|

|

By David Shirreff

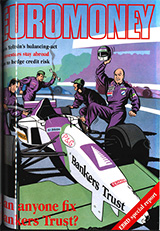

Remember Bankers Trust? It is one of the many names in banking that have disappeared over the past few decades. And with good reason as I recall, having written a damning piece about BT’s doomed culture 23 years ago – ‘Can anybody fix Bankers Trust?’ – in April 1995.

I was hardly alone in perceiving that something was seriously wrong with the bank. Two big US companies, Gibson Greetings and Procter & Gamble, had successfully sued it for selling them unnecessarily risky derivatives. Another, Texaco, refused to deal with it after it took an ungentlemanly £10 million windfall by sticking to the letter, not the spirit, of a swap contract. Under chairman Charlie Sanford and president Gene Shanks, BT’s bankers were rewarded more for stuffing their clients with risky products than for giving them appropriate advice.

In 1995 this kind of culture was relatively new, but it was catching on fast. Worst affected were the commercial banks breaking their way into investment banking. Unlike the Wall Street broker-dealers – such as Goldman Sachs and Morgan Stanley – that had developed as partnerships, these new kids on the block were expanding rapidly into areas where a big balance sheet and a top credit rating allowed them to pinch business that fed into the bank’s trading for its own account.

Wall Street firms caught up by demutualizing and running huge repo positions. By the early 2000s clients hardly mattered any more except as stuffees – it was all about inventory and, as we now know, front-running, or, more euphemistically, dealing on asymmetric information.

I was a greenhorn when I joined Euromoney in 1981, and an early aficionado of the first interest-rate and currency swaps, believing that this really was helping to push money more efficiently into new corners of the market. I was a groupie at meetings of the International Swap Dealers Association in exotic venues such as San Francisco, Vienna and Hong Kong.

It was only later that I began to smell a rat. A lot of the products being touted were increasingly complex and being sold only for their high margin or the opportunity to lay off other trades. I once asked TJ Lim – a legend in the derivatives markets – what possible use a client might have for a quanto swap. I am still waiting for a satisfactory reply, if you’re still out there TJ.

|

|

Bankers Trust made a name for itself as an erstwhile commercial bank that had embraced derivatives trading, big time. The fact that it had damaged its reputation in many ways didn’t deter Deutsche Bank from making it an offer in 1998. Deutsche was going gangbusters, with the late Edson Mitchell running the investment bank.

Alas, it thought it had bought a Wall Street firm (well, its address was just round the corner in Liberty Street). But BT was no broker-dealer with a long list of blue-chip clients. By that time, it was a trading shop, pure and simple.

Dissecting BT in 1995 was for me the beginning of a journey of distrust that made me quite a few enemies during my career.

Josef Ackermann, the otherwise affable former head of Deutsche, could not forgive me in 2004 for describing his bank – in The Economist – as a giant hedge fund.

An officer at Moody’s, the rating agency, wondered: “Why do you hate us so much,” when I rubbished their ratings of collateralized debt obligations stuffed with dodgy corporate, housing or aircraft loans.

It was mainly a cultural thing. A culture of greed and invincibility began to permeate almost every front-line institution. RBS and Deutsche were terrible examples. By the time of the credit crunch in 2008 I had difficulty taking bankers and their regulators – the devisers of Basel II and upward – seriously.

To take off the pressure in 2009 I wrote a musical, ‘Broke Britannia!’, which gave as much stick to Mervyn King as it did to Fred the Shred & Co. I endured another five years of bad banking culture before retiring in 2014 and writing ‘Break up the banks!’, a short book that recommends, among other things, capping pay at banks with access to central bank financing at £300,000.

Sadly, today’s bank regulators are too scared – or envious – of senior bankers to contemplate such a step. But if they want to change banking culture it would be a good start.

I am grateful to Euromoney and especially to my first editor there, Padraic Fallon, for setting me on the path to investigative, no-holds-barred journalism. The culture of the magazine was nothing like that of the banks we were reporting on.

For a fraction of the rewards offered in the City, we were driven by mainly two things: to understand how the world of finance works and to turn that material into articles that people will read.

The fact that we were continually bamboozled by fast-talking super-salesmen often made it difficult to get at the essence. Conversely, the fact that the magazine attracted so much advertising gave us a travel budget that was the envy of most broadsheet journalists of the time.

David Shirreff was a staff writer at Euromoney from 1981 to 1986 and managing editor from 1993 to 2000. He also co-founded Risk magazine and wrote for The Economist in London, Frankfurt and Berlin from 2001 to 2014. He now writes plays and satirical musicals.