Speculation that the European Central Bank (ECB) is considering extending its asset purchase programme beyond its originally intended scope of covered bonds and asset-backed securities (ABS), to include corporate bonds, triggered downward pressure on the euro this week.

The speculation seemed to underline persistent doubts in the market that the ECB’s existing, official plan would be sufficient to stoke inflation in the eurozone, and deliver growth.

The covered bond purchase programme officially launched last week, with reports suggesting the first acquisitions were made of Spanish, German and French covered bonds, while ABS purchases are expected in December.

The impact on peripheral debt levels was negligible at best, with Italian, Spanish and Portuguese 10-year yields rising by 10 basis points, 9bp and 18bp respectively. German and US 10-year yields fell slightly.

“The move to buy corporate bonds could be justified on the basis of increasing the universe of assets that the ECB could buy to expand its balance sheet,” says Abhishek Singhania, European interest-rate strategist at Deutsche Bank.

|

There is at present €1.1 trillion of non-financial and €7.9 trillion of financial corporate debt issued by euro-area residents, says Singhania, encompassing all forms of debt securities across the risk spectrum.

“Even if we limit ourselves to non-financial corporate and bank debt, which the ECB currently considers as eligible collateral for its repo operations, the universe of bonds would amount to €3.6 trillion,” more than tripling the size of the programme implied by the ABS and covered bonds purchase programme.

At first glance the furore suggests the ECB doubts the effectiveness of its existing ABS and covered bonds purchase plan, making full quantitative easing (QE) look more likely in the near term.

And it would not be the first time the ECB has articulated plans for a programme that appears to supersede its existing initiatives: its plan to buy ABS and covered bonds was announced before the targeted long-term repo operations (TLTRO) had been launched, and the purchases themselves began this week before the conclusion of the asset quality review and stress tests.

“This insistence on putting the proverbial cart before the horse fosters an environment that lends itself to speculation of even more measures,” says Brown Brothers Harriman in a research note.

Other analysts suggest the speculation says more about the political difficulty the ECB envisages with sovereign bond purchases than a real desire to buy corporate bonds. The counter-intuitive interpretation is therefore that the news makes the prospect of sovereign bond purchases more remote.

Corporate bond buying

However, many observers dismissed the possibility of corporate bond buying as either a non-starter, or at least unlikely until the existing programme has been given a chance to work.

If the ECB believes sovereign debt QE is politically difficult, purchases of corporate bonds is one of its few options for expanding its existing programme. However, given that programme has barely got under way, it seems premature to plan its extension, says Derek Halpenny, European head of global markets research at Bank of Tokyo-Mitsubishi UFJ.

However, for traders looking for any evidence of action from the ECB to revive growth, especially in the aftermath of the market panic of last week, it was enough to generate considerable activity. Investors were clearly asking themselves if the widening spread between core and peripheral Europe had increased the prospect of imminent European QE.

Opinions on this were divided, with the falling euro suggesting many thought the answer was yes – either in the form of sovereign purchases or via some other alternative scheme. However, Société Générale (SG) argues the policy response to sovereign stress as experienced last week is more likely to come from the European Stability Mechanism, backed by the outright monetary transactions, rather than from QE.

If the ECB begins buying corporate bonds, it will be exposing itself to new risks.

“Spreads on corporate bonds are already very tight and many liken the latest price action in eurozone credit market to a developing asset bubble,” says Petr Krpata, FX strategist at ING.

“Purchases of corporate bonds would expose the ECB to credit risk, while the bank may want to wait for the results of the second TLTROs take-up in December before making such a decision.”

For some, the idea that the ECB is even considering buying corporate bonds only highlights the political difficulties it envisages in executing full-blown QE. The most obvious problem is the considerable divergence that exists in the credit quality of different eurozone sovereigns.

However, other problems also exist. When the ECB implemented the Securities Markets Programme, it was senior to private holders. When Greek debt was restructured in the private-sector involvement programme in March 2012, the ECB holdings were therefore excluded, increasing the losses borne by private investors.

“If credit risk no longer matters in the euro-area, then it can reasonably be argued that whether the ECB conducts QE on a pari passu basis or not is of little consequence,” says Michala Marcussen, global head of economics at SG CIB.

