If there is one thing dance music DJs fear, it is the ‘trainwreck’. That’s what they call it when beatmatching – the synchronization of two different tracks as you crossfade from one to the other – goes wrong. The result is a jarring mess, as beat fights beat in a battle neither can win.

For a DJ caught in the storm, there are a few options. Some use their own voice to drown out the mistake, hoping to limit the damage of an ugly segue by distracting the crowd. Some go for the nuclear option: give up on the smooth transition as a lost cause and simply hard-cut to the new track, however much it might hurt them and the dancefloor.

With a bit of luck, though, there is a third option. If there is enough of the first track still to run, you can simply have another go. Sure, people might have noticed that something had been off for a while, but fade it back, cue a new track, and you’re all set.

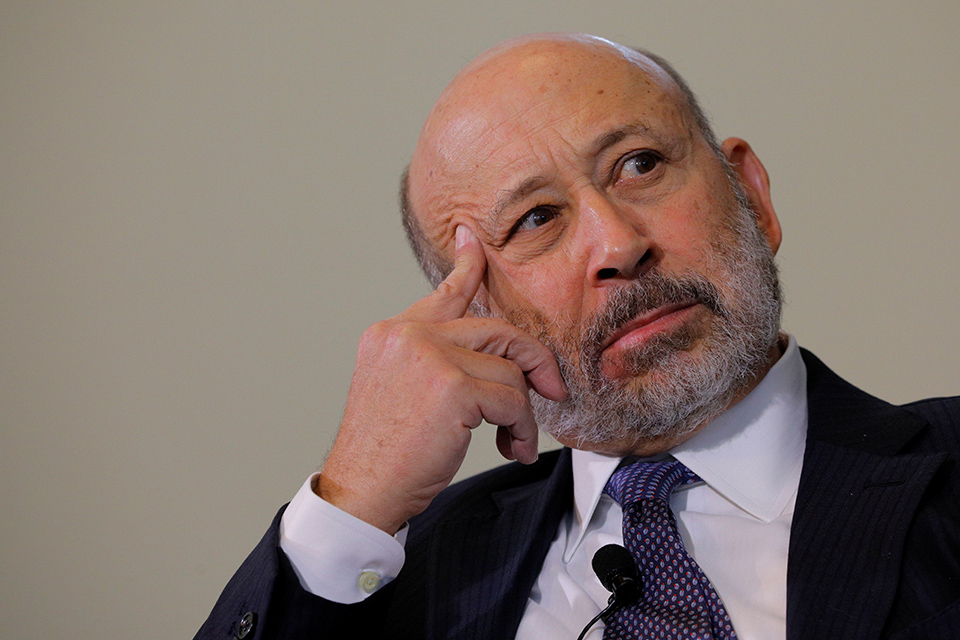

As a dance DJ in his downtime, Goldman Sachs chief executive David Solomon will know all about the risk of trainwrecks. Hopefully he has experienced few, if any, on the dancefloor. But it feels like he may have been grappling with one in his day job over the last couple of years as he tried to execute a smooth transition for Goldman out of one strategy and into another.

DJ D-Sol has enough of the old track left to let him back out of the fade and have another stab

As you may have heard, the beats didn’t always match. The attempt to pivot the firm into one that could compete in some of the funkier aspects of consumer banking didn’t age well, as profitability proved harder to achieve than expected, and costs and credit losses rose.

No surprise, then, that in late 2022 the bank announced that it would be reversing some of its push into those areas.

Fortunately for Solomon, there is every sign that the firm’s previous focus – a single-minded pursuit of excellence in its investment banking and global markets franchises – had plenty of time left to run, despite the downturn in activity that has accompanied the last 18 months of rate hikes.

In DJ terms, he has enough of the old track left to let him back out of the fade and have another stab at it.

Ambitions reset

That, at any rate, is what he seems to be doing. With a $506 million hit to its third-quarter group earnings related to the disposal of GreenSky, the home improvement loan fintech that it bought as recently as 2021 and has now sold to a consortium led by Sixth Street Partners, Goldman has now more or less completed the reset of its ambitions in the wilder forests of consumer banking.

