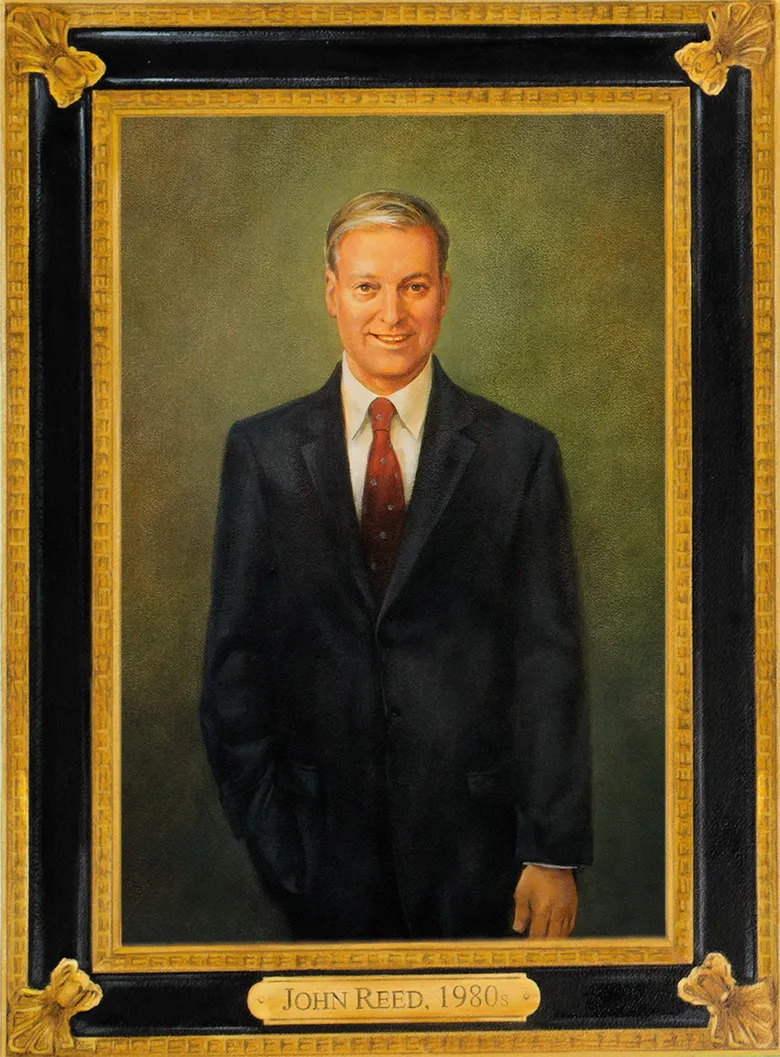

John Reed is a visionary. His ideas about global banking and transformative technology put him decades ahead of his time and set him apart from his peers as one of the leading bankers of the 1970s, 1980s and 1990s. He rethought the business model of consumer banking: as a service built around customers’ whole lives that could be profitable for shareholders. He was a tech pioneer from early in his career, bringing the ATM to bank branches, driving the mass adoption of credit cards and building the biggest international network banking has ever known. Nineteen years on from his infamous ouster after a bruising battle with Sandy Weill, he still thinks deeply about the industry.

|

THE BANKERS |

|

|

|

It is with some quiet satisfaction that Euromoney finally sits down with John Reed in an old and exclusive private social club close to Boston Common renowned as home to New England’s traditional elite.

Spry and mischievous for an 80 year old, Reed advises his open-collared English guests straight off the plane on the choice of ties kept behind reception. These are required for all visitors.

Finally happy with our selections, he leads us up to the library and for the next two hours, after some initial discussion about the booming Boston economy, talks freely about the banking business and his own extraordinary 35-year career at Citibank, rising to be chairman and chief executive, that culminated in the era-defining merger with Sandy Weill’s Travelers to create Citigroup.

Throughout, we are quite alone and Reed allows that perhaps we might just have got away without the ties.

Euromoney can’t help thinking back to the 1990s when we put in repeated requests to interview the boss of the US’s biggest bank, only to be knocked back each time with the reassurance that our request was duly noted and we were “down on the list”.

After several years of this, the realization finally dawned and over coffee with Reed’s press adviser we ventured: “There is no list, is there?”

There wasn’t.

For the last decade of Reed’s career the adviser’s job was to keep him out of the press. Long before Weill appeared on the scene, Reed’s career had been marked by extraordinary technical innovations and strategic leaps – the invention of the ATM, the drive to make Citicorp a global consumer bank – and by two crises: one that he inherited (exposure to Latin America) and one that he allowed to build up (exposure to commercial real estate and highly leveraged loans), both of which Reed dealt with vigorously and decisively.

