HOW COVID-19 WILL TRANSFORM THE FINANCIAL MARKETS |

| How does banking come back from this? |

| Loans: Crunch time for credit |

| Private equity bets on post-Covid survivors with hybrid capital |

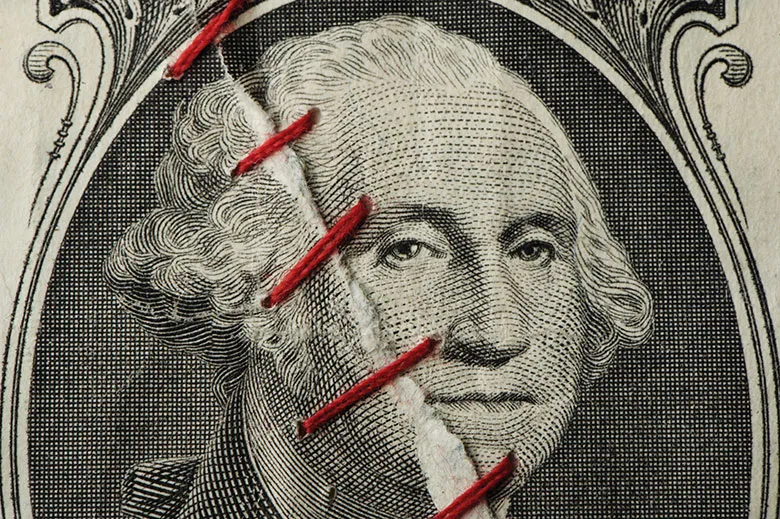

| A stitch in time: can corporates follow bank resilience playbook? |

| Wealth managers find out who is with them |

| Life through a lens: bankers can do deals online, but can they win clients? |

| Home offices get a tech upgrade |

“There is merit in keeping alive the memory of those days.” So wrote John Kenneth Galbraith in ‘The Great Crash 1929’. Banks going through the Covid crash of 2020 have certainly been keeping alive the memory of previous crises. What about corporates?

The human tragedy of the current turmoil means that no one wants to be seen publicly to be pointing the finger at companies just yet. But advisers say that it has sometimes been a battle to get clients to appreciate the potential damage to their businesses.

“Companies are in denial,” says one banker. “We run downside scenarios saying: ‘These are the assumptions; you have a $5 billion hole in your balance sheet’, and they are pissed off. That journey continues for about four weeks and then they capitulate.”

Should companies have done more to prepare? The aftermath of the financial crisis of 2008 saw measures imposed on the banking industry to build bulwarks against a mass deterioration of credit quality and a widespread liquidity freeze.

That was a banking crisis that, without extraordinary government and central bank intervention, might have become a corporate crisis. Even the then-mighty General Electric struggled to finance itself in the commercial paper market.

Beyond its origins as a public health crisis, the Covid-19 turmoil has been the other way around – a corporate crisis that, without extraordinary government and central bank intervention and more resilience than in 2008, could have become a banking crisis.

Revolving credit facilities, which so many big companies made use of as a first resort this time around, are arguably crisis-preparation measures – albeit ones that impose big burdens on the financial sector if many are drawn at the same time.

Like a pre-lockdown shopper in the aisle for toilet paper, there were those that drew on loans in March more out of panic than necessity – as shown by the rising corporate deposits reported by banks in their first-quarter numbers.

One senior European banker thinks back to the March low point with unease.

“I had clients coming to us for liquidity when they should have been lending us money,” he says grimly.

It still might get bad for the financial sector if state support schemes cannot temper the corporate bankruptcies that are to come – and banks’ exposures to them – or if commercial real estate loans blow up beyond the scope of provisions, or if another bout of market dislocation trashes the fund management industry. There are plenty of possible outcomes.

|

|

|

Barry Donlon, |

For the moment, however, it is corporates that are squarely in the firing line of the meltdown. Many did not adjust in light of previous shocks and may again lack much incentive to do so now.