There seems to have been a reset of other things, too. Solomon was last week reported to have decided – as much as a year ago, according to Goldman – to step back from the higher profile activities of his alter ego DJ D-Sol, through which he releases dance music that raises money for an addiction charity.

Viewed with mild amusement by many on the outside, but also with remarkable passion by his online fans, the side hustle has by many accounts lent an unwanted air of frivolity to the serious business of being the chief executive of Goldman, including among disgruntled partners at the firm. It was hard to avoid the ever more lurid tales over the summer, as speculation over Solomon’s own future grew.

Did the DJ gigs matter? Apparently, they shouldn’t have done, to judge by the pointed response given by Goldman’s communications head Tony Fratto in a Financial Times report of Solomon’s decision to stop playing big events.

“Music was not a distraction from David’s work,” he said. “The media attention became a distraction.”

A slightly odd take, one might think. If the music wasn’t a distraction, then simply saying so should have been enough for anyone that really mattered, like colleagues and clients. As for the others, well, it is just media attention. Who cares?

Evidently – and not for the first time – enough people did. But as Euromoney has noted before, the problem was not that Solomon liked doing things in his spare time that were unusual for someone in his position. It is that he was doing them while there was unease in the ranks about the direction – and performance – of the firm. And so it became the lightning rod for everything, whether it was relevant or not.

After all, Goldman didn’t go into consumer banking because Solomon was a bit distracted at a party. It is not as if chief operating officer John Waldron was shouting up at him from the mosh pit: “I’m thinking of buying GreenSky, is that OK?” and Solomon lip-read him wrong while busy bass-swapping.

It is safe to say the process was more carefully thought-out than that.

Nonetheless, speak to senior folk at the firm and there is plenty of candour about the fact that differences of opinion existed. Is there embarrassment at the noise of the last couple of years?

Undoubtedly – although also recognition that this is a company of 414 partners, each of which thinks like an owner.

It is a structure that is arguably Goldman’s superpower, but it also means it will operate a little differently to a Morgan Stanley or a JPMorgan.

Those who are used to seeing themselves as the personal stewards of a bank’s capital will passionately debate that bank’s strategy. Those debates will leak. And when they do, it is easy for the nuances to be lost.

For instance, the move into consumer started out under Solomon’s predecessor Lloyd Blankfein. And as one Goldman partner tells Euromoney, there was basic agreement that the firm was doing the right thing in entering those businesses, both when Blankfein kicked it off and when Solomon added to it.

“To be fair to Lloyd and David, the debate wasn’t: ‘Hey, you are idiots for going into consumer banking’,” the partner says. “There was alignment about going into it – and now there is alignment about coming out of it. The debate was in the middle.”

A timely reminder

It shouldn’t surprise anyone that there was agreement at the start. Think back to the couple of years before the pandemic, when it was clear that trading franchises were under increasing pressure, whether from the macro environment, from regulatory burdens or simply the cost of keeping up with the tech arms race. Deutsche Bank’s response to all that was to get out of equities in 2019, for instance.

Goldman wouldn’t do something like that, of course, but such moves were a timely reminder to its management that it was one of those firms that had the greatest concentration risk in that business. Its global banking and markets division accounts for about 70% of the firm’s revenues. In the last 12 months, its markets business has been about 80% of that portion.

If only quantitative easing would end, went the pre-pandemic thinking, things might get better in fixed income and equities sales and trading. The question was how long that would take – and there was only so long one could wait. Impatient shareholders would make sure of that.

Diversification was Goldman’s response. And while the consumer part of that has not worked out how the firm wanted it to, it is worth bearing in mind that it was not the only move, despite all the sound and fury it has generated.

The recasting of the asset and wealth management business, the de-emphasising of the firm’s own equity and debt investments, and the pivot to a focus on third-party funds was all happening at the same time. And you don’t hear too much complaint about the paths chosen there.

There have been plenty of internal gymnastics around the consumer business since then: insiders talk of a cathartic exercise and say that 18 months ago there were certainly partners who disagreed with the way that the strategy was playing out. That so much of that disagreement has also played out in the full glare of the media has been embarrassing, but internally staff have tried to stick to the mantra that you worry about what you can control.

