What is striking, however, is that the motivation behind them would frequently not look out of place today.

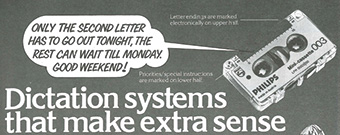

First, the mundane. “Dictation systems that make extra sense” proclaimed Philips in January 1980 as it touted its new mini-cassette based Visual Mark & Find system that etched marks automatically onto the body of the cassette indicating the priority of various items and where instructions to the typist were located in the audio.

And that typist’s job was set to be transformed with the introduction of the word processor, “designed to process words”, as Philips reminded us.

Letters could be printed in 30 seconds, which doesn’t seem too bad even by today’s standards, once printer sharing and activation through security passes is taken into account.

The system’s advanced formatting and operating functions would “smooth the way to work processor acceptance”, we were promised.

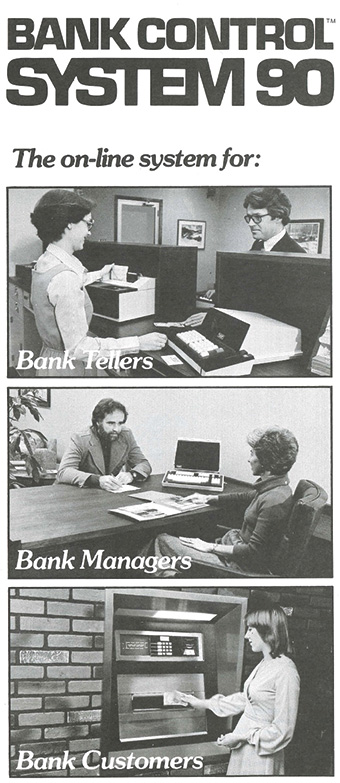

But few things looked more interesting – or sounded more sinister – than the gloriously titled BANK CONTROL SYSTEM 90. A staple of Euromoney’s advertising pages in the late 1970s and early 1980s, this suite was the brainchild of Bunker Ramo, a company founded in 1964 by George Bunker and Simon Ramo, the latter being the chief scientist for the US intercontinental ballistic missile system during the Cold War.

The company’s speciality was the development of electronic control systems for space exploration and the military. But there were obvious opportunities in the rapidly growing financial sphere. By 1980 there were more than 3,500 bank branches across the world using Bunker Ramo’s terminals at teller stations and bank managers’ desks, helping to reduce fraud by allowing the user to view an accountholder’s details instantly and confirm their identity.

It is hard to find anyone very familiar with Bunker Ramo now, but its various successor organizations have been able to funnel some information Euromoney’s way. In 1971 it had been instrumental in developing the first iteration of Nasdaq. The company was acquired by Allied Corporation (later Allied Signal and then Honeywell) in the early 1980s.

In 1986 it was then sold to the market data business of ADP, which moved the staff from their Nutmeg Drive office in Trumbull, Connecticut, to ADP’s Mount Laurel premises in New Jersey. ADP’s market data business was sold to Bridge Information Systems in the early 1990s and Bridge was bought by Reuters in 2001.

By May 1981 Euromoney was writing about a seemingly fantastical system being publicized by Chase Manhattan, based on the Apple II personal computer. “With no more than a flick of his forefinger on one of the buttons, the screen came to life”, we reported breathlessly. In the age of the iPad, that certainly sounds familiar.

The Chase system we were describing was an early example of banking by telephone. At that time there was a debate raging over whether cable television or the phone network would win the battle to supply banking services to people’s homes. One Chase vice-president, Robert Reffelt, reported that: “Some firms are even considering satellite communications, with a small dish on the top of each home.” Imagine that.

Some banks were also grappling with challenges that seem simply extraordinary today. When Standard Chartered in London had to move some of its operations to a building on the other side of the River Thames, it found that the Post Office, which was responsible for telephone systems in the UK at the time, could not connect the two.

The solution was a suitably sci-fi system, Interlaser, built by the Modular Technology Company. It used lasers to transmit data up to 10 miles and could carry 30 telephone conversations. It sounds impressive, but it wasn’t perfect. Euromoney reported that while birds would not be injured by the beam, they would nonetheless disrupt it, hence the need for a stop-and-repeat mechanism.

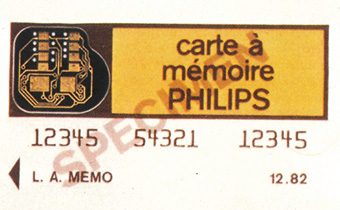

France took longer to wean itself off the paper chequebook than some other countries, but as far back as 1982 a new-fangled electronic version was already being advertised in the pages of Euromoney. It described itself as a “memory card” and promised to be linked to “videotext” home terminals.

Chase and Citibank were the big guns in the bank technology battles of the 1970s and 1980s, constantly at each other’s throats. But Citi often had the edge on technology for its traders and dealers. A picture from that time shows a prototype electronic dealing pad that the bank’s boffins came up with, using a stylus with a graphics tablet.

