One number stood out when Singapore Exchange (SGX) issued its full-year trading numbers for 2018 last week.

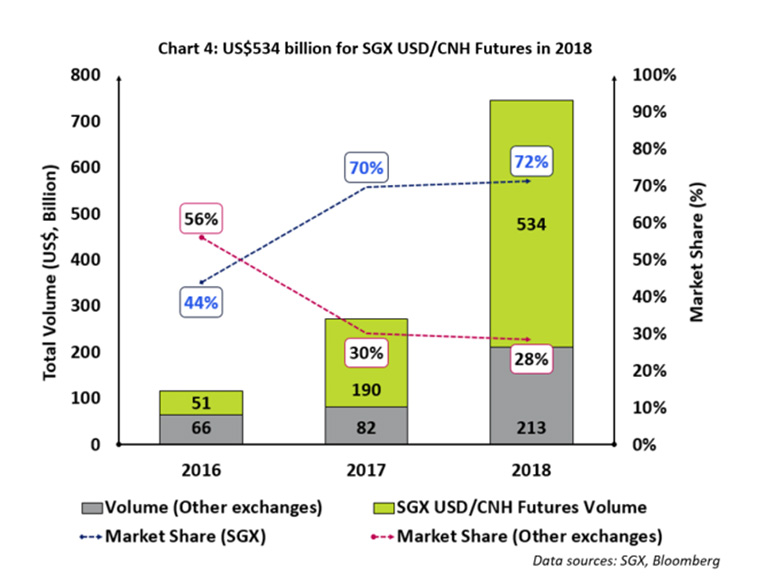

Dollar/CNH futures trading – referring to offshore renminbi – hit a total of $534 billion, a 181% year-on-year increase over 2017.

The figure for December alone was $65.4 billion, a record. The contract is now shifting $2.17 billion a day in average daily volume, and crossed $1 billion on 238 days last year, compared with 54 days in the previous four years.

Access intelligence that drives action

To unlock this research, enter your email to log in or enquire about access