The partial normalization of economic policy in Argentina – as the government chases a deal with the IMF – has led some international analysts to see a floor in the country’s recent financial crisis.

Bank of America’s Sebastian Rondeau says that the macro outlook “has improved significantly amid declining Covid, policy improvement and IMF talks” and he asks if the country has “rounded the corner”.

It is an open question.

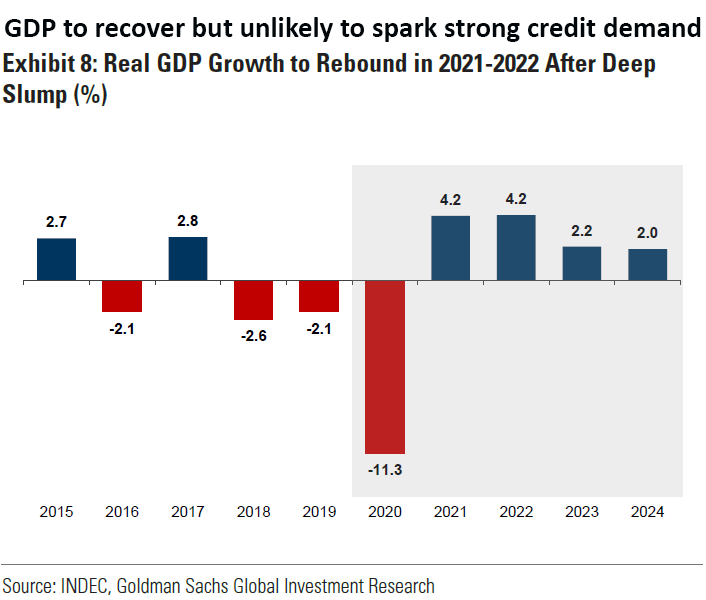

GDP continues to recover – the official monthly economic output index jumped 1.9%

Access intelligence that drives action

To unlock this research, enter your email to log in or enquire about access