For many companies across the region, trade decisions are no longer purely transactional; they are strategic, with direct implications for resilience, liquidity and growth.

Against that backdrop, HSBC has expanded its role beyond execution into advisory. As trade conditions have become more volatile, the bank has increased its focus on helping corporates understand and navigate complexity. As one respondent puts it “our account manager has extensive knowledge, excellent handling of situations and conversations, and a great team that advises and supports us with all our needs.”

Building on that expectation, HSBC has deliberately stepped up its educational and advisory engagement with clients. With uncertainty now a constant, the bank has focused on raising awareness of available trade instruments and solutions. “We’ve held more client events, bringing more intellectual content to clients than any other year, along with partners from legal or advisory firms,” says Vivek Ramachandran, head of Global Trade Solutions at HSBC.

That approach underpins HSBC’s trade proposition in Latin America: supporting cross-border connectivity while delivering execution excellency, digital access and flexible liquidity aligned to real trade flows.

Mexico at the centre of nearshoring flows

Mexico has emerged as a focal point for the region’s trade realignment. As manufacturing supply chains move closer to North America, trade volumes between Mexico, the US and Europe have risen sharply, placing new demands on financing structures, documentation and working-capital management. HSBC positions Mexico as a strategic anchor within its regional franchise, supporting both inbound investment and outbound trade.

Client feedback reflects that role. A wholesale trade corporate in Mexico notes that HSBC “facilitates cross-border transactions and financing”, highlighting the importance of seamless execution as trade activity spans multiple jurisdictions. Another respondent emphasises access and responsiveness, saying that with international operations they can “easily contact HSBC advisors and resolve any problems or questions”.

That emphasis on connectivity and speed mirrors Ramachandran’s broader assessment of client expectations. As companies rework supply chains and business models, he says, “they expect their financial institutions to step up to support them more”, particularly as trade decisions become strategic, being brought to CEOs’ agenda worldwide.

Regional breadth with local execution

Beyond Mexico, HSBC’s trade franchise spans Latin American markets with very different trade profiles. In Brazil, corporates operate in a complex domestic environment where reliability and risk management are critical. In Chile, HSBC is often positioned as a gateway to global trade routes, particularly for exporters linked to Asia-facing supply chains.

We’ve held more client events, bringing more intellectual content to clients than any other year, along with partners from legal or advisory firms.

Vivek Ramachandran, head of Global Trade Solutions, HSBC

Across these markets, client feedback consistently highlights service quality and access to decision-makers. One Latin American corporate describes HSBC’s trade teams as “knowledgeable and responsive”, reinforcing the idea that technology delivers the most value when paired with human expertise. Another notes that HSBC advisers understand their business context, allowing issues to be resolved quickly rather than escalated.

The message is consistent across markets: execution matters, but so does the ability to intervene early and intelligently when trade flows encounter friction.

Working capital under pressure

Working capital has become one of the most acute pressures for Latin American corporates navigating supply-chain change. Ramachandran notes rising demand for solutions that help release liquidity, inject funding into supply chains or mitigate risk at specific points in the trade cycle. “There’s been much more demand for bespoke solutions as a result,” he says, particularly as companies experiment with off-balance sheet options.

Our account manager has extensive knowledge, excellent handling of situations and conversations, and a great team that advises and supports us with all our needs

Euromoney Trade Finance Survey respondent

That demand is echoed in client feedback. Corporates describe HSBC as a partner that understands trade flows end to end, enabling financing to be structured around underlying commercial activity rather than standalone credit lines. Respondents emphasise client centricity and advisory depth, one citing the “attention and extensive experience of the executives, offering products according to the needs of the company”, while another corporate notes that HSBC “understands our business opportunity and acts accordingly.”

