|

| © 2017 Euromoney |

| Full results |

| More data |

| Download press release |

| Charting the FX evolution |

Among the key findings:

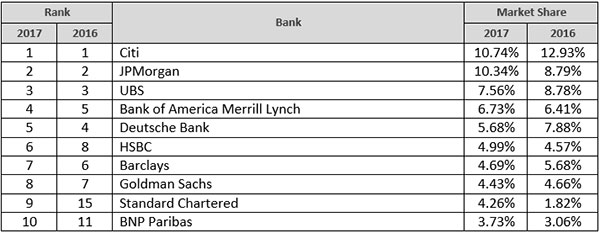

Citi retains its top ranking

Deutsche Bank continues a long-term decline in market share

Standard Chartered jumps from 15th to 9th place

Global headline volume falls by 1.9%

Overall market share among the top five banks declines to 41.05%, from 44.79% in 2016

There are now seven non-bank liquidity providers in the top 50

After years of growth, electronic trading has levelled out at 64% of volume

Detailed information:

Top 10 overall market share:

|

The Euromoney Foreign Exchange Survey is the most comprehensive quantitative and qualitative annual study available on the FX markets.

Access intelligence that drives action

To unlock this research, enter your email to log in or enquire about access