“In our opinion, credit risk does matter. As such, a QE programme conducted on a basis where the ECB is implicitly senior should, all else being equal, increase credit risk premia.” This would clearly be bad news for the periphery, she adds.

It might be that such concerns partially explain the ECB’s hesitancy in conducting sovereign bond purchases, or why it believes they might be less effective in Europe.

While some at the ECB might be comfortable with the idea of ranking pari passu with other investors, and potentially taking losses in any future sovereign restructuring that occurs, it could prove difficult, and perhaps impossible, for the ECB to win approval for such purchases if it was not ranked senior to other lenders.

It remains to be seen whether rumours about the ECB’s plans indicate its desperation to find an alternative to QE, or a more positive belief that corporate bond purchasing is a good idea in its own right. If it is the former, near-term euro downside might be limited from here, says ING’s Krpata, given more detailed plans will probably not be forthcoming.

Given the level of scepticism regarding the likely effectiveness of the existing operation, it seems plausible the ECB is considering its next move. The most persistent concern is that the ABS and covered bonds markets are too small for the ECB to make meaningful purchases.

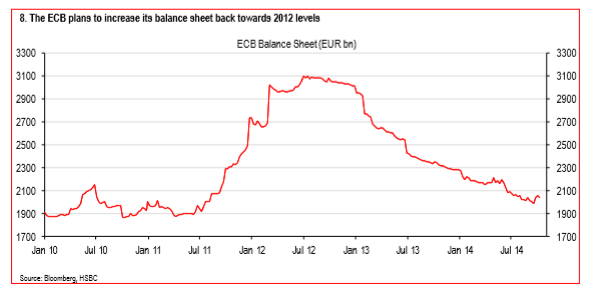

HSBC therefore believes “there is an increasing chance that the ECB will ultimately announce outright purchases of government bonds in a QE programme similar to those seen in the US, UK and Japan”.

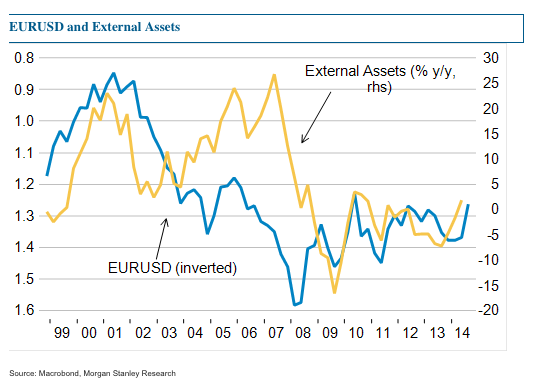

If it occurs, a full QE programme will likely trigger a much larger fall in the euro price than anything yet seen, says HSBC, adding: “Both sterling and the yen fell by more than 20% from their pre-QE peaks against the dollar. A similar fall in the euro from its peak (1.40) would put it below 1.20, which is what we expect to see by the end of 2015.”

|

However, not all analysts are convinced QE holds the answer to Europe’s problems. “A QE cash flood is no substitute for market liquidity,” says SG’s Marcussen. “While dovish speak from central bankers offered some respite to markets Friday, we are concerned that more QE will not satisfy investors for long. It’s all about the transmission of monetary policy to the real economy.”

She argues it is not necessarily the place of central banks to use unconventional measures to maintain an orderly market all the time.

“Unless central banks are willing to make markets in all asset classes and on an ongoing basis, then there will at times be significantly more sellers than buyers – or vice versa – in asset classes,” says Marcussen.

“This is all the more the case as new regulation has effectively capped the ability of investment banks to hold inventories of assets, thus removing one of the liquidity buffers from the financial market system.”

Marcussen argues the impact of QE might only be beneficial in the short term, while planting the seeds for future market panic such as what occurred in the markets last week. The risk is that “as fundamentals fail to deliver, the QE-generated herd will run the other way, triggering a sharp correction in asset prices and with negative implications for market liquidity”, she says.

Marcussen still believes the ECB could be forced to give in to calls for QE – though not before the new year – either in response to Europe slipping into outright deflation in Europe, or if the below-target inflation persists into Q2 2015.

However, this could be misguided, she warns. “Without significant efforts from governments, we do not expect QE to prove very effective in boosting growth,” says Marcussen.