Sometimes it is the bricks and mortar that get in the way, however. “If Citibank made any mistake in its forex development, it was to move into the wrong shape of building,” Euromoney wrote in August 1981.

The problem was a load-bearing wall between the corporate and the interdealer brokers, meaning that they couldn’t see if colleagues were at their desk. The solution for many was to plug one of their many screens into the CCTV system covering the dealing room.

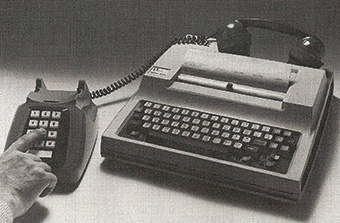

By now, banks were beginning to woo corporate treasurers with computers that could help with cash management. NatWest was advertising one system in 1982 that was connected to the telephone.

It was a tough sell sometimes.

“Some corporations insist that their in-house money management systems are better than anything a bank can offer,” we wrote.

Most treasurers realized that banks were moving from pricing time to pricing data and that they were being asked to buy back the data they had given the banks in the first place.

By March 1983 Citibank had invested $500 million in a satellite system for global electronic banking – a move that Euromoney hailed as the first revolutionary development in banking since the creation of the Eurodollar market.

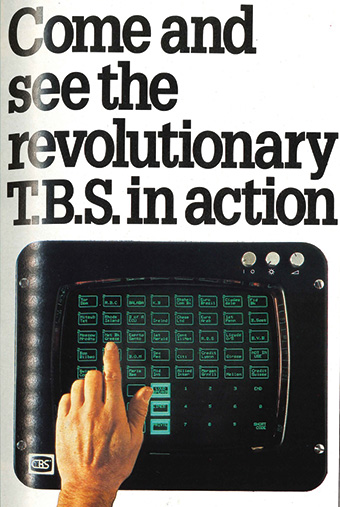

Tech companies were seizing their chance. In April that year British Telecom was advertising its Teletrade system, offering “fingertip control” for currency and commodity dealers.

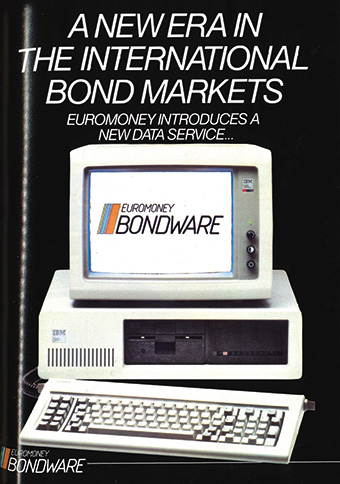

By 1984 data was in demand just as much as systems and Euromoney itself launched Bondware, “the international bond market’s first micro-computer based data system”.

By this time a surprising amount of financial services technology was beginning to be recognizable in function to present-day systems, if slower and more cumbersome. By October 1984, Euromoney was warning that the traditional trading floor might disappear altogether, to be replaced by computers. This was the age of the advert for the terminals being made by “Reuter”, in the singular. By March 1987 we were writing about automated trading.

Treasurers were still being heavily targeted. HSBC starts to pop up in our pages in 1986 as it touted its Hexagon corporate electronic banking system.

By the very end of the decade Hitachi was making a worryingly-named Terminator electronic dealer-board. Boards like it were flooding onto the market, with most big trading banks boasting their own tailored versions.

One gadget that resonates now popped up in January 1988, when an imaginatively named company, ‘The Time and Date Stamp Centre’, was advertising a machine that would automatically apply a time and date stamp to a paper document. As the slogan went: “Where there’s muddle, there’s trouble.”

Some 30 years later we have the EU’s Markets in Financial Instruments Directive asking for date stamps without the snappy tagline.

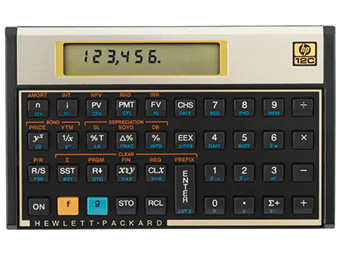

Banks can’t get away with running antiquated technology for long, but individuals can, as long the requirements have changed sufficiently little. And the granddaddy of them all is surely the HP 12C calculator. Introduced in 1981 and packed with financial functions, it is perhaps the oldest piece of essentially unchanged tech still in use in the industry.

Bankers still talk about it – Marty Chavez, who recently ended his tenure as CFO of Goldman Sachs, told analysts late last year that he was still using his. Anyone suffering from nostalgia can still buy newly manufactured units today. Long may it live.

What is remarkable is how the driving sentiment behind all these developments remains unchanged. Technology should be a “weapon of the marketplace rather than a clerical substitute,” we wrote in 1981. And one conclusion we reached in that decade has not dated one jot: “If you can’t afford the systems, get out of banking.”