By Richard Evans

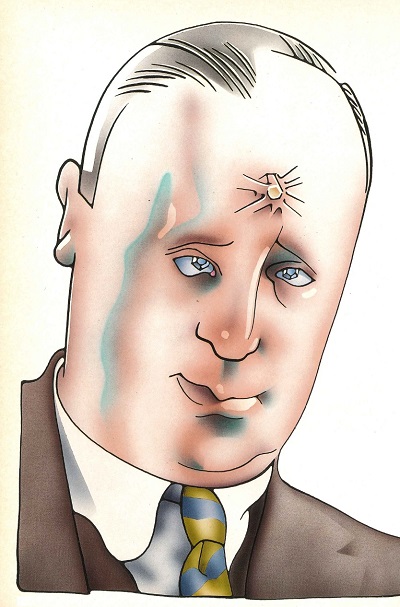

Thierry Barbey, senior partner of Lombard Odier et Cie in Geneva, tells the story with just a flicker of a smile. “It was during the time of the Korean war when there was great political and economic uncertainty. A very old client came to the bank for his regular quarterly meeting. I noticed something different about him as he walked into the room. He had a large lump at the top of his forehead.

|

|

|

The private banker is used to odd clients. And really, |

“I can see you looking at my lump,” he said. “Don’t worry I haven’t had an accident. It’s just that I’m worried about the safety of my money so I decided to sow a diamond into my head.”

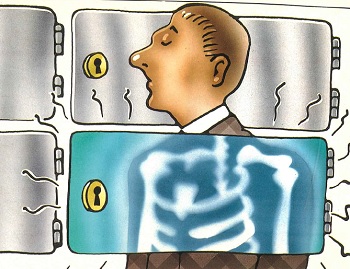

Every private banker has a host of similar stories. Clients with agoraphobia who refuse to come to the bank, others who, if they are passing the bank, deposit any loose change rather than ruin their suits and one customer who, Barbey recalled, kept radioactive metal in his safety deposit box. “We found out only when he died,” said Barbey. “His widow anxiously rang to tell us.”

The wealthy are different, said Scott Fitzgerald. Coping with the problems of rich eccentrics and just the plain rich is the essence of private banking. “I don’t like to think of it as a business or a commercial operation,” said Pierre Lardy, a partner of Pictet et Cie, another of Geneva’s venerable private banks. “It’s more a counselling service for affluent people.”

It’s a noble sentiment. But the service isn’t cheap. Private banking is a lucrative business, giving the private banker a lifestyle very similar to that of his clients.

Many of the banks are still partnerships, and as they do not solicit deposits from the public, they are not required to publish accounts. The general rule of thumb for calculating their profits is to take 1% of the portfolios they have under management. Pictet and Lombard Odier, two of Geneva’s biggest private banks, are each estimated to have over Swfr20 billion under management. That gives them an annual profit of around $100 million.

It seems like easy money. Private banking involves a few basic activities: graciously allowing your bank to be used as a deposit institution by wealthy individuals, trust and custody business – involving the legal custody of a trust or pension fund’s money – broking and foreign exchange transactions and the prestige business of portfolio management. What could be simpler?

Resisting newcomers

It’s a thought that has naturally occurred to commercial and investment banks throughout the world. A gaggle of major banks has established private banking divisions in an effort to enter the business in recent years. The principle of earning profits from other people’s money rather than risking your own is appealing. In the US and the Far East, their efforts have borne some fruit.

The talk among portfolio managers in New York and Hong Kong is of doubling profits and trebling portfolios. But in Europe, the cradle of private banking, the response is less than euphoric. In the shadowy world of private banking, nothing is entirely clear, but there’s reason to suggest the newcomers have made little progress so far. “Outside Europe the private banking tradition isn’t as strong,” said one Swiss banker. “The big commercial and investment banks have had an easy ride.”

Why have the newcomers failed to dent banks such as Pictet and Lombard Odier in Geneva, Julius Baer and Vontobel in Zurich, Bank Scholler and Bank Gebrud Gutmann in Vienna and Hottinguer and Rothschild in Paris? One reason may be generations of experience, and the carefully cultivated discreet image of these institutions. Benedict Hentsch, heir apparent at Hentsch et Cie, one of the oldest Swiss banks in Geneva, explained the basic proposition. “If you want your money managed by professionals you go to those institutions which profess to be experts. When in Rome do as the Romans,” he said.