The good news is that to judge by Goldman’s earnings, clients don’t seem terribly put off by all the hoo-ha.

Its bankers say its client wallet in the markets business has never been higher. Global equities and fixed income are more than ever a two- or three-horse race. The bank vies with JPMorgan for first place in overall investment banking fees – and beats it in advisory and equity capital markets.

As Wells Fargo banks analyst Mike Mayo likes to say of the concentration at the top of the tree in banking generally: “Goliath is winning”.

The few firms with real scale have formidably strong positions. That Goldman is one of those even at a group level, despite its relatively undiversified business mix, is all the more remarkable and something that its leaders think is part of the reason to be confident about the future.

Goldman also hopes that its performance against rivals will be all the more evident after having combined its investment banking and global markets divisions last December, making it in theory more comparable with many rivals that are similarly structured. But it is still not a clean comparison, particularly when it comes to segment return on attributed equity.

One sure way to wind up a Goldman banker is to ask what they feel about other firms’ ‘corporate’ or ‘other’ divisions, where costs of all sorts get buried. Spoiler alert – they don’t like it.

In any case, Goldman’s global banking and markets division – including all its associated costs – posted a return on equity of 16.4% for the full year 2022 and 13.4% for the first nine months of 2023.

At Morgan Stanley, the equivalent numbers were 10% for 2022 and 10.5% for 9M23.

Goldman’s firm-wide through-the-cycle return-on-equity target, as set out at its February 2023 investor day, is 14% to 16%. Group RoE of 10.2% for the full year 2022 and 7.6% for 9M23 was depressed by poor performance in the consumer businesses it is exiting and the drag of its legacy proprietary debt and equity positions that it is also exiting.

Rejigging its balance sheet, growing management fees in asset and wealth management, as well as continuing to build the financing side of its global markets business, should get the firm to its targets, it says.

Bankers think that asset and wealth management should easily be able to clock up an RoE of 15% or more, for instance. Getting there will be bumpy in the short term as the firm backs out of messy investments in public and private equities, and real estate. For the first nine months of 2023, the bank’s asset and wealth management division only clocked up an RoE of 1.4%, making it quite the drag.

Back on track

There is a school of thought that Goldman worries far too much about Morgan Stanley when it comes to comparisons of multiples. More than half Morgan Stanley’s business is in asset and wealth management these days, and there is simply a certain multiple that this should bring with it.

At Goldman, the investment bank still accounts for about 70% of revenues – although that is a statistic that also brings confidence internally when it comes to returns, because it is the bit that is doing well. If most of the franchise is putting out good results, that is a decent position to be in and suggests that moving the dial a little where the business is lagging ought to get the whole back on track.

As Solomon noted in his recent earnings call, investment banking activity is well below 10-year norms and is unlikely to stay that way – and yet the firm’s franchise there is still performing better than most.

A less charitable view within Goldman of its rival is that Morgan Stanley and its soon-to-be-departing chief executive James Gorman have simply done the better job of story-telling: we should hire Gorman to do our marketing, goes the joke.

But it still frustrates Goldman bankers that they can handsomely beat Morgan Stanley at banking and markets only to find that their rival is being rewarded by investors for wealth management.

In calmer moments, they say they are in any case more focused on ensuring that the firm’s book value keeps rising – not such a bad strategy when bank shares trade on that basis. All things being equal, a rising book value should take the stock up with it – unless investors change their view for the worse.

Unfortunately, with few exceptions, they have been doing exactly that for bank stocks generally. Goldman’s tangible book value per share (TBVPS) rose 3% year on year in the third quarter of 2023, but its stock is down 7% in the last 12 months, and it is now trading at a price to tangible book value (P/TBV) multiple of about 1x, from 1.2x one year earlier and having touched 1.4x in late November 2022.

Peer multiples have fallen over the same period too. Morgan Stanley’s TBVPS was up 2% in the third quarter, its stock is down 8.6% in 12 months and its P/TBV multiple is at about 1.8x now, down from 2x a year ago but having been as high as 2.5x in February 2023.

