of the strongest names in the industry from UBS and Goldman, and the expected return to the industry of former UBS Australia head Matthew Grounds.

Jefferies has raided some of the brightest minds at CLSA to create its own launch pad.

Australia is also a distinctive market, particularly because the model increasingly seen in the rest of Asia Pacific – aligning the efforts of private banking and investment banking into a streamlined group, a sort of virtuous circle of referrals that focuses on family wealth and entrepreneurs – scarcely exists in Australia.

There is nowhere else in the region, for example, where UBS would willingly sell its private banking division to its own staff, as it did in 2015, and focus instead on investment banking.

“The model in Australia is very different to the rest of the world, and you don’t see many of the larger international players here having wealth management operations,” says Sweetman at UBS.

Instead, he says, the bigger change has been banks restructuring or exiting their wealth management operations in light of the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry. The latest example of this was KKR buying a majority stake in Commonwealth Bank of Australia’s wealth management business, Colonial First State.

Only two foreign banks buck the trend: Credit Suisse and Morgan Stanley.

“Our relationships with entrepreneurs and ultra-high net-worth individuals is a key differentiator for Credit Suisse across the Asia-Pacific region – and Australia is no exception,” says Gibb. “We’ve had very successful collaboration between our investment bank and private bank, and see a real benefit in being able to provide private clients with the full suite of investment banking products in addition to wealth management advice.”

In this respect, it sounds like any other Credit Suisse operation in the Asia-Pacific region, and Gibb can point to examples where it has worked, notably the Homeco transaction, which involved private banking, advisory, financing and ECM working together.

That transaction goes back to 2017, when several prominent high net-worth individuals, some of them Credit Suisse private banking clients, bought the Masters property portfolio from Woolworths. Those assets, suitably repositioned, were listed in late 2019.

Morgan Stanley’s entry into private banking in Australia dates from the bank’s purchase of the Smith Barney business from Citi globally.

Since acquiring that business, Wagner says, “we have revamped it considerably. We have gradually moulded it to become a high net-worth, family office and not-for-profit charity-focused business.”

Wagner agrees that “it’s rare to have only two global banks in a country having a material wealth management business”, but he’s got no complaints about the lack of competition.

“We have seen enormous growth in that business,” he says. “Particularly this year, post-Covid, there has been a real flight to quality in the wealth management space. Covid is a global problem, markets are increasingly global too, and we have a worldwide breadth of research to offer to clients. We have seen more than 1,000 accounts open across our platforms in the wealth business this year.”

More than advice

Other banks have their own methods of differentiation.

Macquarie, as a group, has always marched to the beat of its own drum, doing things differently and not much bothering what everyone else is doing.

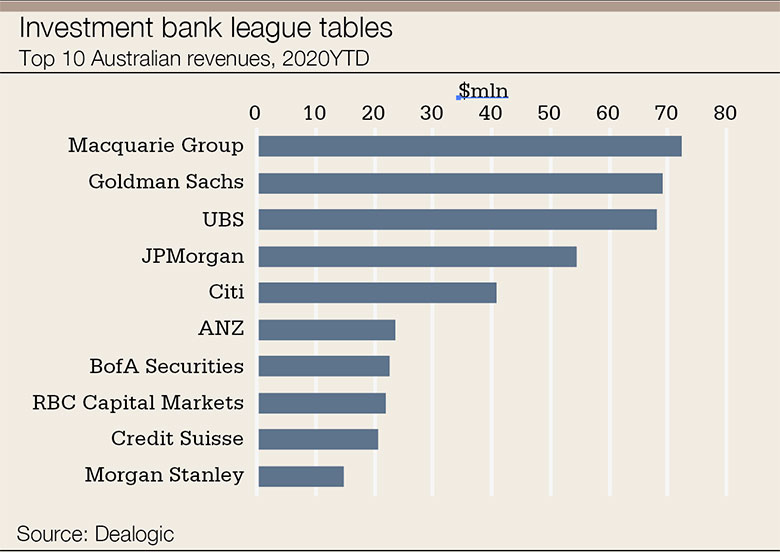

Historically Macquarie and UBS have clashed as the country’s preeminent investment banks, but Macquarie’s mainstream ECM, DCM and advisory work has always been just one branch on a strikingly complicated tree.

It’s never quite enough for Macquarie to be an adviser or a financier; typically it is a partner, a co-investor or a developer. These days this finds its clearest expression in its work on renewables.

“One of our main strategies is to look beyond pure advice to being a partner and developer of assets, whether that’s in urban development, renewables or tech,” says Joyce. “In those sectors where we see strong tailwinds, we look to participate as a partner and investor as well as an adviser.”

Pickhaver explains the philosophy as moving from a transactional to a thematic approach.

Transactions might still drive it all – raising capital, M&A advice, defence advisory and working with governments – “but we look at it in combination with themes like urbanization, resilience, technology and energy transition.”

One begins to get a sense of the different approach by looking at the backgrounds of people who work at Macquarie Capital. Joyce was originally a lawyer and Pickhaver an engineer in civil infrastructure.

“There are quite a lot of people in the business with a technical background like mine and who still operate in a technical capacity,” says Pickhaver. “That helps with project development and asset creation. We have quantity surveyors, mechanical engineers, civil engineers on staff.”

For example, Macquarie is working on the development of not only an office tower but a metro station beneath it at Martin Place in Sydney.

“To think of projects like that and to bid them and deliver them, we have the technical engineering resources on staff to do it,” says Pickhaver. “The blend of technical resources, commercial, legal and financial is a bit different.”

One sees this in action in the Kwinana waste-to-energy project in Western Australia, where Macquarie has partnered with local councils in order to provide the waste and then with other investors and developers in bringing those assets to market.

Macquarie partners with the people who want the power, the people who provide the feedstock and the people who want to invest.

Offtake partners for the electricity from its wind farms include Telstra, ANZ and Coca-Cola, all of them corporate relationships for the bank. In this style it has helped create wind farms, solar farms, battery storage and waste-to-energy.

“We are not necessarily the long-term owner of those assets,” Pickhaver says. “We create the asset and bring in longer-term investors beside us.”

This is still a reasonably unusual approach in Australia – Joyce certainly thinks so.

“I think we stand alone in the types of partnering we can do,” he says.

Some international houses have principal investment or special situation businesses, “but we are a bit different,” he says. “We invest in upcoming new businesses, usually technology driven, where we are quite venture capitalist in our style.”

It’s not completely unique, however, and Goldman has a principal investment business in Australia.

Known internally as PIA, it dates from the aftermath of the global financial crisis when the firm began purchasing non-performing loan portfolios, initially from the local arms of UK banks and then from Australians too.

“That kick started the business for us,” says Rothery.

Since then the bank has built a big business across credit and equity investing. An example of this division divesting a business came with its sale of a stake in AirTrunk, the data centre platform, to Macquarie’s infrastructure arm, Mira, in April.

|

In part 2, Euromoney will look at the competitive environment that jostles to take advantage of this vibrant market: the new pretenders, the challenges they will face, the established leaders they seek to poach staff from, the shifting sands as people move around. And as Australia emerges from a crisis that still grips the rest of the globe, it is likely to become more attractive and competitive than ever.