“We accept only accounts of over Swfr1 million. It’s impossible to provide a proper service for less. It would be like trying to run an upmarket restaurant such as Langans in London, and a hamburger cafe.” – Oscar Holenweger, Bank Vontobel

Many of the banks which came to Switzerland were first attracted by the wholesale banking business and discovered private banking only later. For instance, Canada’s Royal Trust Bank only switched to private banking seven years ago, Deutsche Bank was a late arrival in Switzerland in 1981 and was initially more concerned with capital markets activity.

The big US commercial banks, such as Chemical, Citicorp and Manufacturers Hanover, were more interested in setting up investment banking subsidiaries to operate in the Swiss capital market in the 1970s than in private banking and are now fighting to make up lost time. American Express signalled its intention to go into private banking as late as 1982 when it bought Trade Development Bank. American Express and the others may eventually break through, but it takes more than five years to build a thriving banking division. More than any other aspect of banking, it depends on contacts and building relationships. Private client business cannot be bought.

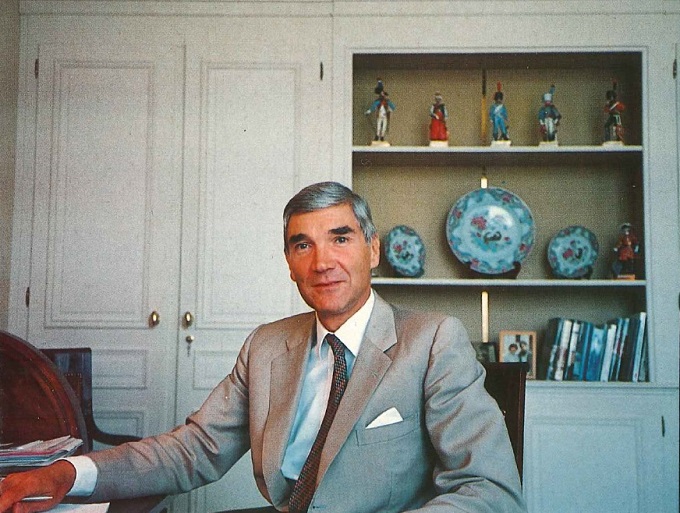

|

| Pierre Lardy of Pictet et Cie: “I don’t like to think of it as a business… It’s more a counselling service for affluent people.” |

Switzerland remains the pre-eminent country for private banking. There is competition, but the prestige end of private banking, portfolio management, remains largely in Switzerland, while the rivals are mostly busy with custodial and depository work. Switzerland has the advantage of unparalleled political and economic stability. Other European centres are primitive by comparison. Austria is hampered by the fact that its citizens don’t possess the wealth required for sophisticated private banking services. Luxembourg is at the beginning of a move into portfolio management by its resident banks, (Euromoney July 1987) while such centres as Liechtenstein and Andorra lack the political and economic muscle to assure potential clients of their stability.

Despite the push by the domestic commercial banks and the foreign banks into the field, the Swiss private banks still look after a large proportion of the Swfr500 billion which is estimated to be managed from Switzerland.

Friend and confidant

Acquiring the knack of private banking isn’t as easy as it seems. Dealing with individuals is different to dealing with large commercial organisations. It’s not just a question of providing the same services on a smaller scale. There really is no substitute for mastering the personal touch.

The kind of service a client expects from his private banker was illustrated by Oscar Holenweger, an executive vice president of Bank Vontobel in Zurich. “The phone rang at about two in the morning. It was one of my Brazilian clients. I thought he was worried about the fall in the dollar or wanted to switch some investments. Instead he told me his daughter had gone missing on holiday in Europe. Rather than ring Interpol or the Brazilian police he rang me.” Did Vontobel succeed in tracking her down? “Oh yes, we traced her to Morocco where she was quite happy,” said Holenweger.

A private banker is a friend, confidant and counsellor to his client. “It’s a question of how you handle the knowledge you get from being in such a sensitive position of trust,” said Hentsch. “Many matters are very intimate and discreet. You know the beneficiaries of his will, whether he wants to hide money from his wife or his business associates.”

