|

| View results now |

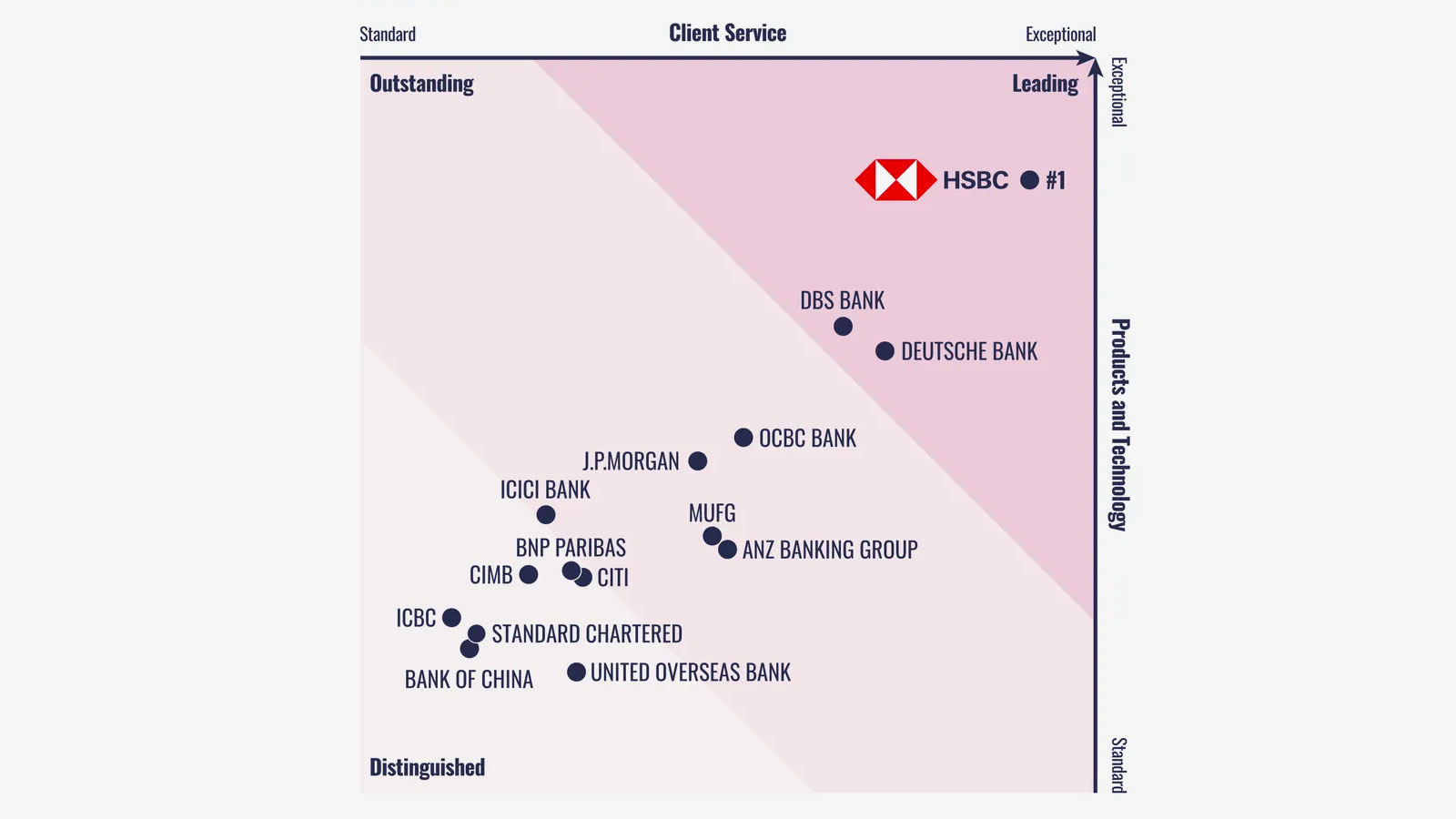

Treasury professionals of non-financial institutions and financial institutions have separately voted HSBC the number one international cash manager in Euromoney’s 2014 Cash Management Survey, the third successive year the bank has won both awards for the global cash management services it provides clients.

In a record year for survey responses, the strength of HSBC’s global transaction banking franchise once again resonated with its non-financial and financial institution clients, despite fierce competition from its three closest rivals – Citi, Deutsche Bank and Bank of America Merrill Lynch (BAML).

Citi was ranked second for services to non-financial institutions globally this year – maintaining its 2013 position – but fell one position to fourth among financial institutions.

By comparison, Deutsche’s performance was solid, maintaining its second and third rankings for financial institutions and non-financial institutions, respectively, while BAML improved its ranking in both categories, moving up to fourth among non-financials and third among financial institutions.

HSBC’s global rankings were supported by its number one ranking as a regional cash manager for non-financial institutions in Asia, the Middle East and Australasia, and among financial institutions, where it was ranked the leading clearer in dollars, euros, sterling and yen in Asia.

Outside of the top four rankings, BNP Paribas was ranked fifth – down from fourth last year – for services to non-financial institutions, while Royal Bank of Scotland and UniCredit both maintained their sixth and seventh rankings, respectively. JPMorgan was ranked eighth, Commerzbank ninth and Standard Chartered maintained its 10th position.

Among financial institutions, Commerzbank improved its ranking this year, displacing Standard Chartered, which fell to sixth from fifth last year. JPMorgan maintained its seventh ranking, while Bank of China hit its highest ranking at eighth – up from 10th last year. The Chinese bank’s movement helped displace UK banks RBS and Barclays, which both fell one position from last year to ninth and 10th, respectively.

Key issues

In addition to ranking transaction banks globally, Euromoney’s annual benchmark survey consults treasury professionals on key issues they face, such as managing banking relationships, banking stability and regulation.

One of the standout findings this year was that there is overwhelming demand among non-financial institutions and financial institutions for electronic bank billing.

The survey receives responses from senior treasury and finance professionals working for companies across industries, with annual revenues ranging from more than $100 billion to less than $50 million.

This year, the survey recorded a 14% year-on-year rise in valid responses from non-financial and financial institutions, pushing the total valid responses to a new record high of 27,794, making it the largest and most comprehensive survey of cash management service provision globally.

The multi-language survey is split into a survey for non-financial institutions and financial institutions, and respondents are asked to:

Indicate which three banks they use most for their cash management operations/services;

Rate their lead cash manager on a sliding scale of one (equals very poor) to seven (equals excellent) across service categories.