Bank of America stock is down about 25% even as its TBVPS has risen 12%, and its multiple has fallen from 1.6x to 1.1x. Citi is languishing at the bottom of the heap, with a multiple of about 0.5x for most of the last two years. JPMorgan shares, meanwhile, are up 17%, exactly in line with its rise in TBVPS, with its multiple having stayed fairly consistently around 1.8x for the last 12 months.

Not defenceless

For all their bullishness, Goldmanites would still like more of the valuation that the market grants Morgan Stanley. That is one reason for the diversification, but given how much Goldman still relies on its revenues from trading bonds and shares, a more immediate question is whether investors will ever reward trading businesses with a higher multiple. Historically they have tended not to do so, but scale increasingly matters – and with scale comes pricing power.

That is why those at the firm are also not despondent despite ever more burdensome capital regulation. The proposed final implementation of Basel III by US regulatory agencies – the so-called “end-game”, informally referred to as Basel IV – is currently expected to increase common equity tier-1 capital requirements by about 25% at the biggest firms. But as bankers point out, they are not defenceless.

First, there is to be a consultation process – and systemically important financial institutions (Sifis) can be loud when they want to be. Ever since the proposals were announced, banks’ senior managers have been queuing up to lambast them, as have industry bodies like the Bank Policy Institute.

The third-quarter earnings season this month has seen plenty more commentary from bank CEOs: Solomon himself told analysts that “the rules, as proposed, go way too far”, and that they would lift the cost of credit for all businesses, push more activity into the shadow banking sector, which could increase systemic risk, and hurt US competitiveness.

The backlash may already be having an effect. Last Friday, we saw the US Federal Reserve push back the deadline for comments on its proposals from the end of November this year until mid-January next year. (Spare a thought for the medium-sized Category III and IV banks, though – the comment period for the accompanying proposal for long-term debt requirements to be enlarged to include them has not been pushed back from its end-November date.)

Second, there is the seemingly ever-worsening political dysfunction in Washington DC, which could become a critical factor. Right now, Congress cannot even function in the absence of a Speaker, and another government shutdown looms in mid November. The idea that a regulatory broadside on the banking industry will pass its inevitable political tests smoothly seems fanciful.

Third, banks are getting better at optimization of risk-weighted assets, doing more with swaps and less with cash, and shifting things off balance sheet where possible.

Goldman partners think the firm also has the scope to accrete business even in a tough environment by virtue of its brand

And finally, back to that pricing power. Take global prime brokerage, a business that nowadays is dominated by JPMorgan, Goldman, Morgan Stanley and to some extent BNP Paribas. It is hugely capital intensive, consuming perhaps half of an equity franchise’s resources. Another slug of capital requirements in such a concentrated industry will mean it will get much more expensive for the clients.

But in any case, Goldman partners think the firm also has the scope to accrete business even in a tough environment by virtue of its brand. In keeping with the OneGS messaging of swarming over clients to deliver the whole firm to them, interactions in businesses such as markets have been rising. And there may be more that can relatively easily be done elsewhere to get that really firing on all cylinders across the firm.

After all, the firm’s most senior partners meet billionaires in investment banking client meetings all the time – do they always think to promote the firm also as a wealth manager? If they do not, then there is an unusually accessible client base waiting to be tapped.

Goldman bankers love telling people how important it is to keep sight of one’s “true north”, and in Goldman’s case this is investment banking and capital markets. There is precious little evidence that the firm ever lost sight of that at all, but its actions and talk certainly allowed that perception to spread. And as with DJ D-Sol’s music hobby, perceptions count for a lot.

It is hardly surprising that all the noise has generated talk of succession – perhaps even a co-CEO arrangement for the firm. But given the advantages that Goldman still possesses in its core business, and the rectifying moves it is making to the rest, such upheaval would seem an oddly premature response and not supported by the kind of longer-term thinking that decisions of that nature demand.

Goldman doesn’t have a history of responding in a knee-jerk fashion. In fact, quite the opposite, as the internal agonising of recent times illustrates, helping to explain the persistence of the consumer banking effort while it lasted.

It is unlikely to start doing so now, when it needs continuity the most.