Managing a client’s money can often mean managing his life. “We offer a complete package,” said Hans Baer, president of the managing committee at Bank Julius Baer. “It can include advice on which school a client should send his child to in Switzerland and medical and legal advice.”

|

|

|

One customer kept radioactive |

The private banks pride themselves on the network of friends they have around the world. “One angry lady client rang me up from New York late one afternoon,” said Hentsch. Her credit card provided by our bank had been rejected. As she had over $2 million in her account with us I could understand her fury. I immediately rang a friend at Brown Brothers Harriman and asked him to send the necessary amount to her so she could buy the painting she wanted. She got the money within the hour.” Today, with such banks as Citicorp sprawling the globe, these informal contacts may be of little practical value, but they still impress clients.

When private bankers were asked what was the main factor that gave them an advantage over their commercial banking rivals almost all replied it was continuity. At Hentsch the average length of service for staff is 14 years. “I’d be happy to see a Japanese style of work here,” said Hentsch. “It’s important for the client, when discussing so much confidential information, to have the assurance that only a few people will be aware of his affairs.”

Lardy at Pictet said that only two people had left the bank in the past 12 years. Jean Pierre Cuoni, chairman of Citicorp Investment Bank in Switzerland, acknowledged the problem. “It’s true the private banks have a much lower staff turnover level than us. It’s partly a problem of youth. The average age of our personnel is 33, which I’m sure is around a decade younger than the staff of the private banks.”

The minimum amounts which the banks accept vary. The average is around $100,000. What concerns the private bankers more than the size of the initial deposit is the potential for growth. They also accept a client’s wish to test them. “If a client wants to start with $100,000 to see how we perform I have no problem with that,” said Hentsch.

None of the banks thought it was possible to provide an individually tailored portfolio management service for accounts of under $350,000-$500,000. The products are not available and the commissions would be too expensive. Holenweger at Vontobel was adamant. “We accept only accounts of over Swfr1 million. It’s impossible to provide a proper service for less. If we accepted smaller accounts we wouldn’t be able to offer the same standard of service. We would have to use the same infrastructure, which is why the commercial banks haven’t been able to compete effectively. It would be like trying to run an upmarket restaurant such as Langans in London, and a hamburger cafe,” he said.

Clean-up campaign

The days when portfolio management consisted of intuition, guesswork and inspired stock picking are past. All the top flight private banks are very professional. Asset allocation strategies are carefully drawn up, reference currencies are chosen for each client, the split between bonds and stocks is decided and then individual companies are considered.

An investment committee co-ordinates these activities, and is backed by teams of researchers. They conduct primary research in the Swiss market and research the research on other markets which is sent in by affiliated institutions or bought from specialists. When clients put their money in Switzerland they should remember that most of it will be re-exported on to the international capital markets.

The banks’ clients come from all over the world: Middle-East traders, European industrialists, the old nobility and their dwindling millions, Latin American entrepreneurs keen to protect their wealth from the ravages of inflation and Hong Kong and Far East businessmen anxious to find a safe haven for their money. Most of the clients come through referrals from existing clients or other contacts.

|

|

|

Helmuth Frey of Bank |

Money laundered from drugs trading, the proceeds of organised crime and flight capital all represent the seamy side of private banking. The latest figures available from the Swiss National Bank show that enormous volumes of money flowed from the Caribbean into the banking system. Last year some Swfr7.66 billion from the Bahamas was placed in Swiss banks. A further Swfr6.08 billion came from the Cayman Islands. And Swfr8.9 billion from Panama. It’s not possible to tell how much of the money is flight capital, but the enormous sums from such tiny economies suggest that not all of it can relate to legitimate banking business.

Switzerland’s popularity is also increasing because of the crackdown by the SEC and the US Justice Department on discreet money flows. The Cayman Islands has signed a treaty with the US giving the Americans wide access to the financial records of Cayman banks in criminal investigations. And the SEC achieved a notable coup when it forced Bank Leu’s Bahamian subsidiary to give details of Dennis Levine’s account.

In July last year, the Comprehensive Money Laundering Prevention Act was passed by the US House of Representatives Banking Committee. And the Money Laundering Control Act was passed by the House Judiciary Committee. Under the terms of these, any person who launders money is criminally liable. The punishment is a $1 million fine or five years in jail.