“We have seen periods of stress in the commercial paper market in the past, and yet we saw a number of borrowers going into this crisis with significant short-end balances,” notes Barry Donlon, head of EMEA debt capital markets at UBS. “The problem is that the lesson of the crisis may be that if you get into trouble from a liquidity perspective, a central bank will step in.”

Historic arguments that even the biggest corporates lack the systemic importance of big banks depend somewhat on the definition of systemic. Governments that have to provide for the unemployed may see things differently, particularly if many businesses are hit at the same time.

Resilience

No one could have provisioned for the full effects of the pandemic. But are companies as resilient as is reasonable to expect? And if they are not, who or what can force them to be?

|

|

|

Reid Marsh, |

“It’s the old adage – finance when you can, not when you have to,” notes Reid Marsh, head of Europe, the Middle East and Asia Pacific banking at Barclays, as he considers the extraordinary wave of activity that came in early April from big corporates that did not all need the money.

This, then, is at least progress from 2008, when many corporates were reluctant to take proactive steps if they did not need to do so.

Writing in the Financial Times in May, Willem Buiter, former chief economist at Citi, outlined how ‘just-in-case’ economics would now replace ‘just-in-time’. That applies as much to corporates’ balance sheets as it does to their supply chains.

“There is clearly the question of whether companies, like banks, should have buffers – a rainy day reserve,” says a banker.

The problem is that most government schemes right now are simply promoting more debt. Added to that, there is much less pressure for corporate finance reform now than there was pressure for bank reform after the previous crisis. Companies did not trigger the coronavirus crisis: they will not be a lightning rod for the pain felt in society.

Securities that convert into equity are an obvious mechanism to tackle big debt ratios over time. But even when it doesn’t result in a backdoor nationalization, dilution is a touchy subject – “Europeans seem to think it’s illegal,” quips an American banker.

Another answer for resilience might be to have hybrid, non-dilutive, very long-dated instruments in companies’ capital structures that are loss-absorbing on triggers relating to market or business conditions, and restrict coupon and dividend payouts.

“I don’t think many people are quite thinking about this yet,” says a senior banker at a US firm, “because what galvanized the bullet-proofing of the banks was really the taxpayer bailouts.”

Main Street may have to develop greater buffers. CEOs will have to make the case for it, but you will see higher tolerance from investors

Mo Assomull, Morgan Stanley

Bailouts are now beginning – and they come with strings attached.

Norwegian Air secured about NKr3 billion ($302 million) of state aid only after agreeing to hand over ownership of the company to creditors in order to wipe out its debt. Lufthansa is negotiating a €9 billion bailout that may see the German government take a 20% stake in the company.

Corporates have for decades sought efficient balance sheets, burdened by cheap debt, rather than by cash and equity, with investors preferring to see stock buybacks and dividend payments rather than resilience.

If large parts of the world are to enter a Japanese-style period of no growth, might investors become more tolerant of Japanese-style balance sheets?

“I do think that post-Covid, companies that have stronger balance sheets will enjoy higher ratings with investors,” says Marsh.

|

Mo Assomull, global head of capital markets at Morgan Stanley, also thinks attitudes could evolve.

“We went through a harsh period where corporates were getting hit by activists and shareholders for having lazy balance sheets and too much cash,” he says. “But now Main Street may have to develop greater buffers. CEOs will have to make the case for it, but you will see higher tolerance from investors.”

In bailout situations, governments have an obvious ability to impose conditions, whether on payouts to investors or relating to corporate resilience more broadly. Elsewhere, it’s less immediately obvious what the appropriate route could be to impose strengthening measures if market forces will not do it. Corporates lack the central regulatory agencies that apply to the financial services sector.

|

|

|

Mark Lynagh, |

Bankers note that public companies are subject to regulatory bodies governing listed entities, which could step in to impose standards. Accounting rules could be another, much more widespread, method. Many industries have consumer bodies that could get involved.

Some think it may be left to markets after all.

Mark Lynagh, co-head of EMEA debt capital markets at BNP Paribas, is another who thinks the days when investors would automatically penalize companies for the inefficient carrying of cash might be ending.

“Liquidity has become integral to the equity story,” he says.