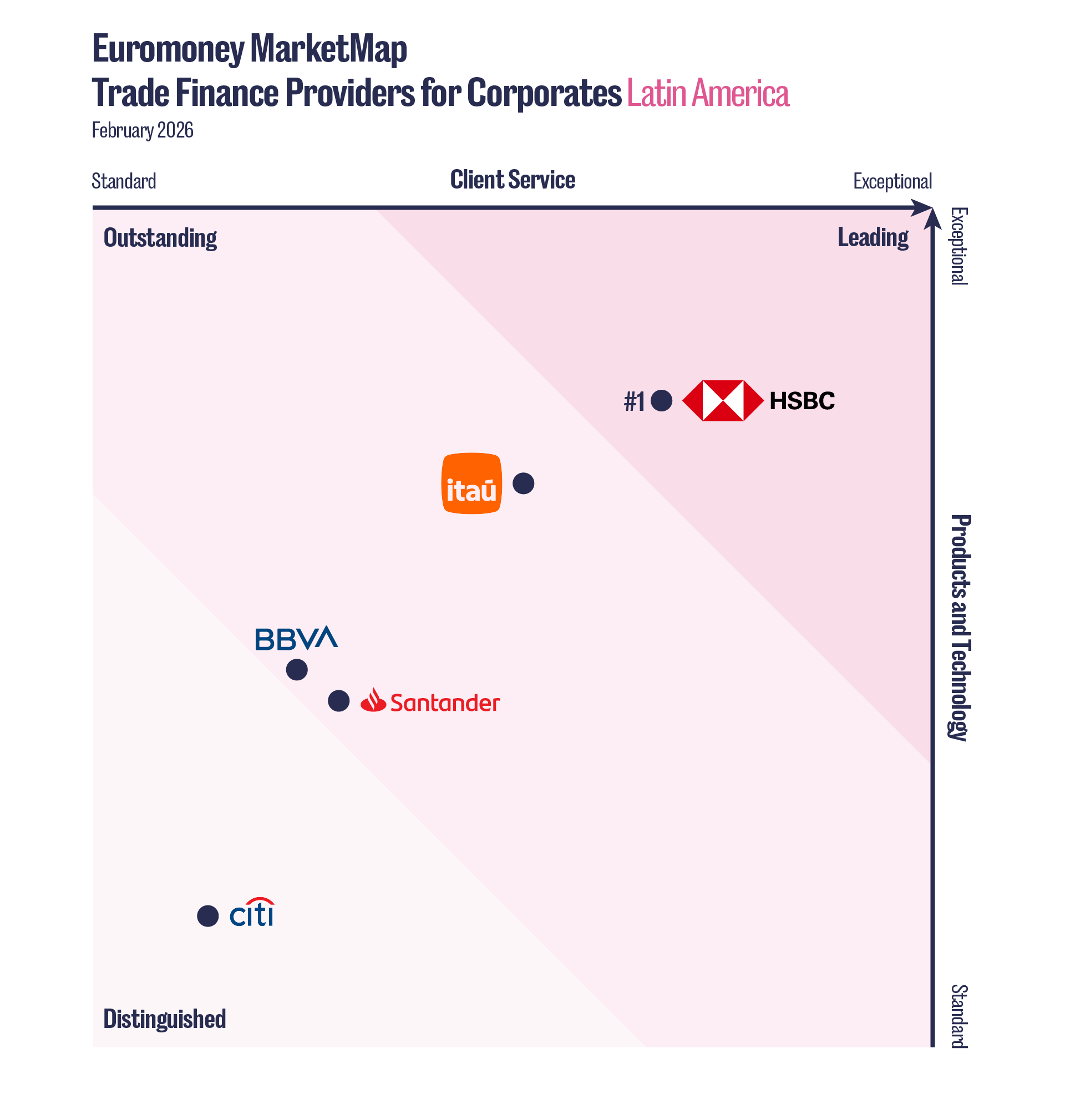

This positioning is reflected consistently across the region. Latin American respondents ranked HSBC as the leading provider for letters of credit, structured trade, working capital solutions, foreign exchange and documentary collections, with product capability standing out as the area of greatest differentiation versus regional peers.

Looking ahead

For Latin American corporates, the direction of travel is clear. Trade finance is no longer judged on footprint or product range alone, but on execution, integration and the ability to support strategic change. Client feedback increasingly reflects that shift, positioning HSBC as a bank that combines international connectivity with operational consistency and access to expertise.

As nearshoring accelerates and supply chains continue to evolve, HSBC’s trade finance proposition in Latin America is being defined by its ability to operate at the intersection of global scale and local expertise.