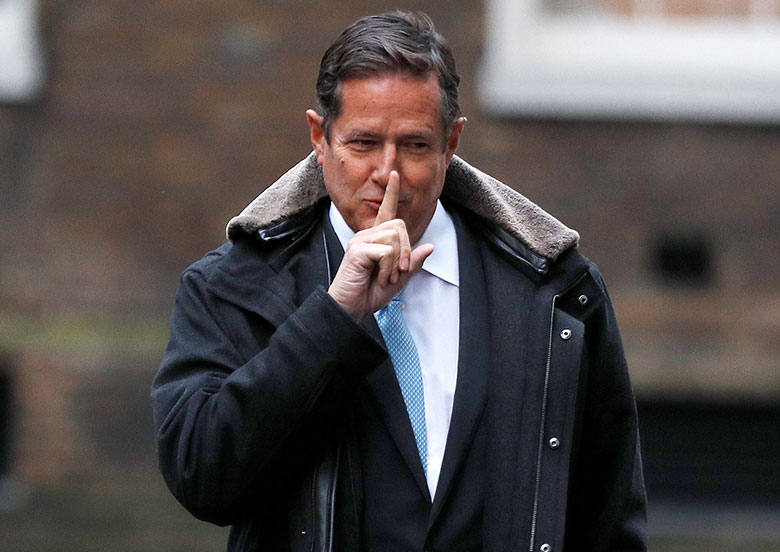

Has Barclays’ CEO Jes Staley managed to quieten the naysayers with the latest results?

Barclays announced strong first-quarter trading results on Wednesday, with the biggest percentage increase in markets revenues of the leading investment banks.

Fixed income revenue rose by 106% compared with the first quarter of 2019, on the back of growth in both macro products, such as rates and FX, and credit trading. Equities revenue was up by 21% on higher equity derivatives volumes.

Fixed income is the biggest sales and trading group at Barclays, so strong performance across debt instruments was enough to drive a 77% increase in revenue for its global markets division to £2.42

Thanks for your interest in Euromoney!

To unlock this article, enter your e-mail to log in or enquire about access: