If you’re earning decent profits, see no immediate causes for concern that might require drawing down your cash reserves but equally no good places to invest for future earnings growth, then the simplest and easiest choice for any management team is to return most of that money to shareholders.

Being unwilling to throw retained earnings into investment in organic growth or strategic M&A shows a certain lack of confidence in the operating business. However, if your stock is trading at a low valuation, say at a price below tangible book value per share, then buying it yourself can look like a smart investment.

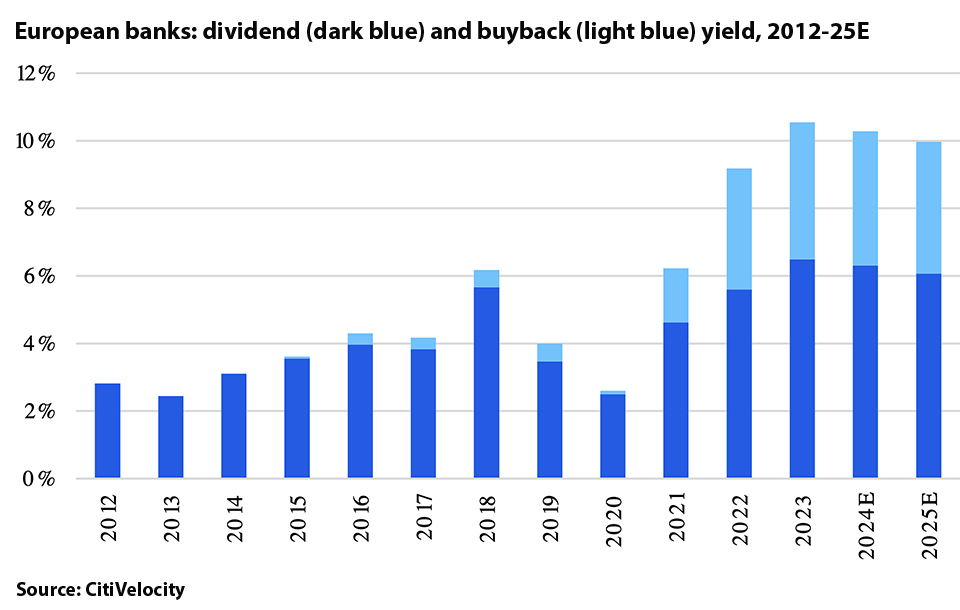

European banks have become addicted to this trade, using the bounty from high rates and swollen net interest margins to boost returns to shareholders through buybacks and dividends. Buying back shares and cancelling them both boosts stock prices and, by reducing the number of shares outstanding, improves earnings per share.

Analysts at Citi expect European banks to announce €73 billion in dividends and execute €46 billion in buybacks this year, equivalent to an all-in yield of around 10%. Banks with the highest yields include UniCredit – where buybacks dominate the stock story – ING, HSBC, Caixa and Intesa, all with yields of greater than 12%.

Stock-valuation gaps are starting to close. While the Stoxx Europe 600 index of leading listed European companies had risen 6.33% in 2024 up to April 3, the bank index had done twice as well, rising by 12.82% over the year to date.

Other investors see the same value trade as bank executives and directors. They have been buying bank shares for the most fundamental reason of all. They are cheap. But are they cheap for a reason?

More and more investors are taking a view that the risks of rising loan losses, particularly from commercial real estate as well as from corporate and unsecured consumer credit, may turn out nowhere near as bad as first feared when rates started rising.

Banks are also showing that they don’t expect regulators to require that they hold even higher amounts of capital that would reduce lending to the real economy and also that they have become adept at risk-weighted asset (RWA) optimization through securitization and significant risk transfer.

Rising returns

Announcements continue to come thick and fast. At the end of March, executive chair Ana Botín told shareholders of Santander that the bank is confident of delivering a better performance in 2024 than in 2023, when it returned a record €5.5 billion to shareholders through dividends and buybacks.

This year, after keeping expenses flat and containing its cost of risk in the first quarter, Santander now expects to return more than €6 billion.

Analysts at UBS expect ING to unveil another €2.5 billion share buyback along with first quarter 2024 results on May 2, followed by another €2.5 billion with third-quarter results, allowing it to continue to offer one of the best total capital return yields in the sector.

On Tuesday, UBS announced that – having just completed a two-year share repurchase programme when it bought in SFr5 billion-worth of shares between March 2022 and March 2024, accounting for 8.62% of its share capital – it will now immediately commence a new repurchase programme.

However, this one will be smaller: up to a maximum of $2 billion-worth of shares, equivalent to 1.82% of its share capital, to be repurchased between now and April 2026. The bank has a big acquisition to integrate and much of the cost will come ahead of the benefit.

New normal or temporary?

Are high pay-out ratios of 75% to 100% of net income the new normal for banks and likely to prevail over the medium to longer term, or a pragmatic and temporary response from executives and directors to embarrassing valuation discounts?

Buying in your own shares starts to look less of an obvious bargain if and when they trade at a premium to book value. What else should banks do with surplus capital?

Ever since the global financial crisis, conglomerate banks that once harboured international ambitions have been selling sub-scale domestic retail banks and cutting back investment banking businesses. Banks have acquired fintechs as a cheaper alternative to building out essential digital technology in-house. But large-scale M&A in Europe, especially cross-border M&A, has been a non-starter, seen as a step likely to crater any would-be consolidater’s share price.

Cash-rich banks in Europe may be squandering the chance to acquire rivals on the cheap and build scale to compete with the industry’s US leaders.

Does Nationwide’s bid for Virgin Money start a new phase of bank M&A? FIG bankers can name the usual suspects for acquisition: Banca Monte dei Paschi di Siena, BPER Banca, Banco de Sabadell and even larger banks such as Commerzbank, Societe Generale and Standard Chartered, perhaps even Barclays at a push.

It is much harder to name any bank brave enough to be a potential acquirer. Industry leaders are happy to cast banking as a value play for now and relieved that investors are buying the story. If shareholders eventually decide they want growth, they will have to push banks to secure it and reward them for doing so.