Jul-15

Capital markets

Securitization: Commodities firms seek funding alternatives

Capital markets

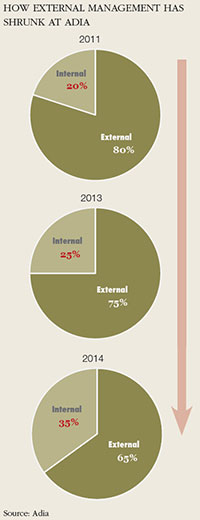

Abu Dhabi: Adia accelerates in-sourcing push

Capital markets