Perhaps scarred by a magazine cover image of him holding a globe and declaring him banker to the world, just months before the truth of the second crisis began to emerge, those close to Reed decided to prevent any more such public declarations of victory or genius.

Euromoney, however, doesn’t give up. It might have taken us 25 years, but we are finally sitting down with our man.

Dominant figure

The setting is a little jarring. Reed may now look every inch the Wasp establishment grandee. But that is certainly not how his banking career began in the 1960s or developed in the 1970s and 1980s, when he rose to the top at Citicorp and became the dominant banking figure of that decade.

He was not born to the role. He was not a banker by family heritage or by training. Certainly, Reed was not disadvantaged, growing up in middle-class comfort in Argentina and Brazil, where his father was a corporate executive. He went to MIT, first taking a science degree, and later a masters at the Sloan School of Management. And although he was later tagged as a visionary for taking Citicorp into consumer banking, he refers to himself as one of those people who just roll their sleeves up and get the job done.

“I was a manager, not a banker,” Reed says matter-of-factly.

In a way, Reed’s career is almost a forerunner of the days when MBAs came to dominate banking’s executive floors. He was more interested in re-engineering back-office processes than in schmoozing corporate borrowers and making loans. He was not a natural at clubs like this one, not an old-school corporate relationship manager, which is how most bank leaders began.

He had to acquire many of those social skills and he learned at the feet of a master, Walter Wriston, the legendary Citibanker who Reed eventually succeeded as chairman.

Maybe Wriston was the visionary. He was certainly a captivating mentor.

“I joined First National City Bank [renamed as Citibank in 1976] in 1965 and took a job in the international division, which Wriston ran,” Reed tells Euromoney. “He became chief executive in 1967 and he did something quite extraordinary. Back then, the bank had compulsory retirement at age 65 and so Wriston knew that he would have to leave in 1984. He hired a consulting company called Tempo – a part of GE where Walt sat on the board – to produce a set of books studying what the world would look like in the year 2000. Even at the very start of his time as CEO, he was already thinking far past his own retirement date.

“The books looked at various fields: one was on energy and predicted we would have a hydrogen economy with energy produced from water; another was on computers. Now, I had some knowledge of computers. I had done a little coding. Wriston walked into my office one day, threw this book at me and said: ‘Read this and try to figure out what it all means for the banks and what impact it could have on us.’”

It sounds like an extraordinary relationship had already developed between the chief executive and the much younger man. Euromoney wonders how Reed spoke to Wriston.

“Well, I called him Mr Wriston,” he says. “In fact, to start off with I called him ‘sir’ because I had just come out of the army and it seemed natural to call anyone older than me ‘sir’. But he didn’t like that.

“Walt was super smart. I told him years later that after he retired he should be editor of The New York Times because he could so quickly grasp the key points of any subject and sum them up in beautifully succinct prose. He was a great banker, a traditional banker in many ways. The legend inside Citibank was that while still relatively junior he had somehow had a meeting with Aristotle Onassis when Onassis explained that he had one contract to build a tanker and another contract to deliver oil but that he had no money. Wriston lent Onassis the money and so began a lasting and deep relationship.

“Walt was very conservative,” Reed continues. “We used to joke that he was the last American who believed Nixon had done nothing wrong and that his retirement present should be a gunboat. But he would always take risks on the young. If we were trying to decide who should run a country, he would often go for the least likely, youngest candidate. That’s how Jack Hennessy (later chairman and chief executive of Credit Suisse First Boston) ended up running Peru for Citibank at the age of 28, for example.”

Reed took the mission very seriously, spending several months trying to figure out the likely future relationship between banking and computers and visiting the industry leaders at a time when IBM was the big supplier of mainframes and the concept of file-sharing was only just coming in.

Looking back, he says: “It would have been easy to talk about mainframes and automating processes. The first airline computer reservation system had just been launched. But I advised Wriston that the future would be about online interaction between banks and their customers via computers, and we started a business based on that idea here, in Cambridge, called Citicorp Systems Inc.”

The past may not repeat, but it certainly echoes.

In 2017, Euromoney reported on how Citigroup’s present chief executive of global consumer banking, Stephen Bird, had set up a small unit called Citi FinTech, based away from its Manhattan head offices, across the East River in Queens, to disrupt from within and revive the consumer business. It was staffed with some bank veterans as well as a lot of hires from Amazon and PayPal.

“We are striving to create a future-compatible competitor,” Bird told us two years ago. “We set up a spearhead inside the bank to run at the speed of Silicon Valley, which is now super-energized and raising the game of the entire organization.”

It could have been Reed talking 40 years earlier about setting up Citicorp Systems Inc.