True, a clean-up campaign is proceeding in Switzerland, but slowly. For the past decade the Swiss banks have been slowly enmeshed in a web of treaties and mutual assistance agreements. Insider trading will be made a criminal offence this year. Form B accounts, which can be opened by lawyers on behalf of clients who remain anonymous, also looked doomed. A provision has been included in the new good-conduct convention. “It’s still possible for lawyers to open these accounts,” said an official at the Banking Commission. “But all lawyers who do so must swear that he is the client’s attorney and not just a commercial money manager.” However the Banking Commission remains unhappy. It has said that unless form B accounts are ended, it will issue a regulation abolishing them.

Global diversification

In recent years it has become obvious that the Swiss private banks are not content to sit back and just carry on their traditional role as money managers to the rich. They have diversified their business mix and expanded abroad. Most of the big private banks now have offices in London, New York and Tokyo. Acquisitions have been made and joint ventures agreed. For instance Lombard Odier has bought Marshall and Co, a London brokerage firm and set up a joint venture with Kempen and Co, a leading Dutch stockbroker to help bring Dutch stocks to international clients.

Domestically the private banks have been looking at new businesses and acquisitions. Last year Bank Julius Baer took a 51% interest in what is now called Société Bancaire Julius Baer SA Geneva, formerly Barclays Bank (Suisse) SA. With this acquisition, Baer got a seat on the Geneva stock exchange.

Bank Vontobel is moving into corporate finance while Bank Gutzwiller is continuing its successful forays into the Eurobond market, under the leadership of its general manager Jean Francois Kurz. The bank has packaged some very innovative deals. It was the first bank to launch Australian and New Zealand dollar issues. Gutzwiller did the first Swiss franc public bond issue linked to gold for Pegasus, a US gold mining company. And it was Kurz who invented the concept of secured convertible issues. “Despite our size,” said Kurz, “along with the big banks, we are one of the major Swiss participants in the Eurobond primary market.”

Recently Arthur Andersen, the leading firm of US management consultants, published a survey of the financial sector in Switzerland. It was favourable. Although the report predicted that the number of private banks would continue to fall (they have dwindled from 200 at the beginning of the century to only 24 today), it was also optimistic about the profitability of those remaining. The report predicted an annual growth potential of more than 10% in this field for the private banks.

“It’s easy to show a private client that his portfolio has performed well just by changing the currency in which the quarterly results are reported.” – Swiss banker

There is a mix of reasons why the smaller private banks keep vanishing. “Usually it is because some vital partner has died or there was a stock exchange crash and the bank was too severely affected to survive,” said Barbey. He was confident, however, that both Lombard Odier and Pictet were large enough to be able to cope with such problems. Benedict Hentsch emphasised the need for capital, children and brains (knowledge). The last two are a matter of luck, but a number of banks have taken steps to ensure that they won’t be caught short of capital: Sarasin in Basle and Baer and Vontobel have all opted for incorporation. Lombard Odier is also thought to be considering the idea. Raising capital wasn’t the only consideration. At Baer, for instance, there was the need to pay members of the family who wanted no part in running the bank.

But the new structures should help these banks to gain the business for which almost all private bankers are clamouring: the management of institutional funds. “Institutions are the high-net-worth individuals of today,” said one Swiss banker in Geneva.

Many fund managers doubt the ability of any bank to be a successful institutional fund manager without adequate amounts of capital. “You need to have inventories of securities on your books so you can react quickly to a client’s request rather than have to rush to the market,” said one foreign banker in Zurich.

It’s in the institutional business that the private banks face their biggest test. “It’s easy to show a private client that his portfolio has performed well just by changing the currency in which the quarterly results are reported,” said one Swiss banker who runs a small fund management company in Liechtenstein and regularly sub-contracts work out to the Swiss private banks. “But institutional fund inanagers aren’t so gullible. They want performance.”

The private banks will be competing against highly sophisticated merchant banks as well as the private banking departments of the international commercial banks. In London and New York, money managers are familiar with the range of sophisticated capital markets and hedging instruments that can dramatically alter a portfolio’s risk return ratio. In Switzerland a futures and options exchange was introduced only this year.

