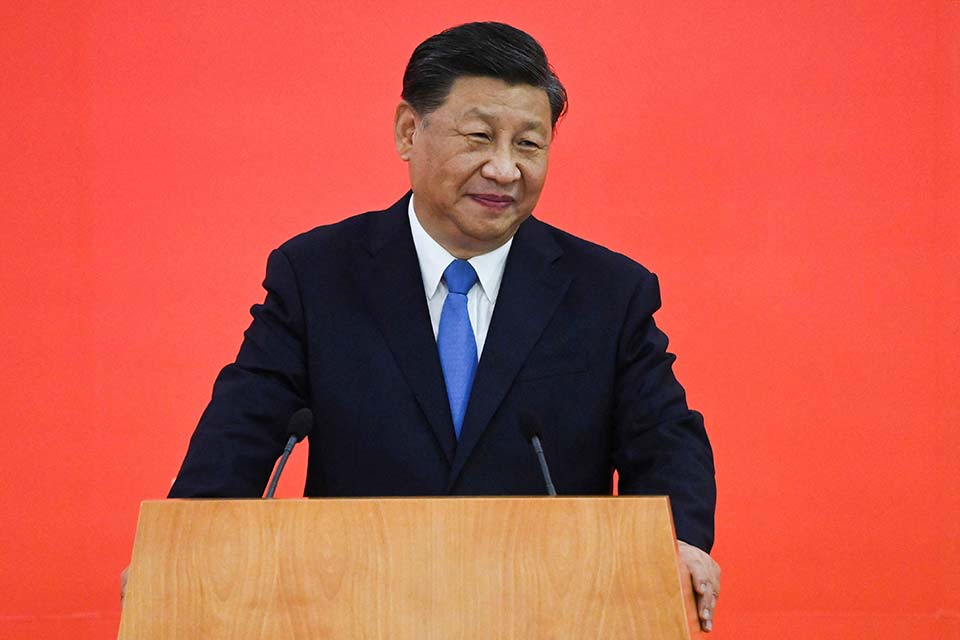

In a normal world, China’s president Xi Jinping would be preparing to hand the reins of power to his successor, having completed two five-year terms. His forerunners Hu Jintao (2003 to 2013) and Jiang Zemin (1993 to 2013) both held power then quietly relinquished it, creating a stable succession protocol that, for the first time in the country’s modern history, worked.

Yet on October 16, at a quinquennial conclave of Party leaders in Beijing, Xi is all but certain to stride out first into the plush chambers of the Great Hall of the People. In so doing, he will become the longest-serving leader since Mao Zedong and perhaps prepare himself as president for life.

That positive quality of self-awareness – an ability to react to setbacks and obstacles in a mature manner – has been sorely lacking in the second half of the Xi administration

In sporting terms, Xi’s tenure as leader since 2013 can be viewed as a classic game of two halves.

In the first half, his administration’s expression was a genial one, with a face turned toward the world.

It favoured a collective, technocratic approach to problem-solving: for example, by reining in a shadow banking sector – encompassing trust and wealth management products – whose power and capacity to undermine the financial sector had spiralled out of control.

Xi’s team tolerated but never quite trusted the big fintech firms that held sway over vast swathes of the private sector, collecting and storing – much to the chagrin and distrust of the Party – untold quantities of consumer data.

Positive qualities

Xi’s team often acted with logic and forethought, suggesting all arms of the government were thinking and acting in tandem.

One example is the decision to create and champion two new multilaterals.

The New Development Bank (founded 2014) and Asian Infrastructure Investment Bank (since 2016) were studied reactions to China’s simmering frustration at being unable to boost its voting rights at the World Bank and IMF.

Each is an undeniable success story run to and by international norms, with truly global boards of governors and directors.

In July, the AIIB opened its first overseas office in Dubai, to bring the bank closer to its clients and the front lines of its business. And in September, the NDB unveiled a new oversight body within its Independent Evaluation Office to show where and how mistakes are made, suggest better future strategies and make the bank more accountable to shareholders.

That positive quality of self-awareness – an ability to react to setbacks and obstacles in a mature manner – has, however, been sorely lacking in the second half of the Xi administration.

He has now cracked down on big tech rather than clipping its wings. The result: billions of dollars in value wiped from many of China’s most prominent and innovative firms.

By failing to rein in real estate early in his reign – a sector that accounts for a quarter of GDP, 50% of household wealth and a third of local government revenues – he delayed the inevitable crunch. Experts had predicted a crash for years, and when it happened, it was a doozy.

On August 24, writing for the Carnegie Endowment for International Peace, Peking University finance professor Michael Pettis said prices would “continue to decline” even as fresh insolvencies emerge.

On September 5, UBS analysts asked if this could be China’s ‘Minsky moment’ – a house-of-cards event where reckless speculation in one part of the economy destroys sentiment in all parts and crashes the market.

