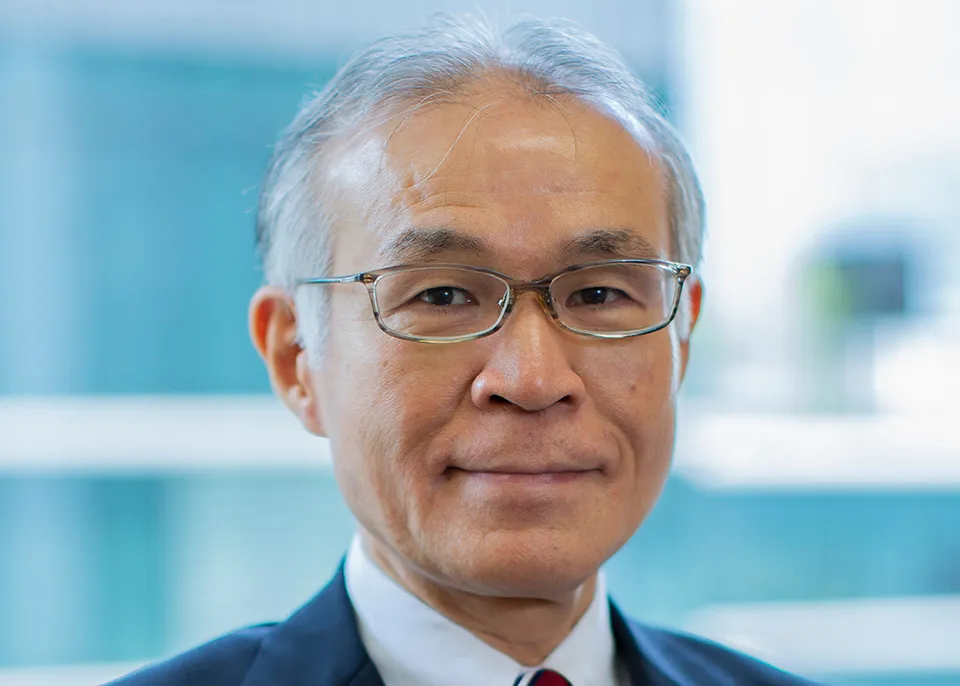

The year 2021 brought a new medium-term business plan for MUFG and the conclusion of the old one. Gone are the ambitions to expand their business portfolio through investments in Asia, which has already played out through shrewd purchases in Indonesia, Thailand, the Philippines and elsewhere. Instead, the new priority is to ramp up profitability in key areas – Asia included – in order to hit 7.5% return on equity and ¥1 trillion ($8.7

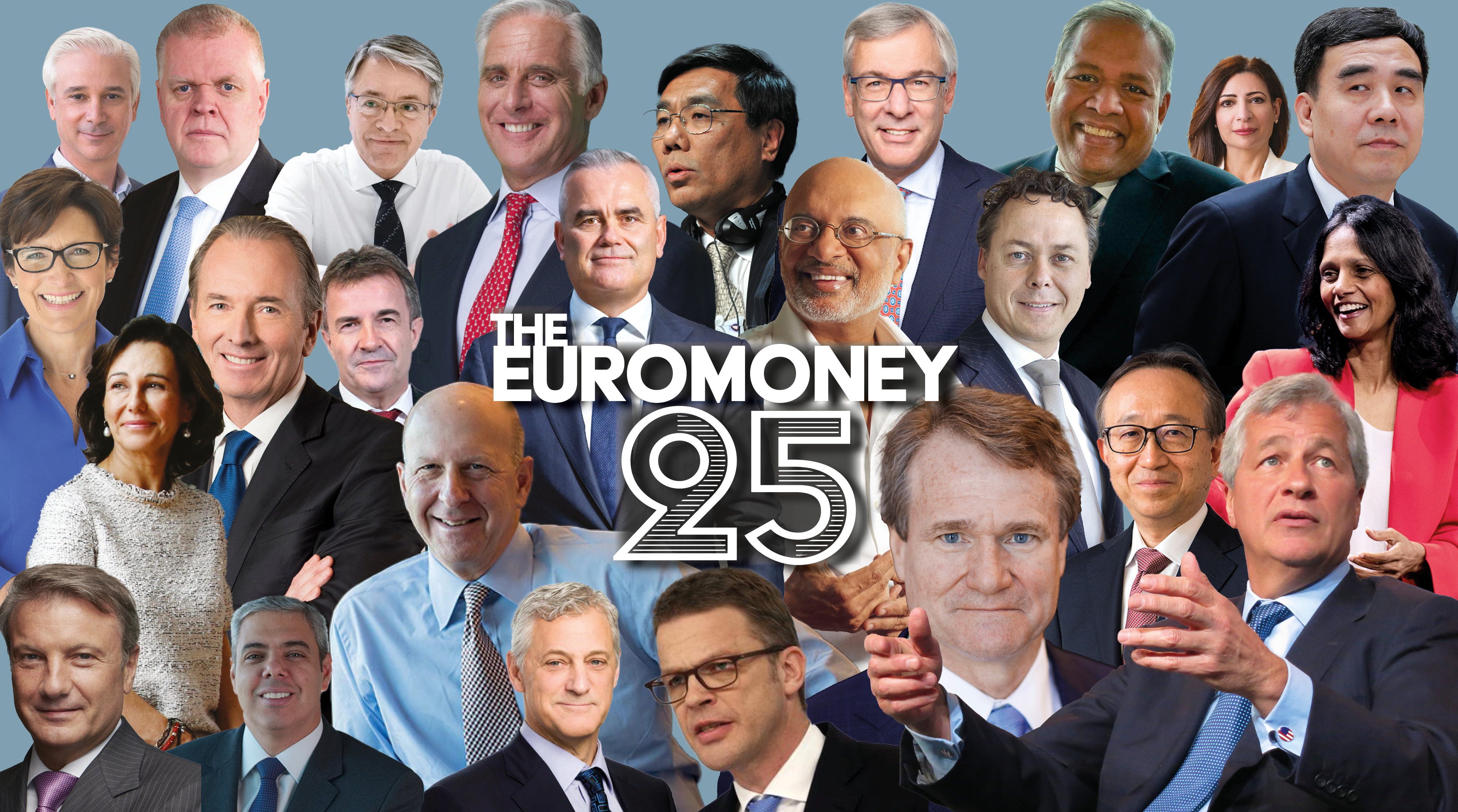

Thanks for your interest in Euromoney!

To unlock this article: