Trade Finance Survey

Trade Finance Survey 2026 rankings report

Insights from ~12,700 corporate treasurers

Trade Finance Survey 2026 rankings

World’s Most Comprehensive Corporate Banking Benchmark.

The 2026 Euromoney Trade Finance Survey reached 12,700 trade finance specialists and corporate treasurers across 96 countries. Between September and November 2025, corporates assessed 436 trade finance providers, and shared their current priorities and outlook.

For almost 30 years, Euromoney’s Trade Finance Survey has been among the most comprehensive benchmarking exercise of the world’s banks active in this sector, offering authoritative insight into the needs of clients and their perceptions of the banks they work with.

2027 Survey

Methodology and questionnaire will be open for consultation in Q2-2026, targeting the 2027 launch for September 2026.

For information about participation and to get weekly participation report, please contact Olga Kontodimou.

Register your interest in the Trade Finance Survey

About the survey

Annually we survey clients across the world to ask which financial institutions they consider to be the top Trade Finance providers in their markets and how those firms perform across a range of categories.

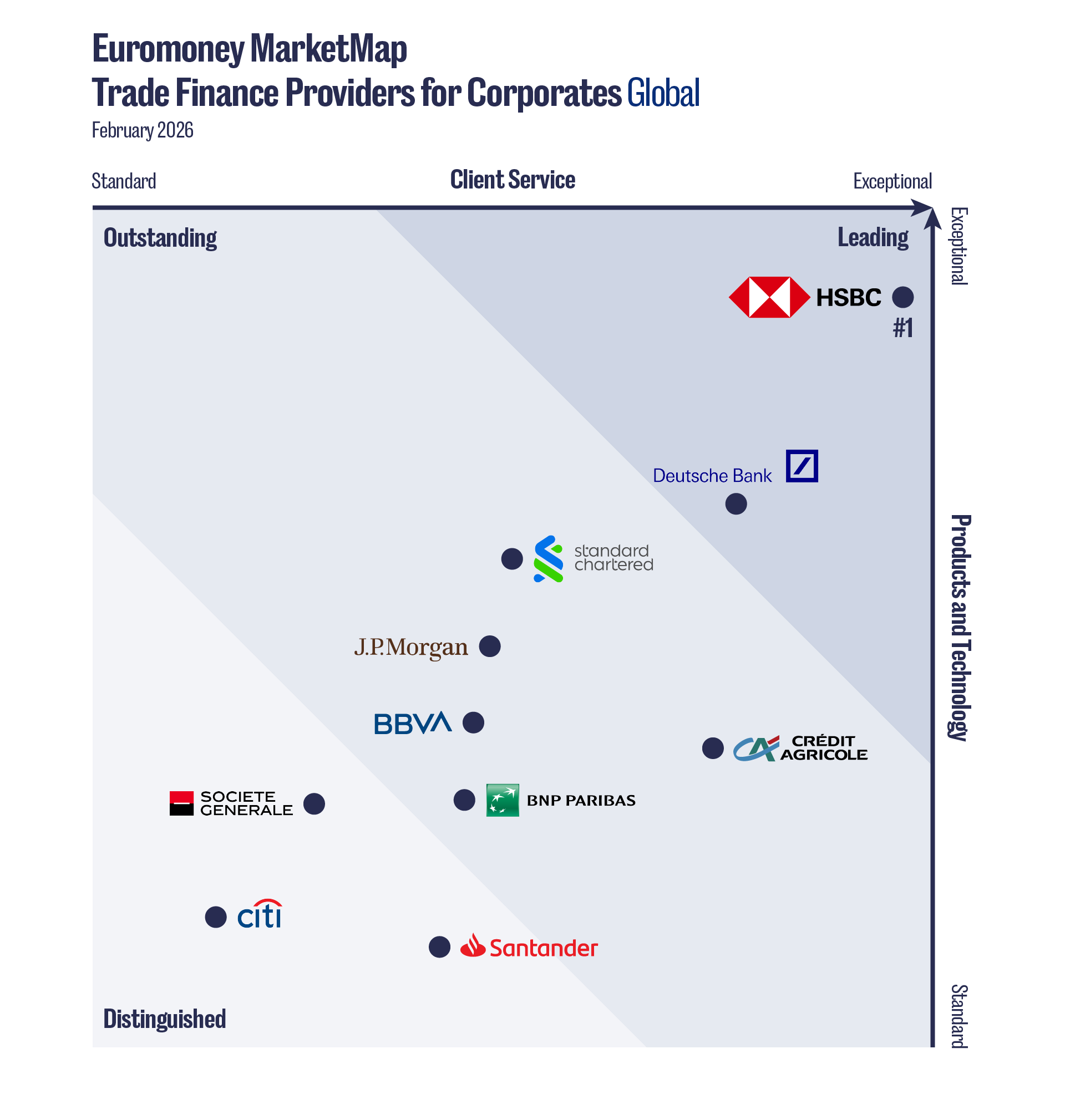

This research is a measure of corporate clients’ satisfaction with their Trade Finance providers across their product offering, technology capabilities and client service.

A minimum number of votes are required to qualify for a ranking. Regional and global rankings are subject to additional qualifying criteria, ensuring that providers have a representative sample across multiple geographies.

Contact our team

Participation and engagement: Olga Kontodimou, senior research manager.

Methodology and questionnaire: Ana Voicila, head of corporate banking.

Amplify your success

For more information on how to amplify your award win, contact Arun Ghudial.