Read more: Spacs

The $100 billion raised by special purpose acquisition companies (Spacs) since the start of 2020 might be stoking fears of a speculative bubble in some quarters of the market.

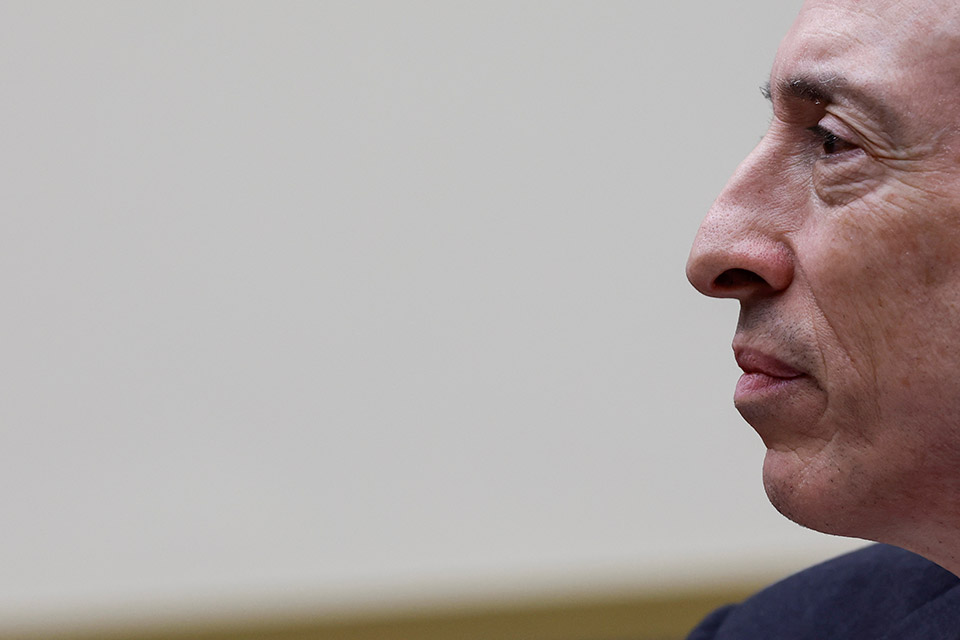

However, for Jean Pierre Mustier, the former UniCredit chief executive who is among a team that is launching a European Spac, the structure has a credible future in a region lacking a deep and unified capital market.

Access intelligence that drives action

To unlock this research, enter your email to log in or enquire about access