Learn more about the Euromoney Corporate Banking Subscription and unlock all corporate banking data and research, exclusive surveys, annual briefings with Euromoney analysts and dedicated customer service support.

Register your details to verify if your company already has a subscription:

Your annual Corporate Banking Subscription

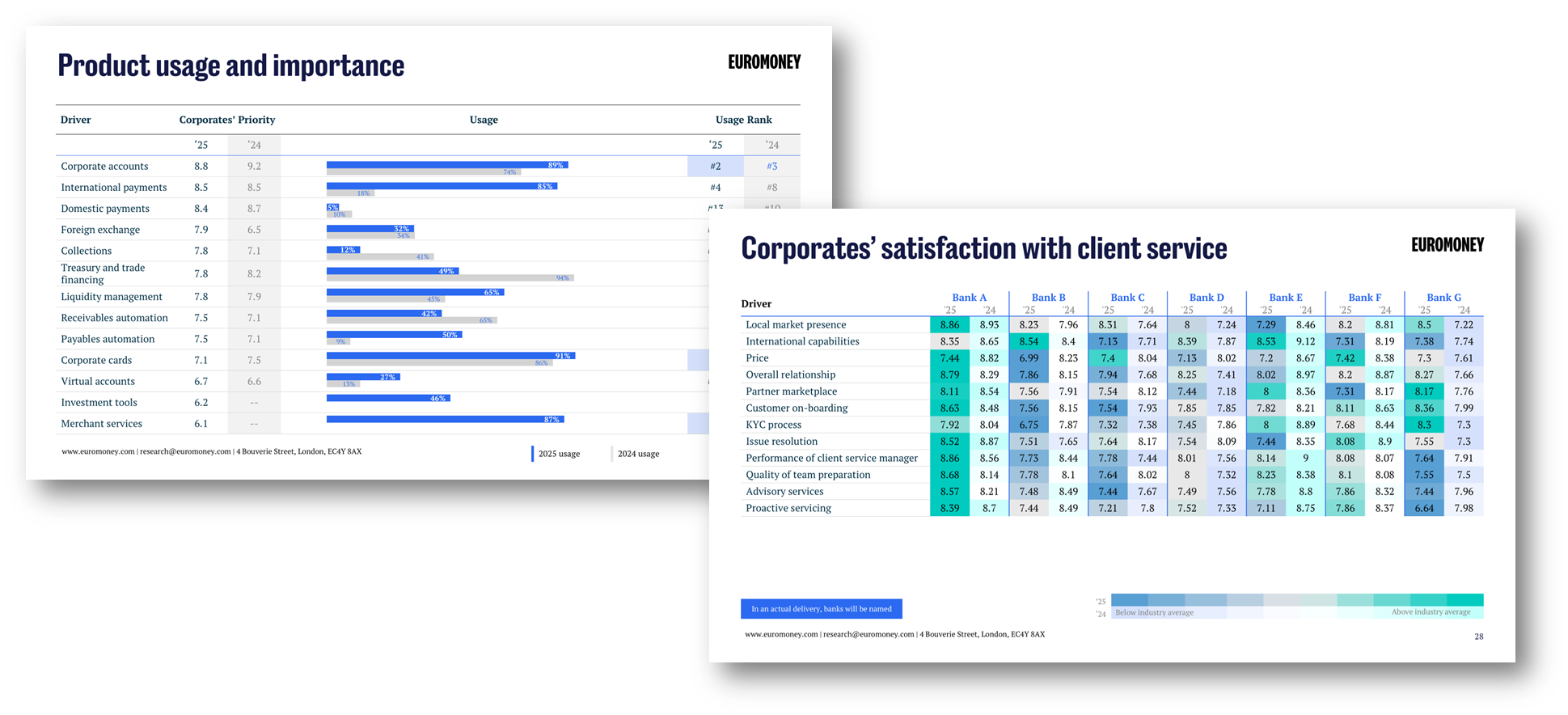

- Client satisfaction rankings across cash management, trade finance and financial institutions

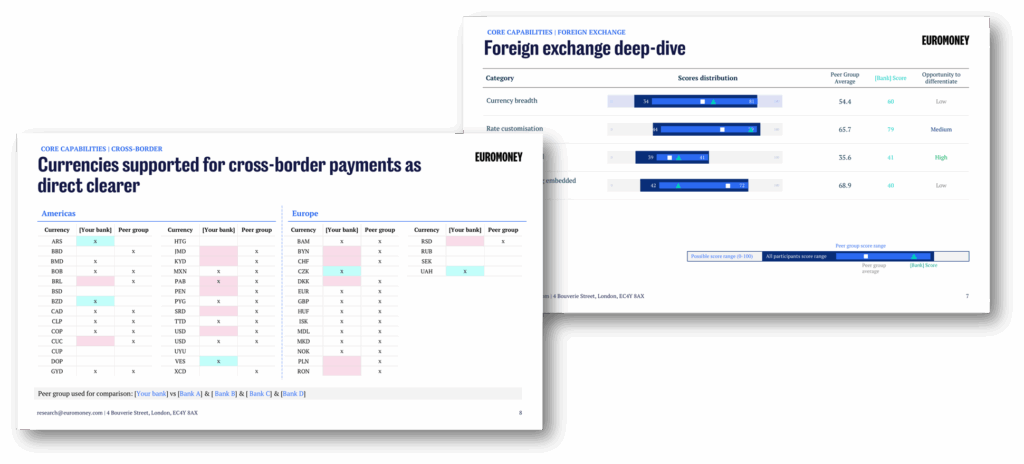

- Currency clearing capabilities of 90+ banks across G10

- Research on corporate banking market trends, industry best practices, innovation and peer strategy

- Corporate payments product capabilities rankings (available from 2026)

- Bank rankings on key performance metrics (available from 2026)

- Instant access to your bank’s award winner spotlights on publication date

- Access to latest intelligence on 100s of corporate banks globally, their achievements and strategies

- Pre-award consultation to shape submission and positioning

- Post-award debrief to provide feedback and scoring

- Annual analyst briefing to walk you through latest corporate banking market trends and peer performance

- Brief our analysts: priority to brief Euromoney on your latest strategic updates and product launches

- Analyst-curated slides and talking points for leadership presentations or external events preparation

- Access to Euromoney’s regional experts in Middle East, Asia and Europe for market-specific guidance

- Dedicated account support via a customer success manager

- Support for onboarding new users and training internal teams

- Moderator or speaker support for client-facing events

- Invitations to exclusive Euromoney events and webinars

Bespoke analysis on demand

- Bespoke benchmarking using Euromoney’s client survey data (45,000+ responses across cash mgmt., trade finance and financial institutions)

- Client-level intelligence collected via surveys

- Product capability benchmarking vs your peer group

- Custom KPI dashboard aligned with internal performance metrics

- Executive board pack including market position, strengths, gaps and growth opportunities

- Flexible product benchmarking cadence, with the ability to run multiple benchmarking exercises per year

- 1:1 analyst engagement for offsites, townhalls or internal sessions

For more information contact Arun Ghudial.

Latest from Corporate Banking research

Cash Management survey

Cash Management Survey 2025 results

Product capabilities benchmarking

G10 Clearing Product Capabilities Benchmarking

Liquidity in focus: adapting to a 24/7 treasury

Top ranked cash management providers for corporates

Corporate banking