On Wednesday, New York Community Bancorp (NYCB) reported a loss for the fourth quarter of 2023 of $252 million.

The sharp decline from a $207 million profit in the third quarter of last year and a $172 million profit in the fourth quarter of 2002 came thanks to charge-offs of $185 million on two big commercial real-estate loans – one to a multi-family co-op, the other to an office building – and a hefty increase in provisions for more credit losses.

The group took $552 million of provisions in the final quarter of 2023, up from just $62 million in the quarter before, and $124 million in the last three months of 2022.

The stock fell 44% in the next two days.

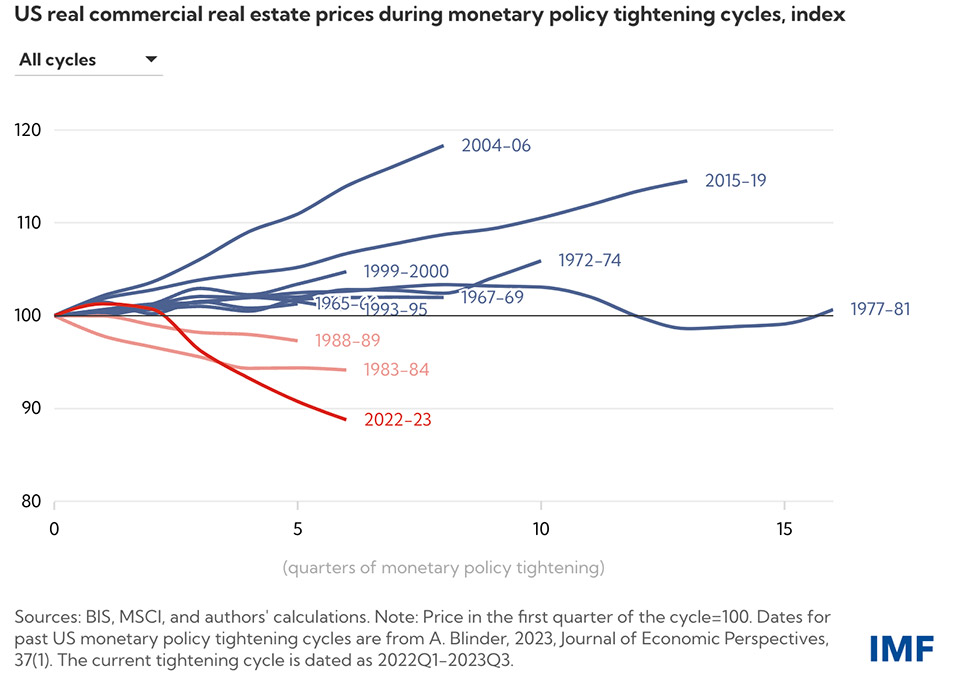

Nobody should be remotely surprised by this. On January 18, researchers at the IMF pointed out that the 11% fall in US commercial property prices since the US Federal Reserve started raising rates in the spring of 2022 is the sharpest correction for US real estate in any hiking cycle in the last 60 years.

Partly that is thanks to the speed of rate rises from the zero bound but also to secular changes in end-customer behaviour since the pandemic that have dragged down the earnings capacity – and with that the valuations – in particular of offices and retail spaces.

Real estate is always site specific, but in those classes of commercial real estate, valuations have fallen more than by 11%. One credit investor who is now very wary of US banks suggests that the hit could be 15% already and that it still has further to fall, even with the Fed now promising rate cuts.

This source worries that US regional banks piled into commercial real-estate lending heavily after 2018 and that at many it accounts for 40% of their lending. Several, he suggests, have loan exposures to commercial real estate four or five times larger than their equity capital bases. It wouldn’t take much more of a meltdown – perhaps another 10% fall – to put them in a perilous position.

There are very few large real-estate transactions taking place right now and so not much of a market to mark assets to. But the alarm bells are deafening.

