JPMorgan went on a shopping spree in 2021 to secure its present leadership far into the future. This was at the same time as its already large share of US deposits – driven even higher by savers’ flight to safety in the pandemic – prevents it from buying banks in its home market.

Among 30 or so bolt-on deals, it acquired OpenInvest in June. OpenInvest is an environmental, social, governance (ESG) investment management products and impact reporting services company.

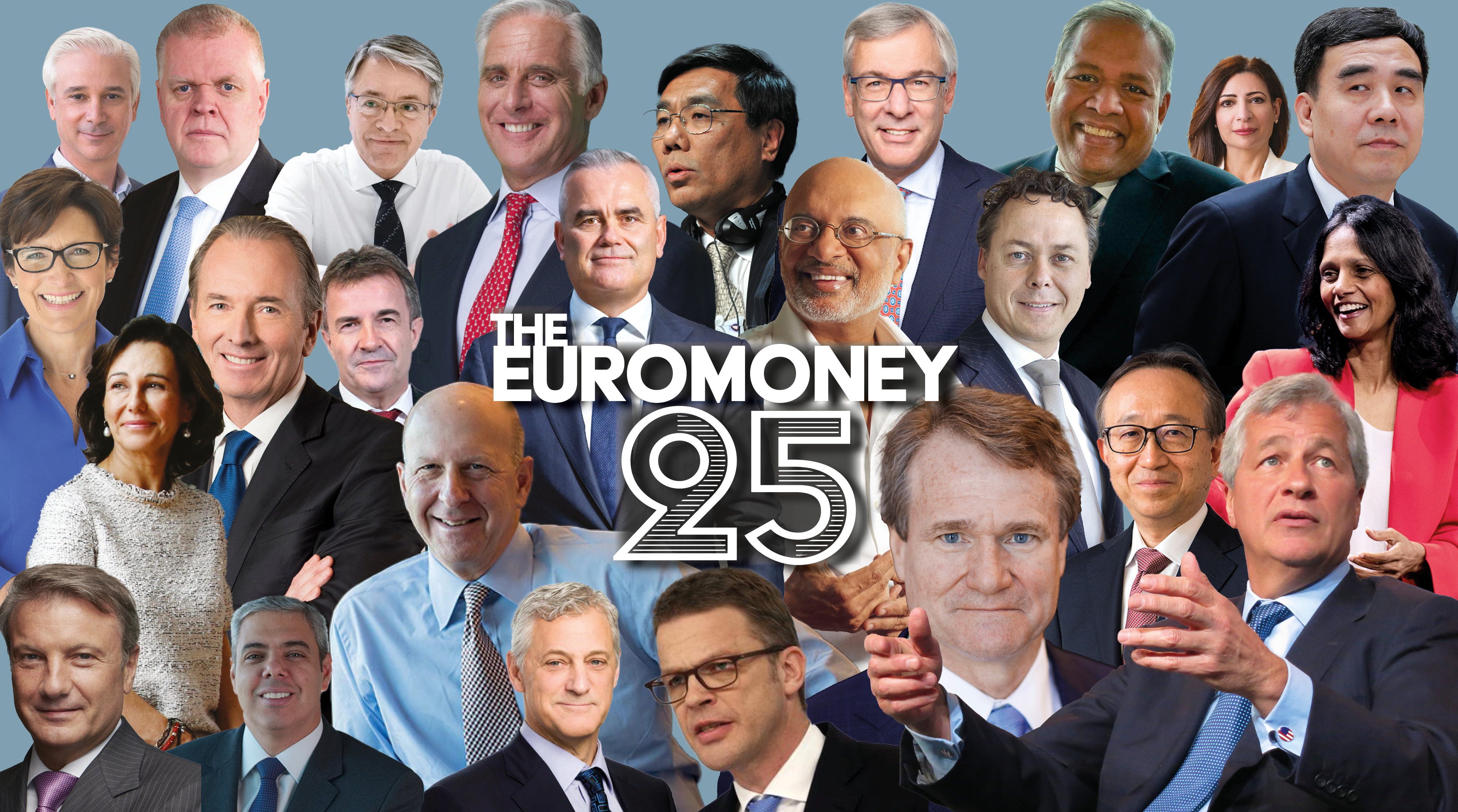

Thanks for your interest in Euromoney!

To unlock this article: