|

It might be time to stop calling Singapore ‘the next Switzerland’. The maxim needs to be inverted.

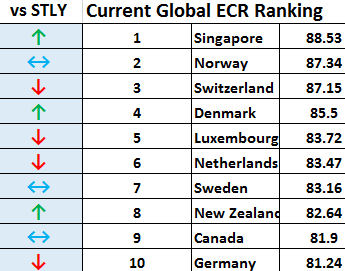

This is what we learn from the latest iteration of the Euromoney Country Risk (ECR) survey, which for more than 20 years has ranked the world’s countries and states by investment risk.

Those who follow ECR know it is far more than an idly determined award. It reflects a complex methodology combining the views of a community of economic and political experts across 15 categories of economic, structural and political risk; a further survey of debt syndicate managers; IMF data on debt indicators; and Moody’s and Fitch credit ratings.

It covers 186 countries, but the top spot rarely moves far. In 1993, Japan was the first top-ranked country. The US and Luxembourg have also held first place, but over the past decade either Switzerland or Norway have been in the ascendancy.

So, Singapore joins an exclusive club in claiming the number-one spot. Its ascent, from 21st in the world as recently as 2007, reflects a changing and uncertain world order, where nothing seems reliable or assured.

Norway has dropped a spot with the low oil price; and Switzerland’s score has been hit by its own safe-haven status, with ardour for the Swiss franc undermining the strength of its economy.

|

|

| Source: Euromoney Country Risk |

Enter Singapore.

It’s not as if the country is without challenges. Euromoney’s November edition even called for a reinvention of Singapore, as its stock market struggles to attract new listings and its private banking industry deals with the fallout of 1MDB.

Its banks, though conservatively provisioned, have had to deal with bad debts in the offshore oil and gas services sector, albeit they are among the most technologically advanced and forward-looking banks in the world. However, in terms of sovereign strength, it is now peerless.

Singapore’s position in the ranking represents a confluence of a number of strengths in categories that have turned into weaknesses elsewhere. So, Singapore’s economy only grew by 2% in 2016, and the government forecasts only 1% to 3% for 2017, but it is considered good and sustainable growth in an unpredictable world – and GNP is strong, with national livelihood high.

Despite the oil service problems, non-performing loans in Singapore hover around the 1% mark, and the banking sector is the most stable in the region and among the strongest in the world.

Monetary stability is as good as it gets, employment is high, the government obviously doesn’t change and its finances are relatively luxurious, it is largely transparent and without significant corruption, its institutions are sound and its regulations clear, it has the best infrastructure in Asia and – as anyone who has ever passed through the airport knows – it just works. It exudes efficiency.

Actually, the more mundane reason Singapore reached the top is an improvement in its ranking for its debt indicators, brought about by a full-year S$78 current-account surplus including a near-record S$22.8 billion in the third quarter alone. But really, Singapore’s ascent reflects the culmination of a mission that has taken half a century.

Location, location

When the British left and Lee Kuan Yew set about marshalling a newly independent society, Singaporeans had to reflect on what they had – and what they didn’t have. No oil or gas or coal reserves, not enough land for significant agriculture; some old Colonial-era assets such as the ports, but not a whole lot else.

What it did have was location, on a key trading route, and so Singapore set about becoming the easiest place through which to trade, which it still is. It built its name on efficiency, stability, education and ease of doing business.

It handled the wealth of its British legacy assets so deftly that today three separate top-order institutions – the Monetary Authority of Singapore, GIC and Temasek – manage or invest the nation’s hundreds of billions of dollars of reserves and sovereign assets.

Today there are only 11 countries left rated AAA by Fitch – as recently as 2009 there were 16. Singapore breathes increasingly rarified air in having the reputation of being an impregnable economy and financial system.

It might not last for ever – a rising oil price is likely to push Norway back up to the top spot – and one can’t avoid the fact that Singapore has achieved its climb to the top with lesser electoral freedoms than any other countries to have held top spot.

However, Singapore should be proud of its time at the peak. And it should continue to remind its private banking industry that nothing in the country is more important than its safe and reliable reputation.

Sometimes boring is good.