Benchmarking

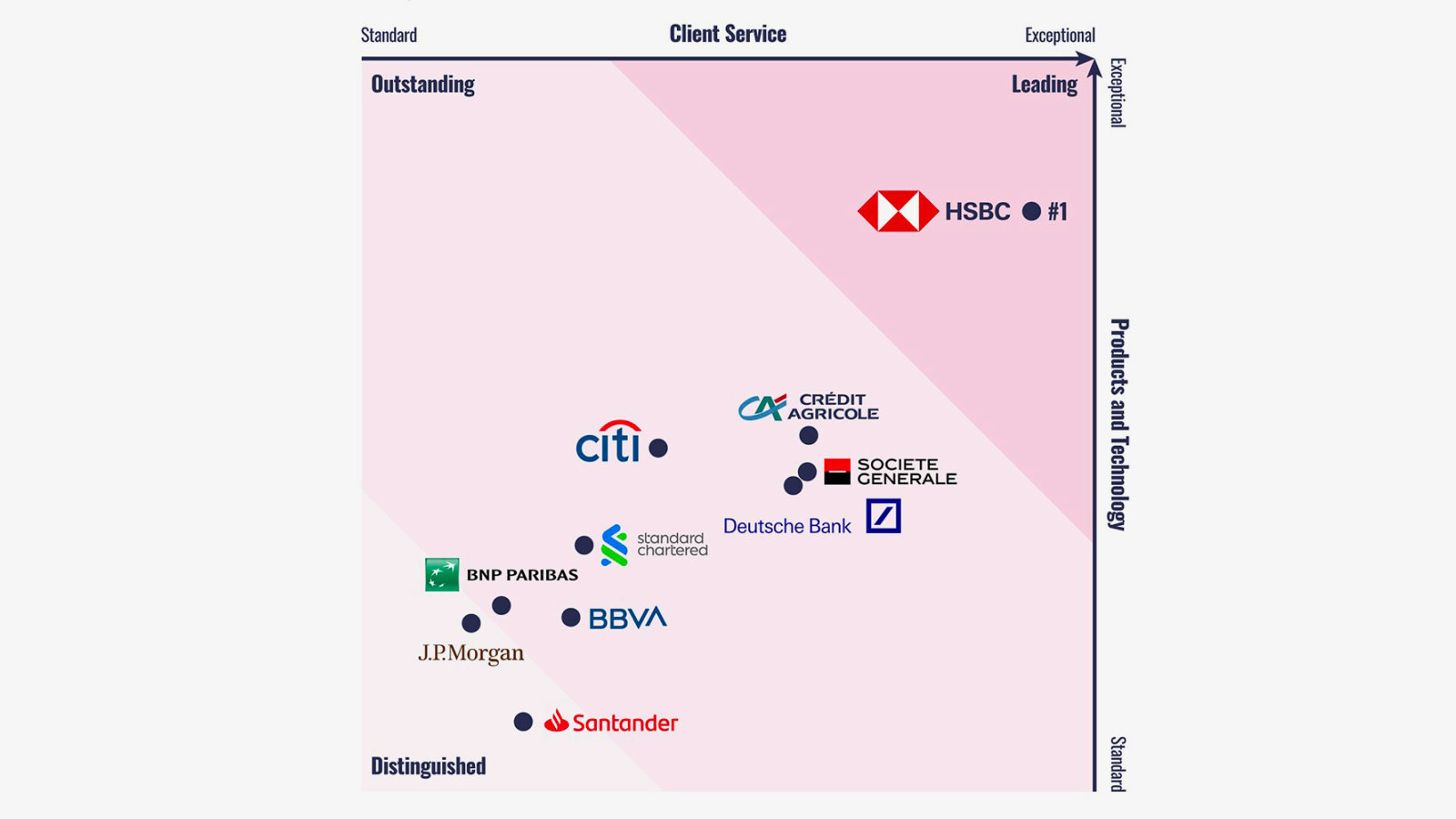

Euromoney produces industry-leading benchmarking unmatched in scale and depth of insight. Our benchmarking offering assesses client satisfaction, strategic positioning and product capabilities across the global banking landscape.

Benchmarking Calendar

From Euromoney’s Research

Trade Finance Survey 2025 rankings report

Insights from 13,000+ corporate treasurers

Cash Management Survey 2024 rankings report

Setting the benchmark for excellence in cash management

Trade Finance Survey 2025 Results

Setting the benchmark for excellence

Trusted by clients. Recognised by Euromoney.

Euromoney runs the world’s most comprehensive transaction banking benchmarking exercise, with 30,000+ corporates participating in Cash Management, 13,000+ in Trade Finance, and 1,000+ institutions in the Financial Institutions surveys.

Euromoney’s research is your opportunity to showcase your strength in products, technology and client service – while gaining powerful insights directly from clients.

Your clients’ feedback. Analysed by Euromoney.

Our bespoke benchmarking reports go beyond the rankings to give you a strategic edge. Understand your position in the market and evaluate your key competitors. Dive into how your products, technology and client service are perceived – and compare that to the market.

Whether you’re looking to grow market share or defend your position, these insights help you make smarter, faster, client-driven decisions.

Client-level data now available.

Contact Arun Ghudial and Ana Voicila for more information.

Built to Perform. Measured by Euromoney.

The 2025 Payments Product Capabilities pilot benchmarks your offering at global and regional level using a structured scoring model -measuring both standard and distinct capabilities.

Participants are eligible to receive tailored benchmarking reports, revealing strengths, gaps compared to their peer group, and priority areas for investment.

Start your benchmarking journey today

Engage with Euromoney to stay informed about survey timelines, submission windows, and key insights as they become available. Whether you’re aiming to improve your performance, earn recognition, or better understand your clients, we’re here to support your journey every step of the way.