|

|

|

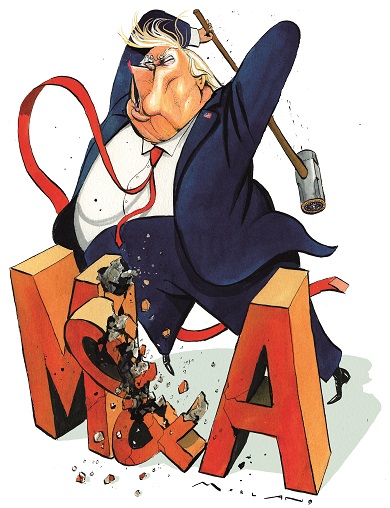

Illustration: Morten Morland |

The typical investment banker working in mergers and acquisitions tends to be shrewd, considered and a little bit ruthless. You don’t rise up the ranks without becoming good at weighing all your clients’ strategic options with unemotional clarity; learning to roll with the blows in the heat of battle during contested takeovers; and adept at calmly persuading third parties – board directors, shareholders, analysts, regulators – round to your view of the rights and wrongs of a deal.

Access intelligence that drives action

To unlock this research, enter your email to log in or enquire about access