“I was smart enough not to do it in New York,” Reed tells us. “The folks in head office didn’t want to see the kind of people I was hiring. They did not look like bankers.”

‘Get things done’

Citibank was a socially conservative institution. The whole banking industry was. When Reed arrived at Citibank any executive who got divorced was expected to resign. How could you run a business or advise customers on their money if you couldn’t run your own family? The way people dressed mattered a lot. Reed may have grown up comfortably in Latin America, but he had not been to Harvard. He was not as smooth or socially adept as many at Citi.

“I was this ‘get things done’ kid,” says Reed.

There was much more to it than this of course. When Reed realized he had to keep the technologists building a new bank away from head office, he first based them in Cambridge and later close to Santa Monica airport. Los Angeles, not Silicon Valley, was then the centre of computing technology, with innovation focused on the defence industry clustered around the airport. It seemed a good spot to locate the newcomers.

“A bank’s immune system always wants to get rid of disruptors. Head office wants to cast those people out,” says Reed. “It is interesting just how long it has taken for technology to take over banking. Indeed, it has not happened yet. Banks don’t know how to run technology. And technologists don’t understand the banking business, customer management and marketing.”

He recalls hiring a number of people from a GE business that had been working on electronic cash registers and splitting his new staff between teams working on technology for retail customers and for business customers.

“We wanted to put a terminal on the desk of every corporate treasurer we did business with so that instead of having to ring the bank every day to check where that $1 million payment due in from Brussels or Paris had gone, treasurers would be able to see for themselves.

“It led quickly to the idea of companies moving money electronically, initiating their own transactions rather than ringing the bank and asking us to do it. That was the beginning of the funds transfer business that became a very big and profitable one for Citibank.”

Later he would bring in engineers from Quotron, who had been building technology to deliver stock price quotations from market makers to brokers, and strive to adapt this technology to move money instead. It was this team out in a building next to the Santa Monica airport that later built the first automated teller machines (ATMs) and the network and protocols to support them.

“We had literally to build them ourselves, including all the technology – multipliers, concentrators and central files – to bring them to market,” says Reed. “I went to IBM and asked if they could build them and they told me: ‘No, we can sell you what’s in our catalogue; we don’t just build machines that you would happen to like.’”

Even decades later, Reed recalls how painful this process was.

“You would not believe how slow computation was in those days. But we knew that if a customer came to the machine and put their card in, we couldn’t have them waiting five minutes for the machine to respond. So, in the process of building the ATM, we created the first database manager operating across distributed computers.”

It’s another echo of new technology today threatening – or promising depending on your point of view – to transform banking.

The first ATM appeared at a Citibank branch in Queens in 1977 and by the end of that year there were two at every branch in New York – one as back-up – so that the bank could be sure customers would be able to use them 24 hours a day, seven days a week and back up its claim that “Citi never sleeps”.

Was all Reed’s time in the early years taken up with these rather blue-sky technology projects?

“Well, I kept responsibility for the company that was doing them, now called Transaction Technology Inc,” Reed says. “But you know what banks are like. They said to me: ‘Reed, now you’ve got this done, why don’t you run our whole back office.’”

Back then, the back office meant sorting cheques, reading the routing orders and dropping them into pockets for distribution. Reed sought to bring modern computer technology to bear here too.

“We had to write new machine code. Your software had to be really good back then. Today, a lot of software is garbage, but the hardware is so good that it compensates.”

He was awfully young to have such a big job. Did it not unsettle and antagonize more experienced bankers?

“No one had cared when I was in Cambridge or Santa Monica,” Reed says. “The people who ran the banks were the corporate customer contact people. No one really wanted jobs in operations, or later in consumer banking, because they were passports to nowhere. I just liked the technology and loved the consumer business. Banking turned out to be fun.”

But he was getting through a lot of money, maybe $200 million to build the ATMs and electronic funds transfer services. Did shareholders object to the size of the transformation budget?

Reed raises a big difference between the industry then and the industry today.

“Shareholders had no real voice in those days,” he says. “Those of us working at the bank had our jobs to do and got on with them. We didn’t even know what the share price was from one week to the next. Customers counted; not shareholders.

“We were very competitive. If Chase was getting more customer deposits than us, that was really bad. If they earned more than us, that wasn’t quite so important. And relative share price performance wasn’t an issue at all.”

The Citi Reed joined was building businesses. Wriston’s predecessor, George Moore, had set the mission to put a branch at every crossroads. He didn’t say that it had to be profitable within two years. During World War II, he urged bank staff serving overseas to keep a watch out for bright and talented people and tell them there would be a job for them with the bank. Wriston ran the international division building up those new branches overseas. Nobody paid a great deal of attention to shareholder value.