The commitment from the Swiss banks is obvious. Pictet is one of the 17 foreign banks granted a licence by the Japanese Ministry of Finance to manage discretionary accounts for clients in Tokyo. It also has a joint venture with Mellon Bank to manage US institutional funds, particularly Erisa accounts. “We know many of the pension funds through brokerage contacts on Wall Street, so that helped,” said Lardy. “And we chose Mellon because they are the kind of conservative family-owned bank with similar attitudes to ourselves and contacts with US institutions.”

“The chairman was ill and the company had hired an actor. We were told of the switch but asked to pretend not to know. And if we ever returned to see them, we should bring a different team.” – Pierre Lardy, Pictet et Cie

Baer is also active in the management of Erisa accounts, while Lombard Odier has concentrated its attention on the Japanese market. Unlike Pictet it does not have a full licence but it is active in the management of several Tokkin funds. Lardy believes that the Japanese individuals are not familiar enough with foreign banks to allow them to manage their assets. For the immediate future, the Swiss private banks will have to content themselves with fighting for institutional business, although this could be just as delicate an operation as wooing private clients.

“I was in Tokyo last year to make a business presentation,” said Lardy. “The company gave us a marvellous lunch and then the chairman rose to make a speech of thanks. As he began, one of the junior managers came over to our table. He quietly whispered that the chairman was ill and that to avoid losing face, the company had hired an actor to take his place. To avoid our losing face we were told of the switch, but asked to pretend not to know. And that if ever we returned to see them again, we should bring a different team otherwise the company would again risk dishonour. It was one of the most instructive lessons in how to do business in Japan I’ve ever had.”

Among the private banks there is a growing trend for the older partners to look after the private clients, while the younger bankers deal with the sophisticated business of institutional fund management. Patrick Odier and Thierry Lombard at Lombard Odier and Ivan Pictet and Jacques de Saussure are all part of a new school of private bankers. They still deal with private clients but are familiar with all techniques and instruments of modern portfolio management.

Of the foreign banks active in Switzerland, Citicorp gets the most respect. The bank’s private banking department shepherds around $12 billion for a range of clients from the Middle-East, Latin America and Europe.

“Institutional money is managed from London,” said Cuoni. “The profit margins are thinner in the institutional business and we thought we could best use our resources in Switzerland just by looking after private clients.” The bank is on a different scale to its local competitors. And Cuoni believes this is an excellent selling point. “We are a global private bank. If a client wants to buy bonds in Europe, stocks in Singapore and real estate in California our worldwide network is at his disposal.”

UK merchant banks such as Schroder and Robert Fleming are regarded as worthy competitors, as are some of the French and German banks. However, American Express, despite its much publicised takover of Trade Development Bank (formerly Edmund Safra’s bank in Geneva) has still to win its spurs. “I would never give them any of my clients’ money to manage,” said one Liechtenstein banker who regularly uses Swiss banks to manage some of the funds he has under management. Safra is thought to have taken a number of clients with him when he sold TDB. And integrating the disciplined culture of Amex with the more freewheeling style of TDB has proved difficult.

Apart from the competition from other institutions, the Swiss private banks have a number of weaknesses that could leave them vulnerable. Many of the banks earn a large part of their income from brokerage fees. They are all represented on their local stock exchanges. Around two-thirds of some of the larger private bankers’ income comes from transaction fees. However, if screen dealing comes to Switzerland, and trading moves off the exchanges, fees will inevitably come down.

The private banks are comfortable members of the big bank syndicate in the domestic capital market. They are guaranteed a constant flow of bonds from new issues, and the syndicate does its best to keep at bay any Euromarket-style pricing. But if the fixed syndicate structure breaks up, the private banks will have to fend for themselves. They will still be invited into syndicates, but may not find it so easy to pass any badly priced bonds to their customers.

France fights back

Historically, French and Italian clients have formed a big part of the private banks’ client base. But now, the French banks are making a big effort to keep wealth inside France. Crédit Lyonnais has over Ffr50 billion under management in its private banking division in Paris. “If someone is receiving income from abroad or wants to hide money, then obviously he is going to go to Switzerland,” said Hindi. “But we try to keep as many people as possible within the French banking system.”

