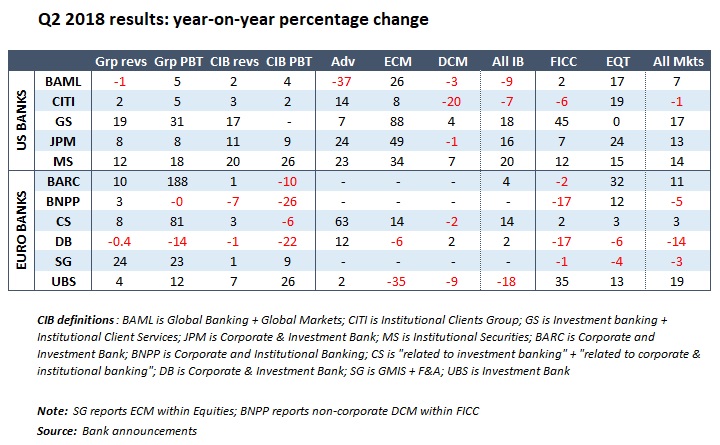

Fixed income at BNP Paribas was eye-catching for all the wrong reasons in the second quarter of 2018 as the FICC unit posted a 17% fall in revenues in sharp contrast to most peers that enjoyed a strong recovery from the prior year period. However, a strong equities and prime services performance was the more notable number for the French bank, since FICC and the corporate and institutional banking division more broadly were both hit hard by adverse foreign exchange movements compared to US firms.

Access intelligence that drives action

To unlock this research, enter your email to log in or enquire about access