And real estate continues to suffer – new property starts from May to July are down 50% from two years ago, with sales 30% lower – creating a nightmare scenario for state lenders.

UBS puts total bank-wide exposure to the property sector at between Rmb96 trillion and Rmb108 trillion ($13.8 trillion to $15.5 trillion), equivalent to 30% of total banking assets and as much as 56% of all bank loans. It includes loans to shadow credit used to fund the property sector and to non-property entities such as local government financing vehicles, collateralised by land and property.

Banks are already feeling the pinch. Non-performing loans hit a record Rmb2.95 trillion in June. Bank of Communications, the fifth largest domestic bank by assets, posted a 79% year-on-year rise in non-performing property loans in the first six months.

China’s big banks will be fine, but some smaller ones will struggle. Baoshang Bank’s closure in August 2020 marked the first collapse by a mainland lender in nearly two decades. More will surely follow in the months and years ahead.

These are problems with deep roots and no easy fix.

So far, Beijing shows no desire to take tough and necessary action, deepening the crisis. “Until the systemic problem is addressed and resolved, there can be no permanent stabilization of China’s property market or of its economy more generally,” said Pettis.

Self-destruction

Then there is Covid. When it first emerged in Wuhan, Xi closed the country’s borders. While that action probably saved millions of lives by first controlling the pandemic then keeping it out, it failed to solve another endemic issue: under-investment in public health.

Today, the best way to describe Xi’s draconian zero-Covid policy is ‘self-destructive’. Lockdowns are crippling the economy: Shanghai was shut for two months from March. On September 16, UBS head of China economic research Tao Wang trimmed the full-year growth forecast to 2.7% and tipped a third-quarter recovery to be “weaker” than expected, with under-performance to continue through 2023.

Still, Xi refuses to bow to wisdom and signal a pathway to more open borders.

As he prepares for an unprecedented third term in office, his focus will almost certainly will be turned inward.

Once, China had the wherewithal to deal with crises as they emerged. The sovereign almost seemed to get stronger when times were bleak

China is not pushing the world out: its economy, deeply embedded in global supply chains, would collapse were it to embrace another Mao-style era of autarky.

But Xi wants it to be more self-reliant. Earlier this month, he handed 9,000 young firms, in sectors from healthcare and semi-conductors to seed manufacturing, the moniker ‘little giants’.

China wants to compete with the US and Europe to guarantee national energy, technology and food security. Chosen corporates get tax breaks and access to capital at 1,800 state-run venture capital-style ‘guidance funds’, with $900 billion to spend.

But this offers no guarantee of success. Corporate China in the Xi era has not pushed on in terms of innovation and global brand recognition. If anything, it has declined, along with the country’s soft-power status. In Forbes’ latest ranking of the world’s most innovative firms, only two mainland outfits made the top-50.

The state has a terrible record of picking and backing corporate champions. Of the many trips made by this journalist to the myriad government science and innovation parks that dot the country, a personal favourite was being presented with a tablet designed by a local firm in the eastern city of Ningbo.

It was simply enormous – a Party official proudly told me it was the world’s largest. When asked why the screen had to be so big, he replied: “Now it’s easier to play the piano on.”

Navigation

Once, China had the wherewithal to deal with crises as they emerged. The sovereign – witness the size of the stimulus package rolled out in the wake of the events of 2008 – almost seemed to get stronger when times were bleak.

But it now faces a “deluge” of bad data, warns Zennon Kapron, director of Asian fintech consultancy Kapronasia, from Covid controls to a fragile economy.

He says: “It’s difficult to see how China can successfully navigate these [challenges], especially as many are out of their control.”

Global investors seem to agree.

State media trumpeted a 17.3% year-on-year rise in inward foreign direct investment in the first seven months of 2022, to Rmb798 billion, according to commerce ministry data. But the Chinese Academy of Social Sciences reckons 37% of that is ‘round-tripped’ capital raised offshore by mainland firms, and that 76% of all FDI in 2021 was sourced from Hong Kong.

Perhaps more worrying is that in the first three months of 2022, foreign institutional investors sold $79.8 billion worth of mainland securities more than they bought, according to the State Administration of Foreign Exchange.

That is a record high and the first deficit of its kind since the Covid-hit first quarter of 2020. Eyes will now be on second-quarter data due to be issued in the last week of September.

August marked the seventh straight month of portfolio outflows, with the bond market losing $7.7 billion, according to the Institute of International Finance. Non-China developing markets by contrast posted a collective portfolio inflow across all securities of $33.8 billion.

None of this, of course, is likely to stop Xi from anointing himself president until 2028, and very probably for life.

He will trumpet the nation’s undoubted achievements over the past 40 years, from slashing poverty rates to becoming an exports superpower.

He will also seek to convince his vast domestic audience that everything – from Covid to the property sector to a brittle economy – is under control and on track, and that China is the envy of the world.

Who knows, he may even believe what he says.