The bank was organized geographically, with a metropolitan division handling corporate and retail customers in New York, a national division covering the rest of the US and an international division. There was also an operations group and a trust division, effectively the private bank.

Wriston shifted this towards a customer-focused model, establishing a global companies group covering the largest 1,200 multinational corporations; an international local corporates business; a commercial bank for unrated companies; and a separate consumer division. Reed ran this new consumer business from 1974, eventually riding an extraordinary surge in its profitability to the very top of the institution, all after writing one of the most famous memos in the history of banking on a beach in the US Virgin Islands.

“The bank used to close its books at the end of January and pay bonuses and I would take all my annual vacation in one go in February and go to Saint Croix and sit on the beach to think,” Reed says. “This particular year [1974], I was trying to get my head around the consumer business. I remember going to Bill Spencer [Wriston’s deputy] and saying: ‘We have a separate mortgage company, a separate finance company, a leasing company, a retail business. That doesn’t make much sense. Why don’t we put it all together?’”

The Saint Croix beach memo laid out a then revolutionary blueprint for building a consumer banking business around the evolving needs of retail customers that would, hopefully, retain their loyalty throughout their lifetimes. Later, during his years at the top of the bank, Reed would hire regularly from consumer products companies and invest heavily in building a brand, which was, in truth, always much stronger outside the US and where Citibank was the aspirational choice for affluent customers.

Now, just getting started, he showed some of his abiding convictions about banking. The first is perhaps surprising.

“Banks don’t do anything for anybody,” says Reed. “Rather, they help people do what they were going to do anyway. We are facilitators. We help corporations to buy a neighbouring company or invest in expanding production.”

The second follows on from this: banks should not organize around products but around customers.

“No one wants to take out a mortgage,” says Reed. “Some people want to buy a home, and we may be able to help them. No one wants to allocate savings and investments; they want to build a nest egg.”

If that all sounds far too motherhood and apple pie, it’s not exactly how Reed built the consumer bank.

“I proposed three questions for the consumer business. Who is your customer? What role do you play in their life? What makes them chose you?

“Now, we also did a lot of psychographic analysis of customers and their behaviours,” he adds. “And we knew that we could make money from them – a profit of around $125 a year from a branch customer and maybe $25 a year from a card customer. But our starting point was that we measured our success on satisfying customer needs.

“If you do that well, capitalism being what it is, customers will find a way to reward you commensurately. But don’t be crass. Don’t run around trying to take too much money off them. In that regard, I’m afraid, banking changed.”

Reed recalls his horror years later at reading the transcripts of executives at Bankers Trust apparently revelling in how much money they had made from selling complex derivatives to Gibson Greetings and Procter & Gamble that the buyers could not understand.

“You would have been fired for that at Citi.” He suggests such behaviour was in part a consequence of shareholder value taking primacy over customer value in the banking industry.

Back in the early years, running the consumer bank, Reed didn’t have to worry about making too much profit: quite the opposite.

“We weren’t making a lot of money and we were investing heavily; one year we ruined the whole bank’s P&L,” recalls Reed.

His spending did not go down well with some, as back then the bank ran a bonus system where executives might get 20% of their base salary, but it was based on the whole group’s performance.

“We used to have a Christmas party for the top 100 or so executives and their partners at the River Club in Manhattan,” Reed remembers. “Boy, was I unpopular with the wives that year.”

Not every innovation worked and Reed had to watch out for Wriston, an extremely bright and capable banker who never cared for being anything less than the most important person in the room.

Following his theory that no one wants a mortgage, they just want to buy a house, Reed had realized that as Americans travelled more around the country and abroad, they needed a new way to pay for things. They might not be able to pass a cheque in a store away from home where they were not known. People may just want to transact, they don’t want a credit card but Reed became a big fan of cards.

“I had hired Dave Phillips from Polaroid, who said to me: ‘Why are we only giving credit cards to customers who come into our branches? Why don’t we distribute them more broadly?’ So, we just did it. We sent credit cards out by direct mail; millions of them.”

And that created a firestorm. Other US bank chief executives demanded to know what Wriston was doing poaching their customers in this way. Wriston did not enjoy being disliked.

“I would write him a memo each week laying out what I was doing that might possibly get us into trouble,” Reed says. “Sometimes he would write back and say: ‘Don’t do that.’”

Although credit bureaus now allowed rudimentary credit scoring for direct mail recipients, the national credit card business got off to a shaky start. Inflation in the 1970s became a problem because banks couldn’t raise interest charges high enough to compensate and it took a while to include activation and other fees.

Inspiration

Luck plays a part in any career.