What is truly scandalous about NYCB is the vast gulf it illustrates between the prudential oversight of larger US banks with over $100 billion of balance sheets and the neglect of thousands of smaller regional banks

On January 16, the US Mortgage Bankers Association reported a marked pick up in loan delinquencies on commercial mortgages in the final three months of 2023, notably to 6.5% of loans backed by office properties, up from 5.1% at the end of the third quarter; and to 6.1% on lodging loans, up from 4.7% at the end of last September.

Some 5% of retail real-estate loan balances were delinquent and 1.2% of multifamily, up from 0.9% in the third quarter.

Around $1.2 trillion of commercial mortgage debt is due to mature over this year and next, with a quarter of that relating to offices and retail.

If rates stay higher for longer, refinancing that after new appraisals is going to be challenging. And it is not going to be easy even if rates fall because of a slowing economy that further reduces demand.

All this was well known, before investors in NYCB were shocked – shocked! – to find that risky lending has been going on in regional banks.

What is truly scandalous about NYCB is the vast gulf it illustrates between the prudential oversight of larger US banks with over $100 billion of balance sheets and the neglect of thousands of smaller regional banks operating below this level that, in aggregate, bring huge potential for systemic risk.

Category IV risks

Let’s be fair to Thomas Cangemi, the comparatively new chief executive, and his team at NYCB. They have been trying to transform an old-style monoline thrift that was heavily exposed to one segment of commercial real estate – multi-family residential – into a full-service commercial bank with a much higher weighting to commercial and industrial loans and a much more diverse mix of assets and liabilities.

This effort has seen it acquire first Flagstar Bank and then Signature in a Federal Deposit Insurance Corp-sponsored rescue during the first round of the US regional banking crisis last March.

That deal catapulted NYCB into a Category IV US bank, with between $100 billion and $250 billion in assets and so now subject to enhanced prudential standards, including risk-based and leverage capital requirements, liquidity standards, as well as requirements for overall risk management and stress testing.

It was quite toe-curling to hear on the earnings call that it was the prospect of having to submit a capital plan to regulators that led management to conduct a deep dive into the office loan portfolio, revalue assets based on most recent appraisals and boost reserves from 200 basis points of those exposures to 800bp.

Shouldn’t they have been doing all this anyway?

Banking is all about properly identifying risk capacity, fine-tuning risk appetite, underwriting, pricing, monitoring loan portfolios and resolving troubled exposures – ideally even before a problem becomes obvious through a delinquency.

All that is expensive to do. But these are not optional extras in banking, only to be added in once a lender gets past a certain size.

However, you can see why, given the option, they might not have been management’s top priorities when the regulators were not looking.

Being subject to proper oversight and regulation now requires NYCB to raise more capital. It is hard to sell shares with your stock price cratering because you have just cut the generous dividend that you were never going to get past the regulators.

Retained earnings are also going to be tougher to come by now that NYCB must hold more cash and high-quality securities on its balance sheet to meet liquidity requirements, while cutting loans and taking provisions through the P&L.

If a new round of consolidation now runs through the US regional banks and takes more of them above $100 billion in size, how many more shocks like this will we see?

At least my colleague Mark Baker will be happy, busily updating his commercial real-estate exposure models.

European bank shares generally trade at wider discounts to book value than their US peers. But credit investors may be coming to a much more positive view on European banks compared with US competitors.

At least the ECB has worked to ensure that even smaller banks have adequate capital and liquidity, and proper risk-governance frameworks.

It was only the Fed’s emergency provision of term funding that got US regional lenders past the liquidity stress last March. That is due to end soon. Even if it is revived, the Bank Term Funding Programme is not the answer to a solvency crisis if bad real-estate loans start to overwhelm US banks’ capital bases.

It seems to be an article of faith in the US banking industry that regulators are crazy tough, damaging banks’ ability to finance the real economy with ludicrous demands to hold unnecessary capital buffers.

In truth, regulation has been weak to non-existent over large swathes of the industry and if we get a hard landing and a further leg down in commercial real-estate values, the second round of the US regional banking crisis could be ugly.

Under a European regime, many more of these smaller US banks would already have been resolved by now.