News that Spanish bond yields rose above 6% on Monday raised concerns over the sustainability of the finances of the eurozone’s fourth largest economy, while worries over the effect of upcoming elections in France and Greece also added to investor unease over the future of the currency bloc.

|

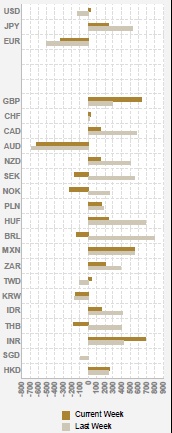

Cumulative FX flows |

|

| Source: BNY Mellon |

“The key question with regard to the latest eurozone tensions is whether they are supported by genuine outflows from both key regional debt markets and the EUR or whether they are simply the result of noise emerging in thin market conditions,” says Simon Derrick, head of FX strategy at Bank of New York Mellon, the world’s biggest custodian bank with $26 trillion under management.

Derrick says the bank’s iFlow data continue to indicate that the former rather than the latter holds true with fresh outflows apparent from the Portuguese, Spanish and Italian markets in recent weeks, along with matching outflows from the EUR.

“As has been the case in previous Euro-area crises, the story changes somewhat once the Alps and Pyrenees are crossed,” he adds.

“Fresh inflows have emerged over the past few weeks into the French, Dutch, Belgian and Finnish markets.”

Surprisingly, flows into German paper have been rather more muted, however, with Bank of New York Mellon monitoring modest outflows since the start of April.

“No doubt this is little more than a temporary aberration,” says Derrick. “Nevertheless, we will keep an eye on this outlier over the next few weeks.”