“I remember sitting next to Cliff Gavin [chief executive of Exxon], a board member who later became lead director when I was chairman,” says Reed. “The consumer bank had been losing money, around $5 million to $7 million each month, and then suddenly we had made a profit. He told me: ‘I’m glad you’ve made it, John. We didn’t always think you would.’ And I realized then that I may not have had much longer in my job.”

A former Citibanker tells Euromoney: “Before he took over retail, Citi had a presence in many countries but the business was treated like an orphan in the bank as a whole. John Reed built up retail, gained critical mass and, when the rates environment improved, the business suddenly became very profitable.”

Reed’s vision and achievements at Citibank inspired many in the industry. Hilmar Kopper who spent his whole career at Deutsche Bank, where he rose to be chief executive and then chairman, tells Euromoney: “John Reed was a hero to me and to many of my colleagues. He was the inventor of modern retail banking and even tried it on a global scale.”

For Piyush Gupta, chief executive of DBS, who spent his first 19 years in banking at Citicorp, Reed was 50 years ahead of his time.

“John Reed would have been a banker in his element today: an IT guy, an engineer, who joined Citi in the back office,” he says. “Today, tech and ops is fashionable; back then, it meant you were a geek. Nobody even talked to you, you had to be an investment banker, front office.

“He came up with this notion that consumer banking could be a P&L business. If you look at the history of banking, consumer banking was always a service. You had branches, you took savings, but nobody had a consumer P&L. Everyone had a corporate and investment banking business. Consumer was just how you serviced the individual.”

Gupta adds: “He used to talk about Citi being an information bank. Other than the fact we used data for credit cards, I didn’t see how anyone would make a financial business out of information. But today when I reflect on big data, it’s what Reed was talking about all those years ago.”

By 1984, Reed was one of three candidates – along with Thomas Theobald, then head of the commercial bank and an experienced banker, and lawyer Hans Angermueller, a consigliere of sound judgement but not a banker by training – to succeed Wriston as chairman. The culture had changed. Divorce was no longer a resigning matter. But Reed, then just 46, was still a bold choice for the board and his elevation a sign of the rise of consumer banking inside the business bank of the American empire.

“Wriston may have wanted a visionary genius to succeed him, but he was stuck with me. I guess I was the hands-on guy who could run the business,” says Reed. “Walt told me that if the board had asked him to stay on, he would have done so. But they didn’t. They chose me. ‘So, don’t try and be me. Be yourself.’

“That was very liberating.”

Under Reed’s leadership in the 1980s Citibank became the biggest bank in the US and the largest issuer of credit and charge cards in the world. It picked up the pace of international expansion first set by Moore, opening up new retail and wholesale operations in emerging markets and in Europe, closing in on 90 countries by the end of the decade, eventually reaching 100 in the late 1990s. Something of an outsider, Reed happily promoted executives who shone in emerging markets to the upper echelons of the bank’s previously white and Anglo-Saxon senior management ranks.

Pei-yuan Chia, a Taiwanese who joined from General Foods in 1974 as part of a drive to bring in new marketing expertise, was put in charge of the US cards business. Victor Menezes, an Indian who had run the bank’s operations in that country and later became country corporate officer for Hong Kong, was put in charge of Latin America and Africa.

Shaukat Aziz, former prime minister of Pakistan, joined Citibank in his home country in 1969 and rose up the ranks to head of global private banking, having previously run corporate and wholesale banking in Asia Pacific. He tells Euromoney: “John Reed was a globalist. He wanted to turn Citibank from an international bank to a global bank where borders mean very little. Walt Wriston was a great banker who had a similar vision, but it was John who made it happen. For most US banks at the time the world ended at California.

“He created a G15 group of senior managers (of which I was a member). We all reported directly to him. Ninety percent were home-grown – had risen up the ranks of Citi and knew the bank inside out. Crucially, eight of the 15 were non-US citizens. We had Latin Americans, Europeans and Asians.

“The same ethos went all the way through the firm. If you were on the ‘international staff’, you were paid the same for your grade wherever you worked, from the graduate level upwards.”

The bank acquired its way into the securities business overseas. It bought Scrimgeour Vickers in the UK, for example, in the scramble around Big Bang, even though it was still kept out of that business in the US thanks to Glass-Steagall.

Unable to underwrite equity and debt in the US, Citicorp pushed hard where it could. It built an unchallenged global leadership in foreign exchange trading on the back of its operations in so many countries and led the development of new markets outside the US in commercial paper as an important source of short-term funding for corporations.

But Reed had been planning something else: a decisive resolution of the overhang from bad loans to Latin American sovereigns extended in the early 1980s.

