“For the rest of the year, everything will be carefully managed and manicured. The 20th Congress is just too important.”

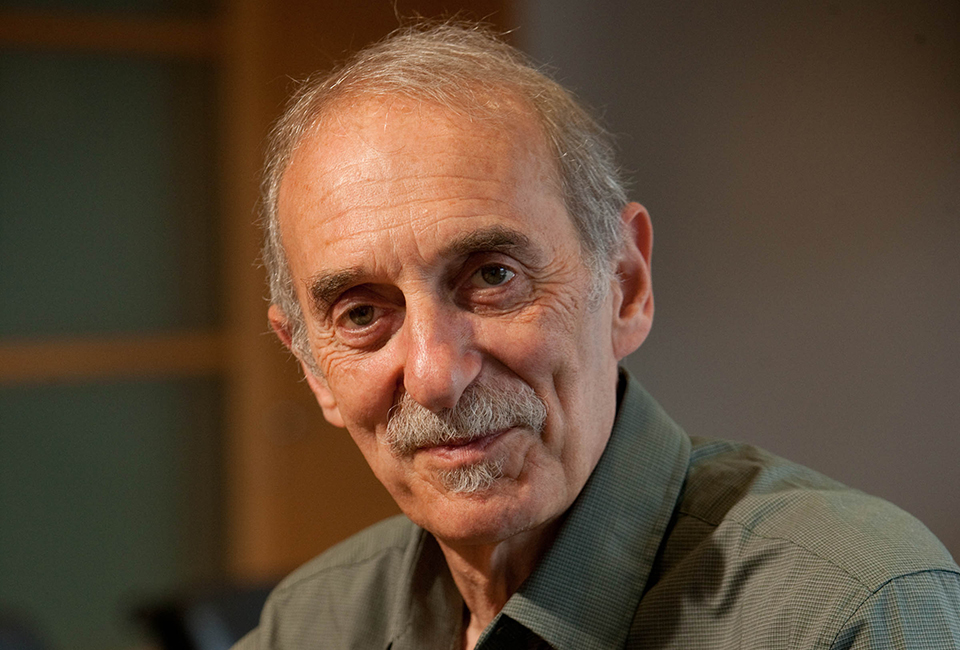

George Magnus – referring here to an upcoming November 2022 meeting of the Chinese Communist Party, where president Xi Jinping should be anointed president for an unprecedented third term in office – knows China better than most.

A former chief economist for UBS Investment Bank, Magnus is also an associate at Oxford University’s China Centre and author of ‘Red flags: Why Xi’s China is in jeopardy’.

In normal conditions, Magnus’s assessment would be a dead cert.

Access intelligence that drives action

To unlock this research, enter your email to log in or enquire about access