Setting the Benchmark for Excellence

We deliver benchmarking and competitive intelligence on the world’s leading financial institutions. Our accreditation and insights drive banking strategies across the globe.

Benchmarking

Best practices

The Middle East DCM Playbook 2025

How banks are capturing the Middle East debt market opportunity

Investment banking

Capital markets

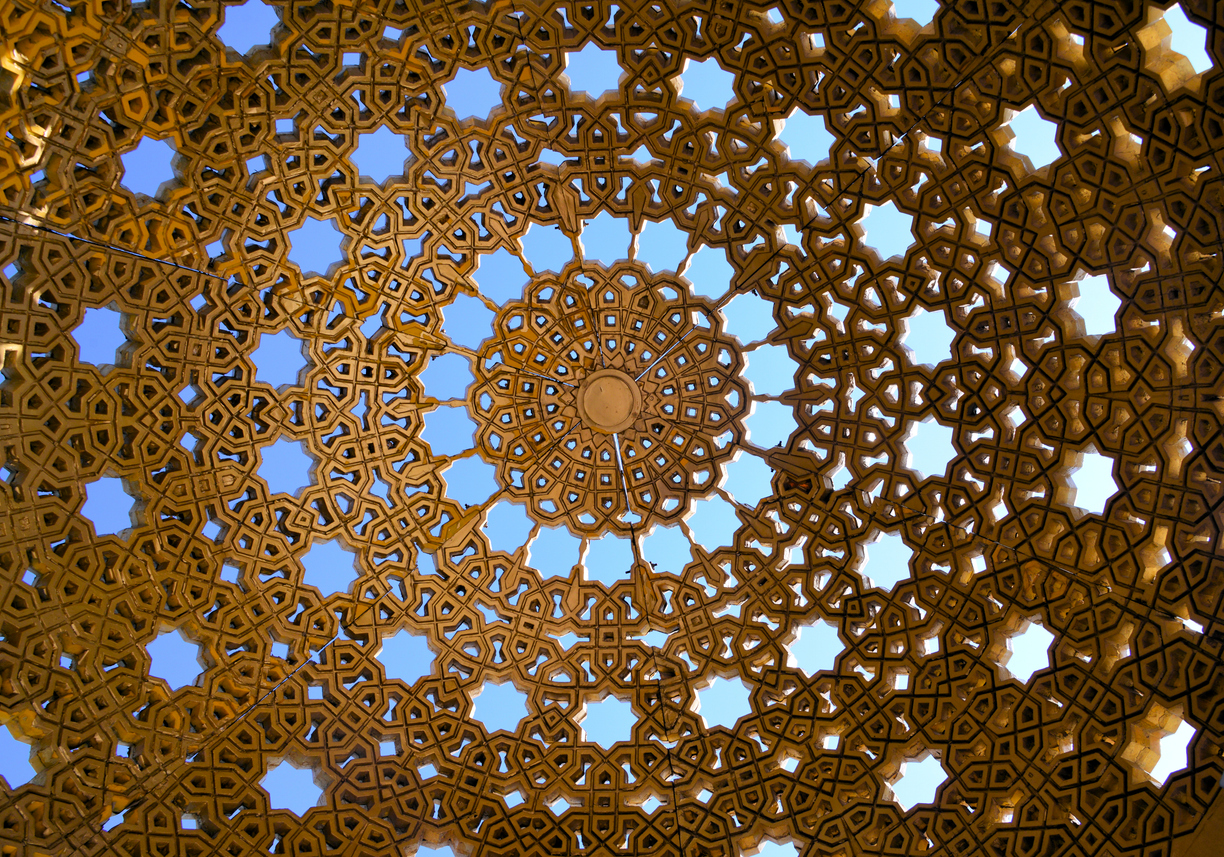

Islamic Finance Innovation 2025

In partnership with Ahli United Bank, Boubyan Bank, NBK, Arab Bank and CIB

Sustainability

Philippines: Blueprint for sustainable finance in Apac

Awards

Banking

Awards for Excellence Middle East and Islamic Finance winners celebrate in Dubai

Awards for Excellence

Awards for Excellence

Middle East 2025 results

Islamic Finance Awards