In May 1987, Reed called a press conference. He announced that Citibank was taking a $3 billion reserve against these bad debts, a huge sum that finally acknowledged the true extent of the problem and forced other banks to follow suit. Perhaps unwisely, Reed joked that he was held up on the way to the announcement by the need to call his peers at Manufacturers Hanover, Chase Manhattan, Chemical and the other large banks and let them know what he was about to do.

The implication was that if this was going to be tough for Citibank, then it would be horrendous for them.

No one found it funny. They all, like Citibank, had to raise capital, sell real estate, dispose of other fringe divisions, rethink their capital allocation. It was tough medicine but long overdue. Salomon Brothers’ Thomas Hanley, one of the most widely followed banks analysts of the day, told Fortune in early 1988: “The ramifications of what Reed did are incredible. In the last eight months, he has accomplished more than any banker, ever. He is the banker of the decade.’“

New problems

If Reed had left banking at the end of that decade his reputation might have been extraordinary. But Reed is the first to acknowledge that he made mistakes and that new problems were already building up, this time in the US.

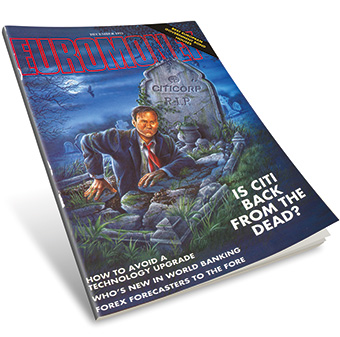

Reed has said that, having risen to the top through the consumer side and not being a corporate banker himself, he was too trusting that those who had grown up in that business were making prudent decisions. By the early 1990s, he was disappointed to realize that they were not. The bank’s own regulators could see that the next crisis was at hand and that it would come from commercial real estate loans to untrustworthy developers and from highly leveraged loans to corporations subject to leveraged buyouts. The decade began with a brutal US recession, corporate bankruptcies and rising unemployment that led to the election of a little-known governor from Arkansas to the US presidency.

Reed forgot about posing for magazine covers and knuckled down.

“I got a call from one of the Citicorp directors saying the board was worried and wanted a meeting and I said: ‘They should be worried.’”

Reed showed the board his analysis of a dire situation that would eventually see him write off $5 billion in real estate exposure back when $5 billion was a big number. He said he needed eight quarters to fix things.

“I asked them: ‘Do you think we understand the problem and do you think we have the right plan?’ And they said: ‘Yes’. I asked: ‘Should I step down?’ and they said: ‘No’. And finally, I asked: ‘Do you think we have the right management team to execute the plan?’ and they said: ‘No.’”

Big changes followed. The bank cut 18% of its staff, reported losses, conducted two equity offerings but managed to maintain customer revenues even as it diluted shareholders. The Federal Reserve helped all the banks, slashing short-term rates and engineering a steeply sloping yield curve.

Euromoney reported in its December 1992 cover story on the vigour with which Reed and his 15-person executive committee pursued a five-point plan to save the bank, to create a new credit culture, raise capital, bolster liquidity, remove bad assets and manage customer fears. Although Reed did not talk to us for that story (“Your request is on the list”), this overhaul was, perhaps, his finest achievement, odd though it sounds.

Forgive us the cover image of him rising from the grave to answer our question: “Is Citi back from the dead?”

It was, big time.

A share price that had been beaten down to below $10 soared towards $100 during the rest of Reed’s time at the top. One of the first to position for this was Saudi prince Alwaleed bin Talal, who built a big stake in the bank at the darkest hour through the two equity offerings and has kept it ever since.

Euromoney doesn’t want to spend too much of our time with Reed going over this ground again but we were intrigued how other banks treated Citi at the time of its troubles. Reed tells us about Goldman Sachs.

“We were the lead bank for Goldman Sachs back when it was still a partnership and run as a customer business, with trading only a small part of the earnings. John Weinberg used to come to see me to discuss its financials over lunch. He would literally take a copy out of his jacket pocket and show me. He wouldn’t even leave a copy with me. But I felt that banking could be done in part on character and trust.

“Later when we hit credit problems in the early 1990s, we had to regularly re-price certain securities through the investment banks. Goldman knew we were in trouble and wanted to help. They would come to me and say: ‘Let’s work out the best way to handle this’. I would do a lot of business with Goldman in the years after that. There were other firms who just got scared and wanted rid of any exposure to us and I would never do business with them again.”

Citi did a much better job through the 1990s of avoiding blow-ups. Reed recalls being on the West Coast in 1998 and taking a call from the Federal Reserve about the meeting of banks to bail out LTCM. He didn’t attend.

“The very last thing they needed was me turning up at that meeting,” he says now. “We had no exposure. I only wish I had been smart enough to tell them they were making a mistake and that they should let LTCM go, because that’s what eventually led us to 2008.”