Other French banks such as BNP are making similar efforts. The bank began offering a portfolio management service to wealthy individuals only in 1972. “Now we offer a broad range of unit trusts, offshore funds and international funds to clients, together with individually tailored portfolio management services,” said Eric Wallart, head of BNP’s private banking services for high-net-worth individuals in Paris. Even if the French persist in going to Switzerland, both banks have Swiss branches which can offer the same discretionary management as the domestic banks.

|

|

|

Thomas Moskovicks, |

The other private banking centres in Europe remain a long way behind Switzerland. Austria makes much of its banking secrecy laws. Foreigners can open bank accounts without revealing their true identity. Accounts under fictional names are common. However, drug money and flight capital hasn’t been greatly attracted to Austria. There are attempts. “A few months ago we had a phone call from a US citizen who wanted to organise a group of banks to exchange $50 million in used bills,” said Helmuth Fey, general manager of Bank Gebrud Gutman, a private bank in Vienna. “We naturally refused.”

The country’s partly nationalised banking sector is also not appealing. And private banks such as Gutman and Bank Schoeller have lost their independence to larger concerns. Gutman is owned by one of Austria’s biggest industrial companies. And Scholler has been taken over by Montana, a large mining and industrial holding company. The National Bank has made a pact with the banks. “There is a gentleman’s agreement,” said Thomas Moskovicks, chief excecutive of Bank KG Winter, another private bank. “The National Bank has agreed to leave the law as it is, as long as the banks don’t try to compete aggressively to be a centre like Geneva or Zürich.”

There are also historical reasons why Austria has been slow to develop as a private banking centre. “After the war, successive generations of Austrians were just too poor to have any financial assets that required management,” said Frey. “It wasn’t until the late 1970s that there was a demand for private banking services.”

Gutman employs about 35 people and is one of the leading private portfolio managers in Vienna. Scheller is just as well-known. The Scheller family is famous in Austrian business circles. The family fortune and industrial empire were built up in the 19th century, only to be dissipated by successively less talented members of the family. It is the main reason why the bank lost its independence. “The family paid all their debts, and they are respected for that in Vienna,” said Frey.

Schoeller is acknowledged to have had the potential to be the leading portfolio manager in Austria, but it has chosen a different course. The bank is now actively involved in commercial banking. Net interest income is double commission and fee income. Werner Engelmann has been hired from Bank of America to manage Schoeller’s commercial banking division, while Herbert Schoeller is in charge of the bank’s private banking activities. “Over the past five years we have developed our commercial banking activities but I like to think we can still offer a good private banking service,” said Engelmann.

Luxembourg is the other country that is touted as a private banking centre, but it remains very much a pretender to Switzerland’s throne. Many of the Luxembourg banks are paying agents for Eurobond issues. “On Belgian national holidays, Luxembourg is full of the legendary dentists exchanging their coupons for cash,” said Jean-Claude Schaeffer, deputy general manager of Chase Manhattan’s private banking and corporate trust department in Luxembourg.

|

|

|

Jean-Claude Schaeffer, |

Many of the banks do trust and custody business and accept time deposits. “Only a very few of the 122 banks here do portfolio management,” said Jean Krier, head of private banking at Banque Internationale a Luxembourg.

The three big Luxembourg banks have a long history as portfolio managers. But some of the foreign banks have only just started. Chase Manhattan for instance began to offer this service only in January last year. Many potential clients are worried that Luxembourg, a member of the EC, is susceptible to political pressure to weaken its banking secrecy laws.

Its status as a separate country is a positive selling point. “I always emphasise that we are a sovereign, autonomous country, unlike the Channel Islands or Monte Carlo, when I am abroad,” said Krier.

Despite these disadvantages, offshore centres continue to flourish, each with its own niche. Jersey specialises in offering accounts to UK expatriates, exempt from UK income tax. Guernsey is the home of many captive insurance companies and trusts. Liechtenstein, firmly onshore, benefits from the lack of familiarity with the trust business among Europeans.

“The trust is an Anglo-Saxon concept,” said one Liechtenstein banker. “Swiss and Germans are more familiary with the structure of a foundation.” International businessmen such as Robert Maxwell, owner of London’s Mirror Group Newspapers, uses such a vehicle to control his empire.

Whether they decide to remain on or offshore, individuals have never had such a varied choice of possible bolt holes for their money. To win in private banking, unlike other banking activities, it’s not just a question of technical skill. Good psychology and public relations can make a big difference. Discreet addresses, oak-panelled rooms and convivial lunches do count. A client has to feel at home rather than just be sure his money is safe.