Recognition

Those who worked for Reed recall a change after he led the bank through this second crisis at the start of the 1990s. One who declines to be attributed says: “John got the recognition he deserved but maybe too much recognition. He became increasingly insular and started getting rid of a lot of the people underneath him. By the time Travelers came around he had lost control. He thought he could win that battle post-merger, but Sandy Weill was much better at M&A than him.”

That deal came together quickly.

“John was very strategic, but he was an abstract strategic thinker,” says Gupta. “So, when he presented this Travelers merger, it was on a strategic canvas. You had a completely global bank in 100 countries and in Travelers a big insurance franchise and a big commercial credit franchise. Travelers had also acquired Salomon a year earlier, so all of the things Citi didn’t have, Travelers did. Add them together, it looked like a match made in heaven. But in the abstraction, Reed’s understanding and appreciation for realpolitik – the people part of this thing – wasn’t as nuanced as it needed to be.”

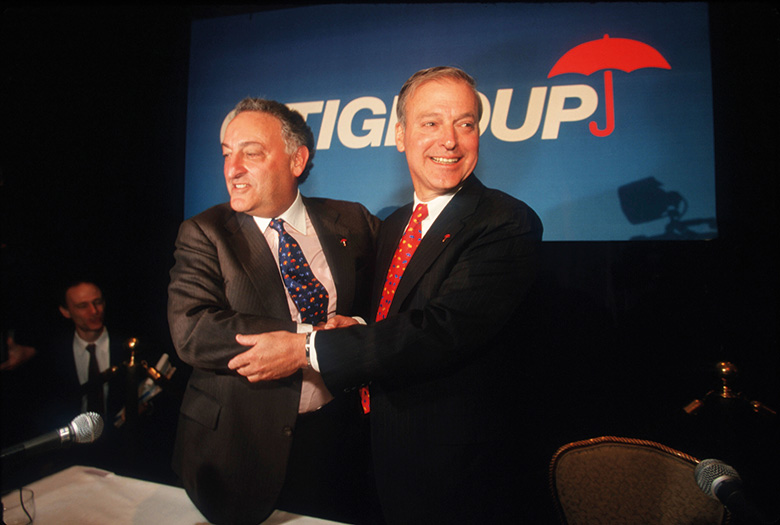

It seemed obvious to everyone at the time, certainly to Euromoney, that severe problems lay in store at the top of Citigroup after the extraordinary merger between Reed’s Citicorp and Sandy Weill’s Travelers group, which initially cast the two very different characters as co-heads.

Travelers Group’s CEO Sandy Weill (l) and Citicorp’s John Reed shake hands at a press conference to announce their merger on April 6, 1998 in New York City

Reed has since, in written comment letters on post-crisis financial regulation, offered his mea culpas and regrets for combining a bank with a big trading business like Salomon Brothers. What drove him to do it in the first place?

“The numbers drove it,” Reed tells Euromoney. “There was very little overlap. Travelers had Salomon Brothers and we had customers that were telling us it would be great if we could take them to the equity and bond markets.”

Euromoney points out that at the time the merger was announced, Glass-Steagall still stood and could have prevented this. Reed waves this aside. “Sandy had done a deal with the Fed on Glass-Steagall. We were knocking on an open door.”

He says that he always knew the personality issues would be a problem at the top of the firm.

“Sandy and I knew we weren’t going to work well together, but we could do it for a short time. What I didn’t appreciate was the depth of the social issues and how incompatible management right through Travelers would be with ours.”

Did Reed know he was making a mistake all along? Did he fall into the merger because of the failure in succession planning?

Shaukat Tareen, a former Citibank country manager in Pakistan, told Euromoney in the aftermath of Reed’s exit: “If there had been the Pei-yuan Chias and Rana Talwars there, it would have been very difficult for Travelers to take over the consumer side of Citi. But Weill came in and within six months he was in charge of the entire consumer side of Citigroup. So Citi had conceded more than half of their territory in the first place. Once Sandy had taken over the territory, it was very easy for him to dislodge John Reed.”

Former colleagues say that Citibank’s most successful business builders, such as Talwar, Chia and Rick Braddock, were forced out by Reed in the 1990s because he was unsettled by high-flyers who might threaten his position.

Talwar, an Indian who spent his formative years at the bank rising to run the consumer branch business in Europe and the US before eventually leaving to run Standard Chartered, told Euromoney in the aftermath of Reed’s ouster: “As people started reaching the top and really succeeding, he just got rid of them. Ultimately that was one reason why he lost to Sandy Weill. Sandy had a bunch of loyal people who had worked for him and would die for him and kill for him. But when John looked around, there was nobody behind him because he hadn’t built up a group of people.”

The end was brutal. A board meeting was called early in 2000. Reed thought he was going to win, former Citi insiders tell Euromoney, that he would get rid of Weill and fix things at Citi once more. He was quite mistaken.

One source tells Euromoney: “Sandy also was on the board of every important foundation in New York. So, when it came to the showdown and a board vote, he had all the board members in his pocket.”

Asked to choose between Reed and Weill, every member of the board voted for Weill.

Global banking

That was 19 years ago. Weill himself was later ousted and so too his successor, Charles ‘Chuck’ Prince, who danced Citi into the financial crisis from which it had to be bailed out and rebuilt over 10 painful years. Reed has kept a low profile, briefly running the New York Stock Exchange in the aftermath of the sub-prime crisis and with just one position of note today in the industry: he sits on the board of CaixaBank, the leading bank in Spain.

Its chief executive, Gonzalo Gortázar, tells Euromoney how valuable Reed’s presence is, even if reporting to him may not always be comfortable.

“John is an open book on banking,” says Gortázar. “His experience is immensely useful in board discussions. Even though the banking business today is quite different from what it was some years ago, it is still about people and clients. John reminds us that banks continue to thrive on customer trust and client service, which have to be built on a fortress balance sheet and a talented team. Winning organizations are so because they have something superior to offer clients.”

He adds: “The complex web of new regulations in which we operate does not change the picture. New technologies, which John is very aware of, are key enablers for financial institutions. While board discussions continue to deal with day-to-day short-term issues and challenges, John provides not just a sharp view on the short term but a relentless focus on what drives long-term success.”

Has management at his former bank ever asked for Reed’s advice or has he ever offered it?

“There is nothing worse than a retired CEO hanging around,” says Reed. “I have not been close to Citi since I left, though I have met the current management.”

How did that go, Euromoney wonders? “They don’t talk the same language as I do,” he says. “They have disinvested from global consumer banking and weakened their global network.”

But wasn’t that the right thing to do and isn’t the era of global banking over?

While Kopper calls Reed his hero, he drew a very different lesson from Reed’s efforts to build global consumer.

“Global retail banking does not work because every country is different,” says Kopper. “You have a different currency. You have different ambitions by the population. It’s very hard to do that. There are no global products in retail. Not really.”

Reed disagrees and says that if it wants to regain its global franchise, Citi could do worse than buy Standard Chartered.

“Global banking will come back,” he says. “There are global companies and if you want their banking business, you have to be global. And on the consumer side, is providing banking services really so different from selling Coca-Cola, which is pretty much the same in Japan as in the US?”

However, Reed admits that “regulatory protection may inhibit this. We used to run a big bank in Germany, for example, but we could never break into the middle-market companies that are not quoted on stock exchanges. And France will never permit a non-French owned national banking champion, though the UK might.”

In fact, it doesn’t sound much as if his belief in the potential for global banking quite fits with his notions of the primacy of customer service. Reed tells us his brother runs a metal-bashing business in Florida and Reed sometimes accompanies him to meet his bankers.

You have to wonder if they know who they are sitting across the table from.

“I tell my brother: ‘Always stick with your local bank, and if it gets taken over find another local bank, because that’s who will provide you with working capital.’ The large banks want to deal with large companies, but most US banks are regional and local, living off customer business between taking retail deposits and lending to unrated companies that they know well. I think that is the most attractive form of banking.”

Can that model survive, however, in an era where large banks like JPMorgan and Bank of America – each with national middle-market businesses inside them – are investing billions each year in technology?

“You can service companies online, but you can’t make loan decisions that way,” says Reed. “There will be banking technology platforms, and small and regional banks should not compete on building those. Rather, they should operate on somebody else’s platform. Their value comes from building and maintaining relationships with local customers.”

And will the big banks be disrupted by technology companies?

Reed certainly thinks it is possible. “You almost sense there has to be an Uber moment in banking. If I had stayed in the industry after Citi, I probably would have looked to someone like PayPal rather than another bank.”

But he also has a strong sense of the as yet unrealized power of data mining.

“Knowing your customer is not the sole province of Facebook and Google. I would rather be JPMorgan. Banks know everything about what you do with money, where it comes from, what you spend it on, your taxes. When I was running Citi, we didn’t have artificial intelligence and machine learning, but we knew when people got paid, what they would spend. Sometimes we might know they were heading for divorce before they did, because we could see their partners going crazy on their credit cards. If you really want to know consumers, I would go through the financial door.”

It is perhaps no wonder that he became isolated and cerebral in his later years in management. Decades after Reed was the first to see it coming, the era of the information bank has finally dawned.